DBS on the launch of Singapore Financial Data Exchange (SGFinDex)

Singapore.04 Dec 2020

Singapore, 04 Dec 2020 - DBS welcomes the launch of Singapore Financial Data Exchange (SGFinDex), a national digital infrastructure that enables consumers to retrieve and consolidate financial data from Government agencies and private sector organisations.

Said Shee Tse Koon, DBS Singapore Country Head said: “The economic challenges wrought by Covid-19 has revealed an acute need for financial planning among Singaporeans, many of whom were unprepared for a sudden disruption in income. The launch of SGFinDex is therefore timely – our customers are now empowered with a helicopter view of their finances, which brings us closer to reaching our aim of providing personalised financial planning to every person in Singapore regardless of their income level. This purpose has also informed our financial and retirement planning proposition, where our financial literacy guides, digital financial planning tool NAV Planner and digital investment solutions were designed to bring financial expertise to all.

We believe this approach is working. Since NAV Planner’s launch in April, we have helped more than 400,000 customers turn their finances around. All five million DBS/POSB customers can now access SGFinDex through NAV Planner to consolidate their financial data, and get personalised insights and actionable recommendations on how to grow their money. We applaud the MAS’s foresight in introducing SGFinDex, which will amplify industry efforts to help people achieve financial wellness.”

Designed specifically to maximise data-sharing benefits similar to those which SGFinDex will bring, NAV Planner has a built-in flexibility where customers can choose to proactively provide information of their external holdings to complete their balance sheet. To date, more than 40,000 customers have done do, proving that DBS’ forward-thinking functionality has resonated very well with users.

With its ability to data-crunch and produce personalised and actionable insights as well as retirement projection plans, NAV Planner has already helped close to 1.8 million customers make sense of their financial data and overcome inertia by empowering them to make better informed decisions with their money.

DBS NAV Planner is available to everyone in Singapore – including non-DBS/POSB customers – to use. DBS/POSB customers can log into their internet banking or digibank accounts to access NAV Planner, whereas new-to-bank customers can sign up for a digibank account in four steps with MyInfo. Only upon customer consent via SingPass authentication will the exchange and consolidation of financial planning data take place.

“Like most in Singapore, I have accounts and investments with several banks and I sometimes forget my login information as I don’t want to take the risk of writing all of it down. It is also a chore to record and update my holdings from each bank on Excel before I can start calculating my financial obligations on my own,” said Karen Chen, 39, a professional creative. “As my primary bank, I initiated the SGFinDex data consolidation via DBS NAV Planner and was pleasantly surprised to see that DBS had gone a step further to help me make sense of the aggregated data. I was provided a financial health analysis which was helpful, as for example, I was unaware I could have invested the funds in my SRS account to achieve a higher return. The insights and recommendations were customised to me, and I found them digestible and actionable which helped me better plan for my retirement.”

Between August to October this year, DBS observed that 8 in 10 customers who are new-to-fund investing have done so as part of their follow-up on a recommendation provided by DBS NAV Planner. More customers are coming forward to invest not just in cash, but also via their CPF or even SRS accounts, and the number of DBS/POSB customers who topped up their CPF accounts more than doubled this year (a 63% y-o-y increase as of Oct’20).

For more information on how to connect to SGFinDex via NAV Planner, visit: https://www.dbs.com.sg/personal/deposits/digital-services/sgfindex/

About DBS

DBS is a leading financial services group in Asia with a presence in 18 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Euromoney, “Global Bank of the Year” by The Banker and “Best Bank in the World” by Global Finance. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney. In addition, DBS has been accorded the “Safest Bank in Asia” award by Global Finance for 12 consecutive years from 2009 to 2020.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets. DBS is committed to building lasting relationships with customers, and positively impacting communities through supporting social enterprises, as it banks the Asian way. It has also established a SGD 50 million foundation to strengthen its corporate social responsibility efforts in Singapore and across Asia.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. The bank acknowledges the passion, commitment and can-do spirit in all of our 29,000 staff, representing over 40 nationalities. For more information, please visit www.dbs.com.

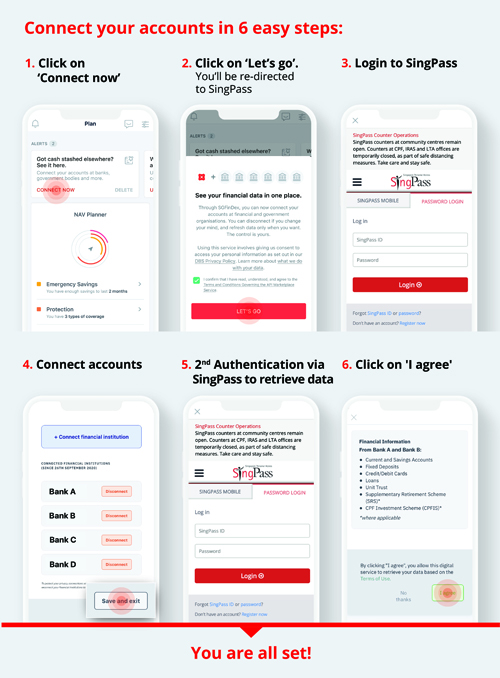

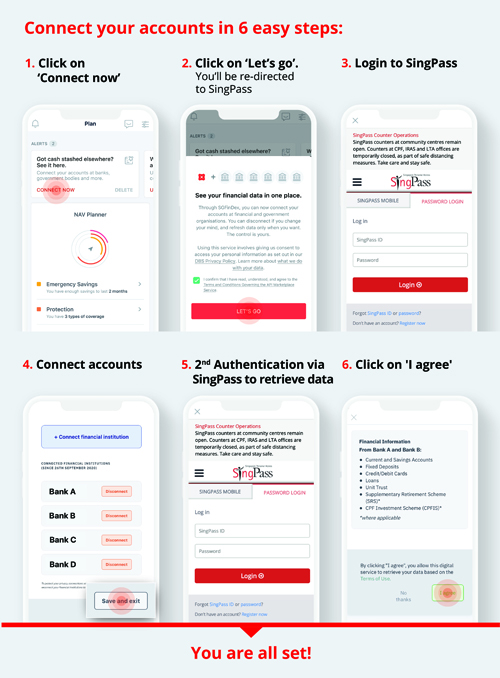

DBS, POSB customers can connect and consolidate their financial info via SGFinDex through NAV Planner in six easy steps.

Said Shee Tse Koon, DBS Singapore Country Head said: “The economic challenges wrought by Covid-19 has revealed an acute need for financial planning among Singaporeans, many of whom were unprepared for a sudden disruption in income. The launch of SGFinDex is therefore timely – our customers are now empowered with a helicopter view of their finances, which brings us closer to reaching our aim of providing personalised financial planning to every person in Singapore regardless of their income level. This purpose has also informed our financial and retirement planning proposition, where our financial literacy guides, digital financial planning tool NAV Planner and digital investment solutions were designed to bring financial expertise to all.

We believe this approach is working. Since NAV Planner’s launch in April, we have helped more than 400,000 customers turn their finances around. All five million DBS/POSB customers can now access SGFinDex through NAV Planner to consolidate their financial data, and get personalised insights and actionable recommendations on how to grow their money. We applaud the MAS’s foresight in introducing SGFinDex, which will amplify industry efforts to help people achieve financial wellness.”

Designed specifically to maximise data-sharing benefits similar to those which SGFinDex will bring, NAV Planner has a built-in flexibility where customers can choose to proactively provide information of their external holdings to complete their balance sheet. To date, more than 40,000 customers have done do, proving that DBS’ forward-thinking functionality has resonated very well with users.

With its ability to data-crunch and produce personalised and actionable insights as well as retirement projection plans, NAV Planner has already helped close to 1.8 million customers make sense of their financial data and overcome inertia by empowering them to make better informed decisions with their money.

DBS NAV Planner is available to everyone in Singapore – including non-DBS/POSB customers – to use. DBS/POSB customers can log into their internet banking or digibank accounts to access NAV Planner, whereas new-to-bank customers can sign up for a digibank account in four steps with MyInfo. Only upon customer consent via SingPass authentication will the exchange and consolidation of financial planning data take place.

“Like most in Singapore, I have accounts and investments with several banks and I sometimes forget my login information as I don’t want to take the risk of writing all of it down. It is also a chore to record and update my holdings from each bank on Excel before I can start calculating my financial obligations on my own,” said Karen Chen, 39, a professional creative. “As my primary bank, I initiated the SGFinDex data consolidation via DBS NAV Planner and was pleasantly surprised to see that DBS had gone a step further to help me make sense of the aggregated data. I was provided a financial health analysis which was helpful, as for example, I was unaware I could have invested the funds in my SRS account to achieve a higher return. The insights and recommendations were customised to me, and I found them digestible and actionable which helped me better plan for my retirement.”

Between August to October this year, DBS observed that 8 in 10 customers who are new-to-fund investing have done so as part of their follow-up on a recommendation provided by DBS NAV Planner. More customers are coming forward to invest not just in cash, but also via their CPF or even SRS accounts, and the number of DBS/POSB customers who topped up their CPF accounts more than doubled this year (a 63% y-o-y increase as of Oct’20).

For more information on how to connect to SGFinDex via NAV Planner, visit: https://www.dbs.com.sg/personal/deposits/digital-services/sgfindex/

[END]

About DBS

DBS is a leading financial services group in Asia with a presence in 18 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Euromoney, “Global Bank of the Year” by The Banker and “Best Bank in the World” by Global Finance. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney. In addition, DBS has been accorded the “Safest Bank in Asia” award by Global Finance for 12 consecutive years from 2009 to 2020.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets. DBS is committed to building lasting relationships with customers, and positively impacting communities through supporting social enterprises, as it banks the Asian way. It has also established a SGD 50 million foundation to strengthen its corporate social responsibility efforts in Singapore and across Asia.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. The bank acknowledges the passion, commitment and can-do spirit in all of our 29,000 staff, representing over 40 nationalities. For more information, please visit www.dbs.com.