AI-driven virtual assistant meets customers’ banking needs and queries 24/7

Imagine a bank that has no paper and does not require forms nor signatures. A bank that travels with you, telling you the best opportunities and deals based on where you are and what you are doing. A bank that offers you much better interest rates because operating costs are far lower than that of any traditional bank.

Imagine a bank that can figure out what you are likely to want and what makes sense for you to do. And over time, continues to get to know you better, and better. At the same time, this is a bank with tremendous inbuilt security – beyond one-touch passwords and the vagaries of today’s cyber-security issues – so all this information about you is kept safe.

If this is the future of banking, that future is here and some one million DBS customers are now part of it.

Last April, DBS delivered an intelligent bank with all the attributes above, neatly rolled into a mobile phone. A year on, one million customers have signed up for digibank – all without stepping foot into a branch. Five million customers are projected by 2021.

Hassle-free banking, AI-driven assistance

digibank is India’s first mobile-only bank, where customers can open their accounts at various designated outlets, including Café Coffee Day joints, across India. All they need is their Aadhaar card, a biometrics-enabled ID which has been issued to over 1 billion Indians. No paperwork? Check.

Doing away with brick-and-mortar bank branches, digibank has instead turned to a wide range of technology to offer improved services to customers.

For instance, an AI-driven virtual assistant that understands natural language and has learning ability is available 24/7 to meet customers’ banking needs and queries. The virtual assistant can hold “human-like” conversations – understanding not only what the customer is saying but also what he or she is trying to do with multi-turn conversations. At launch, the virtual assistant was already able to anticipate and answer some 1,000 customer questions.

Currently, the virtual assistant is able to handle over 80% of all customer requests without human intervention. Less than 20% of customer requests go to live chat sessions.

This technology was rolled out in partnership with US-based fintech Kasisto to harness experimental conversational technology. (POSB has since also tied up with Kasisto to launch its virtual assistant.)

In addition, digibank’s budget optimiser understands customers’ behaviours and provides recommendations based on data synthesised. For instance, foodies get offered restaurant discounts. The tool also studies spending patterns and prompts users if they are overspending; or offers suggestions on how to make their money work harder if they save more than they spend.

Crucially, customers are protected with dynamic inbuilt security in the digibank application, which is safer than One-Time Passwords (OTPs). Instead of receiving OTPs via SMS, then keying in the codes to authorise transactions, digibank has an embedded soft token security, avoiding the need to wait for SMSes to arrive. Authentication takes places securely and automatically every time a customer transacts.

More cost savings, better interest rates

Without the costs of physical branches and by tapping on AI-driven automation, digibank operates on a lower cost base than traditional banks.

DBS digibank, in fact, requires just a fifth of the resources of a traditional bank set-up. It is thus able to pass on these savings, resulting in greater value for customers. Account-holders earn 7% interest from the first rupee, one of the highest in the market.

As noted in an article on Forbes, this set up also allows digibank to “scale across the subcontinent with virtually no additional investment”. “It’s no wonder DBS won the award for best digital bank in the world,” the article stated.

Moving ahead, DBS will be launching a similar version of digibank in Indonesia, reaching out to young, tech-savvy consumers, later this year. The mobile-only banking service includes an e-wallet and a savings account; the virtual assistant converses in Bahasa Indonesia.

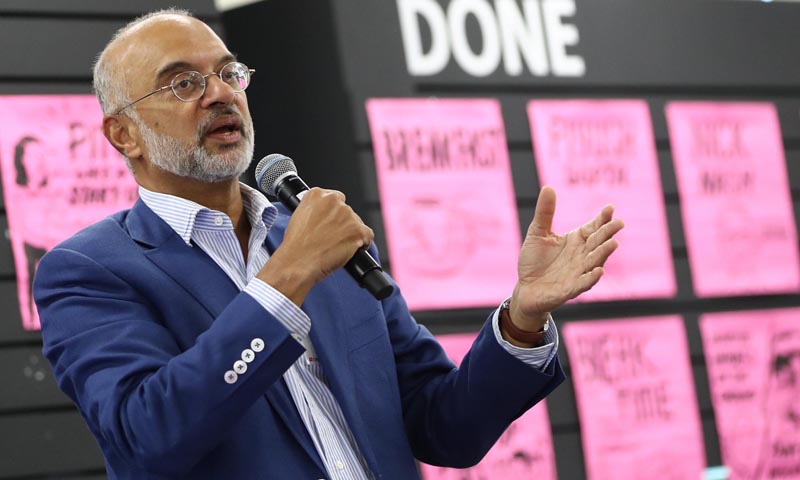

Said DBS Bank CEO Piyush Gupta in a 2015 Financial Times interview on why the bank is focusing on a digital growth strategy:

We’d rather not be caught fighting yesterday’s battle. We’d rather focus on tomorrow’s war.

Hong Kong

Hong Kong India

India Indonesia

Indonesia China

China Taiwan

Taiwan