Making Greater Impact

Download Annual Report 2024 | 中文DBS Group Holdings Ltd

Annual Report 2024

Making Greater Impact

Download Annual Report 2024 | 中文Partnering for Asia’s Transition

Download Sustainability Report 2024Institutional

Banking

Against a backdrop of macroeconomic and geopolitical uncertainty, IBG delivered a resilient performance with solid non-interest income growth. This was underpinned by strong client relationships, prudent risk management as well as our strength in digital solutions, Asian connectivity and sustainability.

2024 overview

Interest rates started going down in the second half of 2024 as central banks made progress in taming inflation. Whilst this was helpful in supporting business growth, geopolitical tensions created continued uncertainty and market volatility. In Asia, China’s slowdown had a palpable impact in muting overall business activity.

By leveraging a strong and diversified franchise, we delivered a resilient performance with solid growth in non- interest income. This was underpinned by deepening client relationships, prudent risk management, digital capabilities, regional connectivity and leadership in sustainability.

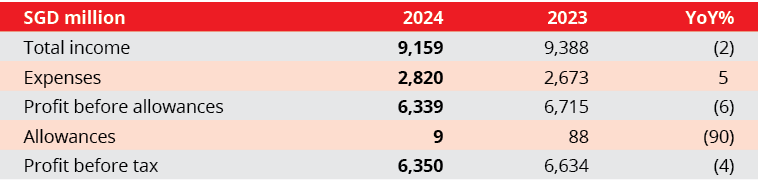

Resilient financials amid headwinds

Total income declined 2% to SGD 9.16 billion in 2024.

Net interest income declined 6% as sustained balance sheet growth was offset by a decrease in net interest margin. Non-interest income grew 9% to SGD 2.43 billion, driven by strong growth in fees from loan-related, cash management, as well as securities and fiduciary services. Treasury customer income also increased as we supported our clients in capturing market opportunities and managing risks. Investment banking fees declined as capital markets activities were muted.

Allowances stayed low as asset quality remained sound, with write-backs partially offsetting additional allowances taken.

Profit before tax declined 4% to SGD 6.35 billion, with the solid growth in non-interest income and resilient asset quality offset by a lower net interest margin.

Diversified growth across industries and markets

There were growth opportunities across our industry segments, including Financial Institutions (FI), Real Estate (RE), Telecoms, Media and Technology (TMT), and Food & Agribusiness (F&A).

Revenue from FI grew across all geographies especially Hong Kong, UK and India, driven by strong momentum in non-interest income as we deepened coverage in these markets to capture capital flows. Our transaction services and financial market offerings continued to be key growth drivers with institutional investors and other non-bank financial institutions.

RE captured growing investments into global gateway cities such as London and Sydney, whilst TMT rode the structural opportunities in data centre growth and telecommunication consolidation.

F&A growth was driven by increased client activity including expansion in the upstream and manufacturing segments, as well as corporate actions in the F&B manufacturing and food services segments. We also increased market penetration among global and regional players across the entire value chain.

Intra-regional trade grew about 30% as Chinese supply chains continued moving to Asean. Our extensive footprint in North, South and Southeast Asia, coupled with our deep industry expertise, put us in good stead to capture investment and trade flows from “China+1” activities. Our ability to bridge East and West was an added boon to Western multinationals expanding into Asia.

DBS India delivered a solid performance across all segments as we leveraged our full-service platform and deepened corporate relationships to capture opportunities in India’s growth.

As a result of these collective efforts, clients affirmed our role as their trusted banking partner in the Coalition Greenwich Large Corporate Survey when we moved from second to first place in the regional list for customer satisfaction and quality, while retaining the top spot for market penetration.

Entrenching ourselves in the mid-sized corporates & SME segments

We continued to entrench ourselves among mid-sized corporates and SME clients. By leveraging our industry expertise, we expanded our mid-sized corporate customer base across markets. By focusing on connectivity flows, better anticipating customer needs and delivering tailored solutions, we achieved strong growth in non-interest income.

We also dialled up our financing and advisory services for SMEs. In Singapore, we were the leading financial institution in providing working capital loans to companies under the Enterprise Singapore Financing Scheme. Across the region, greater digital engagement via campaigns and personalised nudges led to a 4% increase in our borrowing customer base.

To help businesses stay competitive in the new economy, we embarked on several strategic public-private partnerships. In Singapore, we launched the Bridging Business Horizons programme to help companies expand overseas and the Spark GenAI programme to accelerate the adoption of generative AI (Gen AI) solutions.

In recognition of our market leadership, we were named Best SME Bank in Asia Pacific by Global Finance.

Scaling Global Transaction Services to drive growth

Our Global Transaction Services business continued being a key growth engine, accounting for 51% of IBG income.

Our enhanced digital capabilities and strengthened technology resiliency enabled us to deliver more innovative solutions for customers to grow their business.

Real-time transaction volumes increased 34% regionally led by the scaling of domestic payment and collection mandates, as well as the implementation of more than 700 new regional cash management mandates. Nimble pricing strategies for deposits enabled us to respond quickly to volatile market conditions.

Higher volumes of international trade, investments and remittances raised the demand for secure cross-border payments. In June, we partnered Mashreq, a leading financial institution in the Middle East, to offer near-instant peer-to-peer cross-border payments to its retail customers across the Asia Pacific, Europe and the Americas. The service is powered by Globesend, a cross- border payment solution covering up to 132 currencies across 190 markets.

For many years, DBS has led various industry initiatives to explore how blockchain technology could transform the financial services landscape. In 2024, we introduced blockchain-powered DBS Token Services which combine tokenisation and smart contracts with our existing banking solutions to enhance transaction banking and improve operating efficiency for clients. Early adopters include Ant International, which uses the service for instant multi-currency treasury and liquidity management.

With cryptocurrency becoming a professionally managed alternative asset class, our assets under custody grew 20% as more professional investors tapped on bank-grade custodians and exchanges.

Enabling Asia’s transition

In 2024, we strengthened our sustainability leadership by partnering clients as financier and advisor in their decarbonisation journeys. Our sustainable financing commitments, net of repayments, grew to SGD 89 billion.

Notably, the team led the structuring of Indonesia’s first blended finance project – comprising a mix of public-private sector funding and concessionary capital – to develop a water treatment plant. The project aims to deliver fresh water to two million residents in three cities including Jakarta.

We also provided Singapore-based City Developments Limited with an SGD 400 million loan to support nature conservation and sustainable development. The loan integrates targets aligned with Taskforce on Nature-related Financial Disclosures recommendations, a first-of-its-kind achievement.

Regulatory pressure and consumer expectations have made it more pressing for companies to manage value-chain emissions. To manage the inherent complexity of supplier networks, we developed various industry solutions anchored by major corporations to provide working capital and support sustainable outcomes.

In a first for the Hong Kong construction sector, we partnered developer, Sanfield, to launch a supplier payment services programme to help develop a sustainable construction ecosystem. In Singapore, we collaborated with Enterprise Singapore to launch the ESG Ready Programme to help mid-sized corporates and SMEs identify, develop and implement decarbonisation strategies. A similar programme was launched in Taiwan in November.

Internally, we have introduced several initiatives to empower our people with the knowledge and tools to keep up with the rapidly evolving sustainability landscape and deliver more effective sustainability advisory. For example, relationship managers use a Climate Analytics Tool to better forecast and visualise a client’s projected emissions performance.

We also started leveraging Gen AI to analyse data and populate fields in a risk questionnaire that forms part of our ESG risk assessment process. The outcome has led to better ESG risk analysis as well as increased employee productivity.

In recognition of our sustainability leadership, we were awarded World’s Best Bank for Sustainable Finance by Global Finance for the first time.

Leveraging technology for a new way of working

Delivering a seamless, intuitive and efficient customer experience has been a key feature in winning over customers. To achieve this, we have been breaking down internal siloes to create cross-functional teams that are underpinned by data and digital capabilities including Gen AI. We call this approach Managing through Journeys (MtJs), which gained further momentum during the year.

Among the results was a 30% reduction in the turnaround time for corporate account opening, a 20% improvement in risk detection, as well as enhanced employee productivity. We also launched a Gen AI-powered tool to help employees with processes and policies.

Looking ahead

All eyes are on the new Trump administration and US-China trade relations in 2025. While policy swings will be hard to predict, the ramifications of these will be far-reaching and businesses will need to remain agile to adapt to these shifts. We also expect continued macroeconomic uncertainty and market volatility from geopolitical conflicts.

On the other hand, shifting trade and investment flows will be beneficial to much of Asia. We will continue leveraging our strength as an Asia-centric bank to support our clients seeking to diversify their supply chains or to pursue a “China+1” strategy.

IBG has built a formidable arsenal combining strong financials, prudent risk management, deep industry knowledge, extensive connectivity, as well as digitalisation and sustainability capabilities. These are strengths that we will continue bringing to bear to help our customers navigate the complex business landscape.

Looking forward, we will continue dialling up businesses with high return on equity, as well as scale digital acquisition and the use of Gen AI to create impact and unlock value for our stakeholders. We believe these priorities will put us in good stead to navigate the challenges ahead.

* Succeeded by Han Kwee Juan as Group Head of Institutional Banking on 1 January 2025.