We also seek to cultivate a financial technology (fintech)-like culture among our 22,000 people.

We believe that innovation is not just the mandate of our innovation group.

Since 2015, we have run over 1,000 experiments across the bank, and in this way, a culture of innovation at DBS goes broader and runs deeper than at many organisations.

What are some of the strategies we are using to embrace a digital culture?

1. Embed yourself into the customer’s journey

To manage experiments, we adopt agile and human-centred design methodologies. We immerse ourselves in the customer journey before developing any products to understand what customers really need or want to do.

Then we prototype, test and iterate quickly. That way, we fail early and inexpensively to learn faster.

Our people learn what it means to be agile in an immersive way. You cannot lecture on digital innovation and expect people to change. So we started doing hackathons in 2014. Just in February this year, we were also the first bank in Southeast

Asia to use hackathons to recruit top developers in Singapore and India with our Hack2Hire programme.

Through such platforms, employees are given a framework and tools to innovate. The teams have gone on to launch digital offerings such as DBS PayLah! that you see in the market now.

In my first human-centred design session, I had to discuss with a colleague the journey of buying a gift for our wives. We had to consider the pain points we would experience and what would make our wives happy.

As you can imagine, the conversation between two men started out rather awkwardly because as colleagues, we usually do not talk about such personal matters. Often, we hide behind spreadsheets.

Talking about emotions, however, helps us develop empathy and uncover unmet needs. At the end, I had a lot of fun and learnt to see problems in a new way.

2. Create a platform to bring people together

Digital native organisations like Facebook are masters of creating globally scalable platforms that bring people together and integrate into their lives. DBS has begun thinking in similar terms. The job to be done is to deliver joyful

experiences

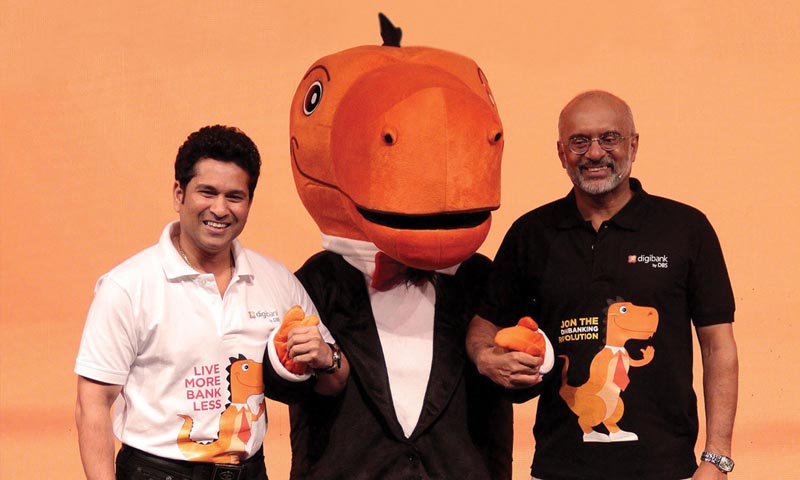

At digibank India, we built an ecosystem of partners comprising artificial intelligence (AI) experts, data scientists and developers. It is the country’s first mobile-only

bank that is branchless, paperless and signatureless, and incorporates technologies like AI.

Our success means we could replicate this platform in other markets. We plan to roll out a similar offering in Indonesia this year.

3. Work with fintech companies

We are actively finding ways to mentor, partner and support fintech companies, who we see as more of an opportunity to work with than a threat.

The rapid spread of fintech might indicate success, but the reality is that only a few have made it. There are three main reasons.

First, their solutions are unproven. Second, customer acquisition has remained a challenge – traditional banks are still seen as safer than online banks. And third, banks themselves have woken up to the threat of fintech and are rolling

out online services for customers who might otherwise have moved to newer, nimbler players.

Traditional banks like DBS can leverage the best of both worlds. Banks still have existing advantages such as safety and trust, deep expertise in banking products, managing risks, processing capabilities and data pools. Fintech companies

are customer-centric, nimble and agile, and are always innovating and experimenting.

For this reason, in Singapore and Hong Kong, we have been running a number of pre-accelerator programmes, which allow us to stay connected with new, emerging fintech; to have a first shot at any opportunities for partnership, and to forge

a banking relationship with startups.

Where we can, we will also bring fintech into our platforms. Going back to digibank India, the offering combined a few startup products: the artificial intelligence technology was from US-based Kasisto, while the recommendation engine and the virtual key were products of two Singapore fintech companies Moneythor and V-Key.

4. Celebrate failure

Getting our hands dirty is part of the process. A few years ago, I learned to build mobile apps. It was uncomfortable because the last time I coded was more than 20 years ago. The interface I designed was not great, but this experiment

has made me better able to guide our digital initiatives as a developer and user.

My teams are encouraged to be multidisciplinary, to experiment and accept that some projects will fail, especially if we set challenging “moonshot” goals. Celebrating failures may be hard in certain cultures. However, I believe it is the

stretch goals that will help transform businesses.

At DBS, for instance, we set an ambitious goal to launch a mobile-only bank, digibank, in India within 18 months. We successfully delivered this in April 2016. A year later, we managed to acquire a million customers for digibank India.

Embracing fintech, integrating them and cultivating a fintech mentality are central to winning.

This article was first published on ChannelNewsAsia.com.

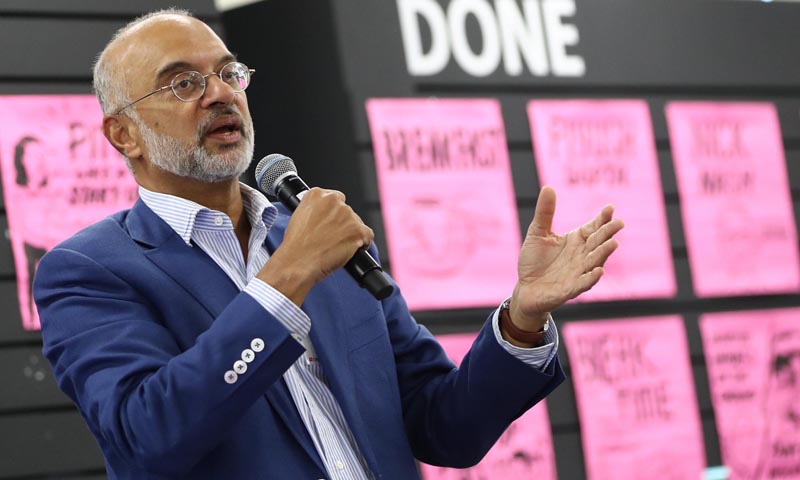

David Gledhill is DBS Bank’s Group Chief Information Officer. David was also recipient of the 2017 MIT-Sloan Chief Information Officer Leadership Award presented by MIT. Follow David on his LinkedIn account for more innovation insights.

Hong Kong

Hong Kong India

India Indonesia

Indonesia China

China Taiwan

Taiwan

8 Jun 2017 by

8 Jun 2017 by