Bank DBS Indonesia’s projections for Indonesia’s and global economy in 2025 | Bahasa

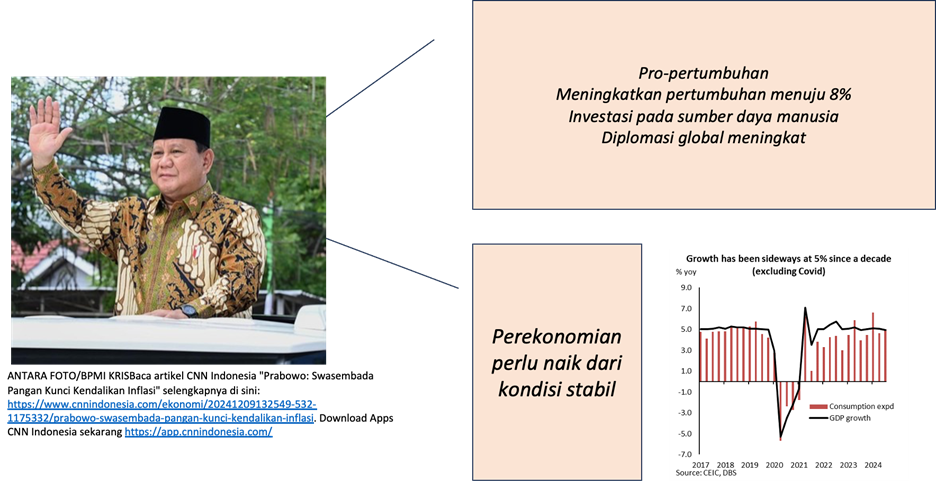

● The year 2025 will mark the first year of the new government. While the political transition indicates continuity from the previous government, changes in focus areas are crucial to kick-start growt

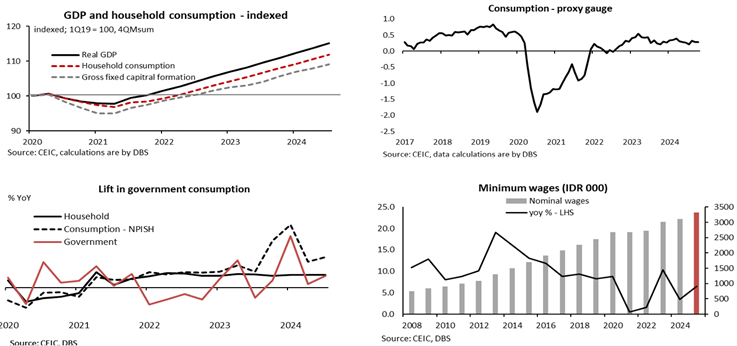

● For 2025, DBS Group Research's gauge for consumption shows that policy support is crucial. Benign inflation will open doors for interest rate cuts, depending on the currency. Current account balance

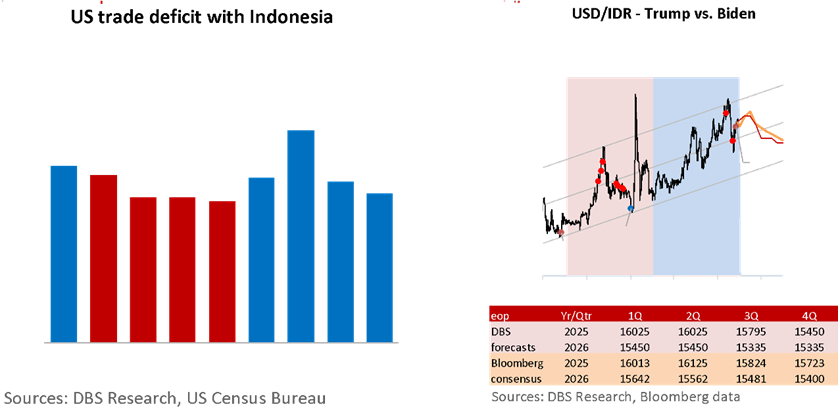

● On the currency side, bearing in mind Trump's promise to impose tariffs at the start of his second term, DBS Group Research expects the USD/IDR exchange rate to remain at above IDR16,000 in 1H25, wi

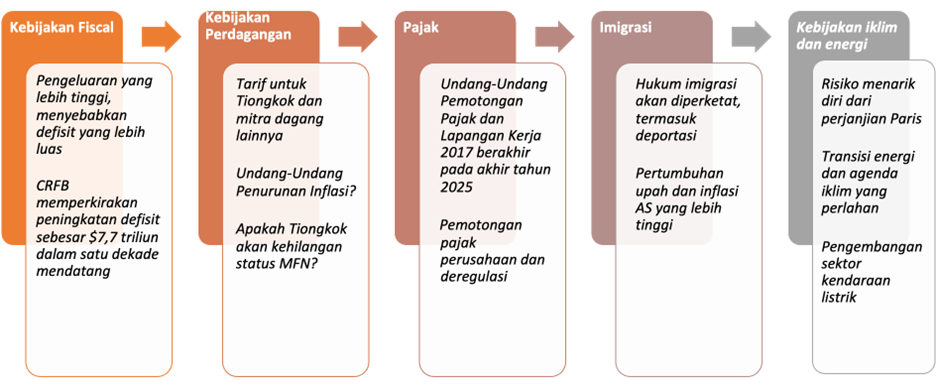

US: Trump, trade, and tariffs

Indonesia outlook

Indonesia 2025 outlook

Drivers of growth

There are positive supporting factors for consumption, namely an increase in minimum wage, government social assistance programmes, slowing inflation, and an increase in real wages.

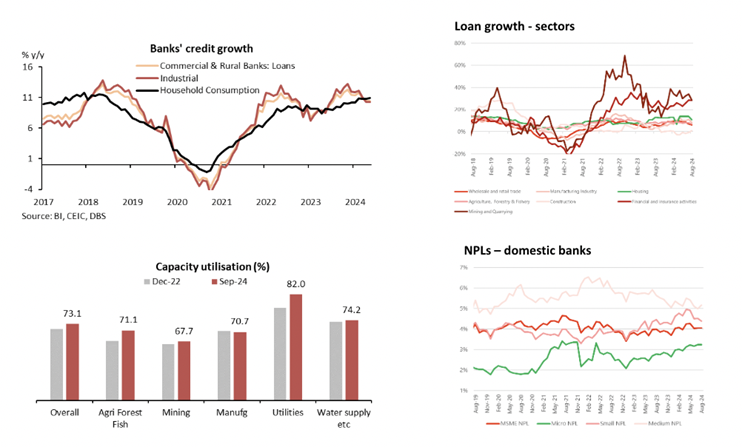

In addition, credit growth is considered to be quite strong, led by corporate demand (financial institutions). Capacity utilisation has increased. As consumption levels improve, businesses will increase spending.

Indonesia's journey towards economic growth, from 5% to 8%

For the medium-term, efforts to boost growth will most likely consist of a '3C' framework, namely:

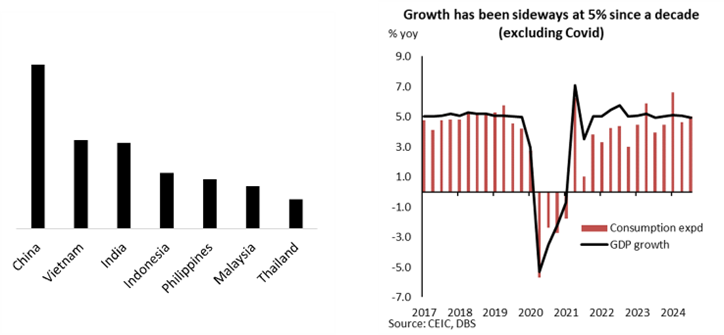

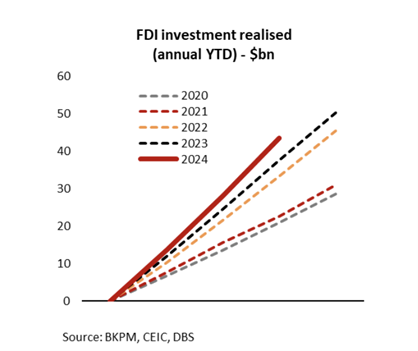

1. Capitalize on exports and China +1 reconfiguration. Under the new administration, DBS Group Research expects trade and investment activities will receive renewed impetus to capitalize on the ongoing supply chain reconfiguration, driven by the China+1 factor.

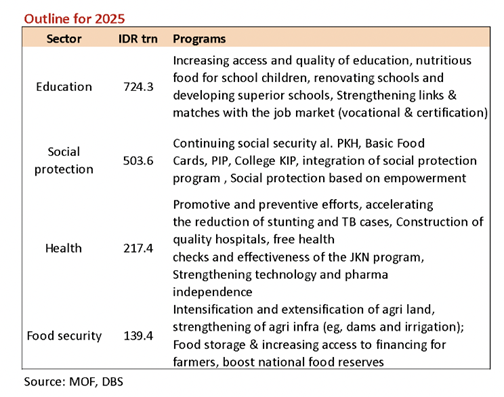

2. Consumption and improvement in human capital. Indonesia continues to enjoy the benefits of the demographic dividend, even as its neighbors face declining working-age population and rising life expectancy, resulting in rapidly aging societies. Home to the largest population in ASEAN, Indonesia has benefited from a consumption-driven growth model. In addition to quantity, the government is also expected to increase efforts to develop the quality of the workforce.

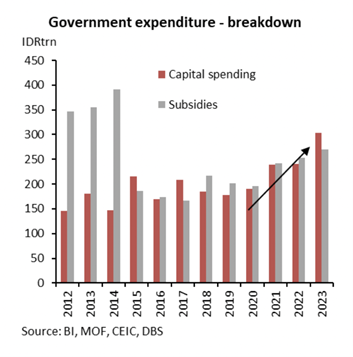

3. Capital investments and fiscal rationalisation. In 2023, government capital expenditure was greater than subsidies. This marked a significant change from the early 2010s when subsidies were almost double capital expenditure, almost double capital disbursements. Subsequent subsidy rationalisation efforts have helped contain the total subsidy bill from 2015-2017.

As the expenditure mix improves, the focus is also likely to shift to the quality of expenditure. For now, the proportion of capital expenditure is relatively small compared to revenue expenditure (materials, personnel, interest payments, subsidies, etc.). Higher development spending is needed to increase the productive capacity and attract investors.

Impacts of US election on Indonesia

Domestic bonds, the rupiah, and portfolio flows remain vulnerable to volatility in global financial markets. Asian countries, including Indonesia, will seek to adopt a defensive stance and strengthen barriers in the face of the risk that the US will become more trade protective and impose tariffs on a number of triggers. DBS Group Research has discussed the trade and investment relations of ASEAN-6, including Indonesia, with the US and China in a report entitled ASEAN-6: Counting on trade, eye on risks and ASEAN-6: Tailwinds from supply chain reconfiguration.

Market outlook - BI to remain cautious

In the second half of 2024, inflation declined and the economy showed moderate growth. DBS Group Research expects BI to move gradually, with an eye on movements in the rupiah exchange rate and US Federal Reserve interest rates.

Currency outlook

USD outlook, new US government policies, and risk appetite will affect the rupiah. DBS Group Research expects currency weakness in the short term, before recovering in the second half of 2025.

In his first term, Trump did not subject Indonesia to high tariffs. Indonesia only accounted for an average of 1.5% of total US deficit during his first term, which increased slightly to 1.7% during Biden's term. In the first ten months of 2024, Indonesia ranked as the 23rd largest contributor to US trade deficit.

However, a review of the Generalized System of Preferences (GSP) facility for Indonesia during Trump's first term is a warning on being overly optimistic about his transactional approach to trade and diplomacy. Despite efforts to improve market access for US agricultural and pharmaceutical products, Indonesia could not stop Trump from allowing the GSP programme to expire globally in October 2020. Effectively, Indonesia lost duty-free access for about 13% of its total exports to the US. The GSP experience gives important lessons about over-reliance on traditional Western economies.

[END]

About DBS

DBS is a leading financial services group in Asia with a presence in 19 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. The bank's "AA-" and "Aa1" credit ratings are among the highest in the world.

Recognised for its global leadership, DBS has been named “World’s Best Bank” by Global Finance, “World’s Best Bank” by Euromoney and “Global Bank of the Year” by The Banker. The bank is at the forefront of leveraging digital technology to shape the future of banking, having been named “World’s Best Digital Bank” by Euromoney and the world’s “Most Innovative in Digital Banking” by The Banker. In addition, DBS has been accorded the “Safest Bank in Asia” award by Global Finance for 16 consecutive years from 2009 to 2024.

DBS provides a full range of services in consumer, SME and corporate banking. As a bank born and bred in Asia, DBS understands the intricacies of doing business in the region’s most dynamic markets.

Established in 1989 as part of the Singapore-based DBS Group, PT Bank DBS Indonesia (Bank DBS Indonesia) is one of the banks with the longest history in Asia. Currently operating 1 Head Office, 13 Branch Offices, 16 Assistant Offices and 4 Functional Offices and 3,011 active employees in 15 Major Cities in Indonesia, Bank DBS Indonesia provides comprehensive banking services that focus on the customer experience to 'Live more, Bank less'. We also see a purpose beyond banking and are committed to supporting our customers, employees, and the community towards a sustainable future.

PT Bank DBS Indonesia is licensed and supervised by The Indonesian Financial Services Authority (OJK), and an insured member of Indonesia Deposit Insurance Corporation (LPS).

DBS is committed to building lasting relationships with customers, as it banks the Asian way. Through the DBS Foundation, the bank creates impact beyond banking by supporting businesses for impact: enterprises with a double bottom-line of profit and social and/or environmental impact. DBS Foundation also gives back to society in various ways, including equipping underserved communities with future-ready skills and helping them to build food resilience.

With its extensive network of operations in Asia and emphasis on engaging and empowering its staff, DBS presents exciting career opportunities. For more information, please visit www.dbs.com.

Events