Making Greater Impact

Download Annual Report 2024 | 中文DBS Group Holdings Ltd

Annual Report 2024

Making Greater Impact

Download Annual Report 2024 | 中文

From Ambition to Action

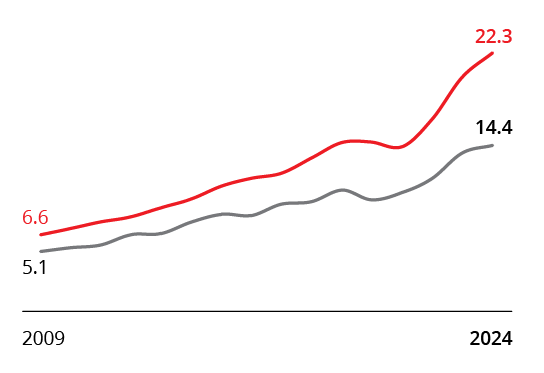

Download Sustainability Report 2024Income growth has outpaced peers

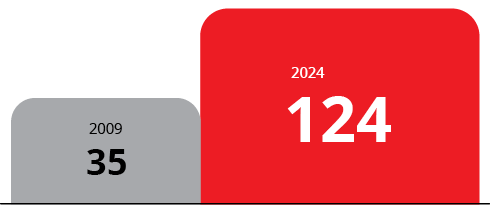

Net profit has grown fivefold since 2009

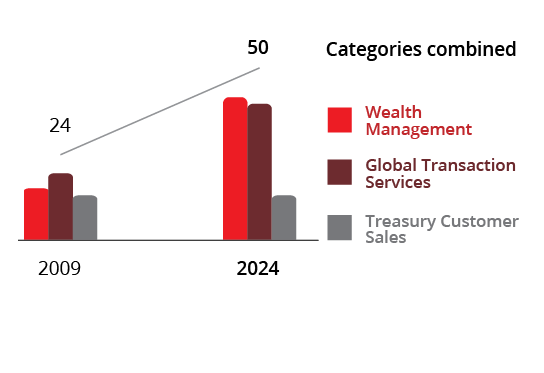

Percentage of group income from high-ROE segment has doubled from 24% in 2009 to 50% in 2024

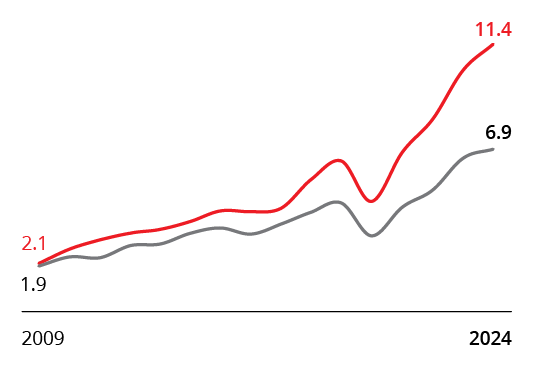

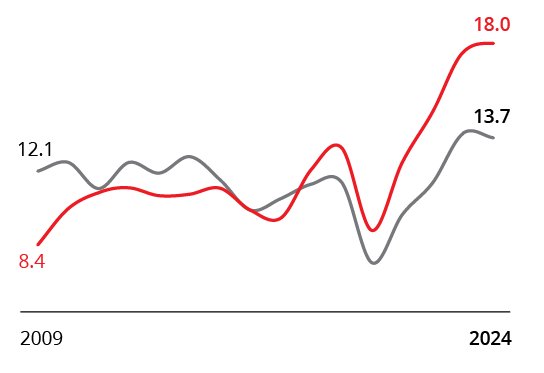

Return on equity has more than doubled since 2009, surpassing peers

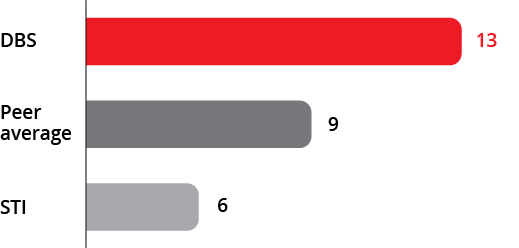

Annualised total shareholder return of 13% since end-2009

DBS' market capitalisation crossed SGD 100 billion in 2024 – a first for a Singapore-listed company. It has quadrupled since 2009.

ROE of 18.0% for latest financial period as well as annualised TSR of 13% since end-2009 in top decile of 100 largest banks by assets.

We have grown our customer base substantially on the back of organic growth, strategic acquisitions as well as the strength of our ecosystem partnerships

| Consumer Banking/ Wealth Management | |

| 2009 | 2024 |

| 4.9m | >18.4m |

| Institutional Banking | |

| 2009 | 2024 |

| >180,000 | >280,000 |

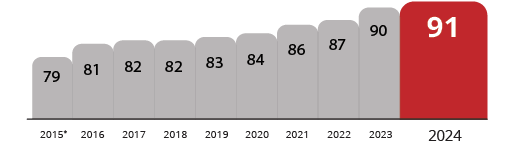

While our workforce has nearly tripled, we have continued to build a positive work culture. Since 2016, we have received the Best Employer Award from Kincentric / Mercer which recognises leading employers worldwide using the most objective measure possible - employee opinion.

* Transited to a new methodology from 2015

We have made a significant impact on society through the DBS Foundation and other community programmes in the markets we are in.

| Upsizing our commitment to the community from 2024 | |

| SGD 1b | committed over 10 years to foster inclusion and provide essential needs to Asia’s vulnerable |

| 1.5m | volunteer hours over 10 years to give back to society |

| DBS Foundation - creating impact beyond banking since 2014 | |

| SGD 130m | in funding committed |

| 161 | Businesses for Impact supported |

| 37 | community programmes forged with partners in our six core markets |

| >1m | volunteer hours contributed through our People of Purpose employee volunteerism movement |

| Other community initiatives | |

| SGD 25m | donated to the National Gallery Singapore in support of the Gallery’s efforts to tell the Singapore story through visual arts |

| SGD 10.5m | for the DBS Stronger Together Fund to support hard-hit communities in our key markets during Covid-19 |