Progressing Business

A business may start out as a Small or Medium Enterprise (SME) at the local or national scale. These days, the prospect of a business expanding and competing in ASEAN or even at the regional level it is no longer out of reach.

DBS shared its views on the important steps business players should pay attention to in order to progress to the regional level.

An SME is needed to be consistently equipped with insights and updates on the Asian market, thus the business players will certainly have direction to bring further their business. They need to understand the local appetite and range of approaches that they can use to develop a business in Asia.

These are three strategic steps SMEs should consider.

Business Efficiency

Running a business in several Asian nations demands players to have an efficient cash flow, product supply, and distribution chain. Otherwise, to have it could cost the company’s working capital.

According to Atradius Payment Practices Barometer research conducted by DBS in November 2013, more than half of the respondents in each of the countries surveyed (Singapore, Hong Kong, China, India, Taiwan, and Indonesia) agreed that cash flow is the major challenges to increasing profit and improving productivity.

As a businessman, it is advised to become more vigilant and open to challenge every method of approach in order to measure the efficiency of a business. The company needs to analyze the distribution chain of goods and finance, before undergoing benchmarking with the industry. This step will help the SME business players reduce its banking costs and have a healthy cash flow to ensure significant growth in productivity.

DBS has held a series of trials through Working Capital Advisory services. The cash flow efficiency of DBS clients that participated in this approach is on average increased at around 20-30 percent. This sort of increase is relatively high for a business. Therefore, Working Capital Advisory services come with a comprehensive consultancy that will help all of DBS clients to see all angles that are critical to their business process and decision making.

Business Networking Based on Market Characteristics

For the Asian market, although countries share many common traits, they are still in a lot of ways very different from one another; from market interests to goods, regulations, and operational needs. Therefore, good business networking should be maintained to help clients understand the appetite and interest from each particular market.

Every SME player will need to view the market in Singapore may be very different from the Malaysian and Indonesian markets, for instance. In that market, an SME has a different unique proposition for their product. At the same time, DBS could provide local analysis on every country that suitable to the client’s needs. This would in turn allow Indonesian clients to better plan their next move.

Banking Technology

In today’s digital era, swift transactions have become a primary need, whereas previously, every type of transaction had to be done at the bank. Nowadays, everything is done via mobile. Foreign exchange, for example, can now be done without a relationship manager (RM).

With no hassle, now applying for Letter of Credit and arranging deposits placement don’t need to be done at the bank’s branches.

With today’s banking technology, it is now easier for clients to conduct business transactions wherever they are. Even though they are not in the country, the business activities in Indonesia can still be monitored.

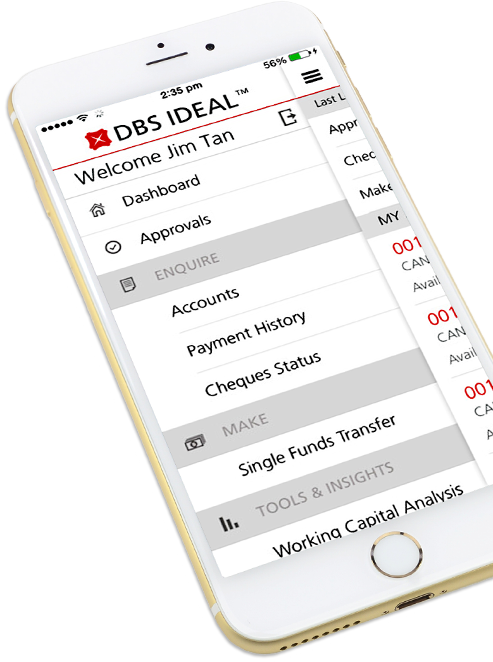

DBS recently introduced an award-winning platform named DBS IDEAL™ 3.0. With the platform, clients can conduct secure transactions in real time anywhere. Since DBS IDEAL™ 3.0 was made available for mobile devices, DBS has seen an increase of the payment volume through the platform until 98% with 66% Straight to Payment (STP) level.

Digital era has brought more to the banking industry. DBS, for example, has added its services with a specific website provided for SMEs, www.dbs.com/id/sme. Moreover, this website not only equipped with Asian market insights, but also features a loan simulator that allows users to conduct calculations for their working capital – everything is connected online, it benefits the SMEs to accurately gauge their business prospects and finances.

The three tips are able to planning SME business further and compete regionally. Other SME may see the ASEAN Economic Community (MEA) as a challenge but now it’s time to see huge opportunity where Indonesia’s SMEs has a path to go regional. However, a mature planning is very much needed.

The sparking idea in growing business has always been motivation for SME players. Additionally, in being partner for growth, a bank should earn trust and professionalism from its clients.

Trust and professionalism are top priorities. DBS delivers it. The bank has always been helpful and supportive to our business. We are comfortable with DBS and we hope this mutual relationship will continue to grow.Jimmy Dharmadi Owner of Apex Indopacific