- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

Demat

- Details of Depository Participant

- Opening of Demat Account

- KYC Update for Demat Account

- Demat Charges

- Contact Details for Customer Grievance

- List of Demat Service Branches

- Mandatory Regulatory Disclosures

- Investor Charter

- Nomination

- ODR (Online Dispute Resolution) Portal

- Terms and Conditions

- e-Voting Platform of NSDL

- Attention Investors

Details of Depository Participant

- Depository Participant Name : DBS Bank India Ltd

- Depository : NSDL

- Depository Participant ID : DP ID IN303892

- Correspondence Address : DBS Bank India Limited, Depository Participant Cell, Ground Floor, Express Towers, Block III Back Bay Reclamation, Nariman Point, Mumbai – 400021.

- Registered Address : Ground Floors No. 11 & 12, Capitol Point, Baba Kharak Singh Marg, Connaught Place New Delhi DL 110001

- Email Address for correspondence : [email protected]

- Contact Details : 022 67528480

Key Managerial Persons (KMP)

|

Sr. No. |

Name |

Role |

Email ID |

Contact No |

|

1 |

Meeta Desai |

Compliance Officer |

+91 (22) 66297548 |

|

|

2 |

Ramalakshmi G |

Retail Depository Operations |

+91 (22) 67528480 |

|

|

3 |

Behram Nakra |

Head – Retail Depository Operations |

+91 (22) 67528349 |

|

|

4 |

Ketan Kulkarni |

Company Secretary |

+91 (22) 66147595 |

|

|

5 |

Rajesh Prabhu |

Chief Financial Officer |

+91 (22) 66297437 |

|

|

6 |

Surojit Shome |

Chief Executive Officer |

+91 (22) 66388847 |

Authorised Person

|

Behram Nakra |

Authorised Person for DP |

+91 (22) 67528349 |

Opening of Demat Account

- DBIL maintains a Depository Participant account with NSDL to offer Demat Services.

- Dematerialised (Demat) Account is an account that is used to hold securities like shares, debentures, bonds, government securities, mutual fund units etc.in an electronic format, facilitating seamless tracking and monitoring of holdings.

- To open a Demat Account please visit a Demat service branch and obtain the account opening form. List of Demat Services Branches Demat Service Branches.

KYC Update for Demat Account

You can now complete your Demat KYC in a few simple steps. The entire process is paperless and only takes a few minutes of your time.

Please click on the enclosed link to complete your KYC.

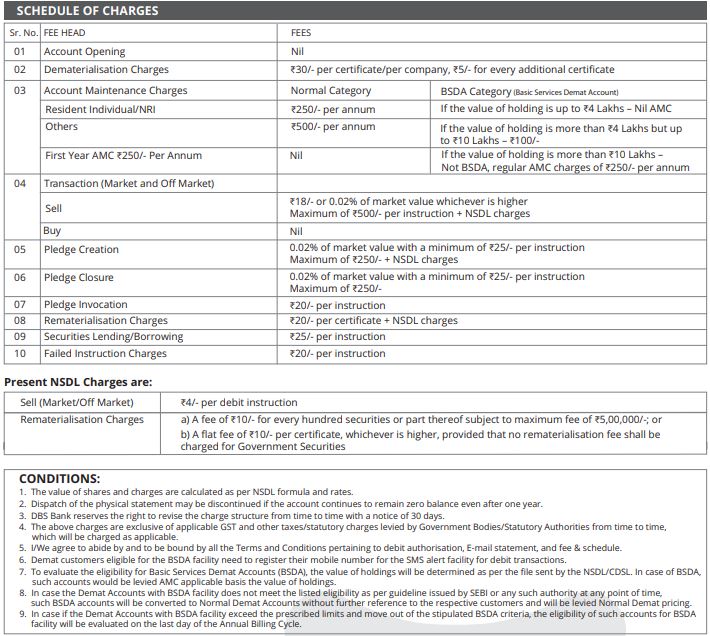

Demat Charges

Contact Details for Customer Grievance

View here

List of Demat Service Branches

View here

Mandatory Regulatory Disclosures

View here

Investor Charter

View here

Nomination

Please be advised that Nomination for your Demat account is now mandatory as per regulations and you have the option to either nominate someone or explicitly choose to opt out of nominating anyone.

We are happy to inform you that the National Securities Depository Limited or NSDL now offers you the facility to update your nomination online for your Demat account seamlessly and easily. However, the online option of the nomination process is applicable for single demat account holders and Resident Individuals only. Using the online facility, demat account holders can add upto three nominees in their demat accounts.

Please visit https://eservices.nsdl.com/instademat-kyc-nomination/#/login and follow the below mentioned steps to update your nominee details –

Step 1 : Enter < DP ID > + < Client ID > + < PAN > and the OTP sent on the mobile number registered for your demat account

Step 2 : Select < Nominate > OR < Opt Out >

Step 3 : E-sign using AADHAAR and the OTP sent on the mobile number registered with UIDAI (for your Aadhaar)

Alternatively, if you need assistance or if your Demat account is held jointly, you may visit and submit the enclosed nomination form at any of our branches offering Demat services. You can locate your nearest designated branch by visiting this page https://www.dbs.com/in/treasures/investments/product-suite/designated-demat-branches

ODR (Online Dispute Resolution) Portal

View here

Terms and Conditions

- This document lays out the Terms and Conditions which shall be applicable to the Demat Accounts which are existing as on Nov 2022 or may be opened anytime in future with DBS BANK India Limited as Depository Participant (DP). You can find these Terms and Conditions on ourwebsite www.dbs.com/in The word “Client” refers to the person(s) who opens the Demat Account and shall include both singular and plural. Reference to masculine shall include the feminine and neuter gender. "DBS BANK" refers to DBS BANK India Limited, a banking company incorporated in India under the Companies Act 2013 and having its registered office at GF: Nos 11 & 12 Capital Point, BKS Marg, Connaught Place, Delhi 110001 and its Corporate address at first Floor, Express Towers, Nariman Point, Mumbai 400021.

- The Client confirms and agrees that these terms and conditions are in addition to the Rights & Obligations (“R&O”) document as prescribed by SEBI and, confirmations given by the Client in the account opening form at the time of opening the Demat Account. The Client further confirms that in case of inconsistency between any terms contained herein and terms contained in the R&O, the terms contained in the R&O shall prevail. Capitalised terms not defined herein shall have the same meaning as assigned to them in R&O or Depositories Act, 1996, SEBI (Depositories and Participants) Regulations, 1996 and Rules & Regulations of Securities and Exchange Board of India (“SEBI”).

- The Client agrees to have read and understood the SEBI rules and regulations pertaining to the Depository and DP in connection with opening and operations of Demat Account.

- The Client hereby agrees to hold DBS BANK harmless against all actions, proceedings, claims and demands, cost and expenses incidental thereto which may be brought against, suffered or incurred by DBS BANK as DP by reason of all acts done by DBS BANK, including any action or omission undertaken in compliance with any instructions received by DBS BANK which DBS BANK believes in good faith to have been given by the Client and make good the losses incurred by DBS BANK on all legal, professional and other expenses incurred by DBS BANK.

- The Client here by agrees and confirms to following for instructions related to transfer of securities:-

- All such instructions shall be sent to DBS BANK on or before the business hours as stated by SEBI on a business day (excluding Saturdays, Sundays and Bank Holidays) prior to the pay-in date for the settlement number indicated by the Client in the debit instruction.

- DBS BANK shall not be liable for processing any instructions received after the above stipulated time.

- DBS BANK shall not be responsible for any failure as a result of non-receipt or receipt of incomplete/erroneous instructions, though received within the stipulated time

- The Client authorises DBS BANK to issue/re-issue a Delivery Instruction Slip (DIS) booklet through Post or Courier or as per their standard practice.

- The Client agrees to pay the charges for the services rendered by DBS BANK as per schedule of charges mentioned in the Demat Account opening form and as amended from time to time by DBS Bank. The Client hereby authorizes and instructs DBS BANK to debit the Bank Account notified by the Client from time to time for the fees and other charges and undertake to ensure that adequate balances are made available in the Bank Account. The Client further confirms that, the securities held in the Demat Account are subject to a lien/ right of set off in favour of DBS BANK for the claims of monies payable to DBS BANK pursuant to opening of the Demat Account and terms and conditions accepted by the Client in the account opening form.

- The Client agrees to be bound by changes in the terms and conditions, change in procedure and/or revision of the schedule of charges from time to time, at the sole discretion of DBS BANK. The Client agrees and confirms that DBS BANK shall notify any changes in the Terms and Conditions herein contained or to the Schedule of Charges by way of letters/email and additionally through any of the following channels :

- Account statements

- Internet, including email and website

- Written communication to the Client's address registered in DBS Bank's records, or

- Any other mode.

- Normally, changes will be made with prospective effect after giving notice of 30 days. If DBS BANK has made any change without notice, DBS BANK will notify the change within 30 days from the date of change

- The Client irrevocably authorises DBS BANK to disclose, as and when DBS BANK is required to do so in order to comply with the applicable laws or when DBS BANK regards such disclosure as necessary or expedient, any information relating to the Client, Client's Demat Account held on Client's behalf to :

- the head office, affiliates, or any other branches or group companies of DBS BANK (in or outside India) their auditors, professional advisers;

- Any person(s) under a duty of confidentiality to DBS BANK;

- Any statutory, judicial, quasi judicial authority and/or local body as and when directed/required;

- vendors, installers, maintainers or servicers of DBS BANK’s computer systems;

- any exchange, depository, market, or other authority or regulatory body having jurisdiction over the Bank, its head office or any other branch of DBS BANK or over any transactions effected by the Client or the Client's Demat Account;

- any party entitled to make such demand or request;

- any person with whom DBS BANK contracts or proposes to contract with regard to the sale or transfer or sharing of any of its rights, obligations or risks;

- any person employed with, or engaged as an agent by, DBS BANK or its head office or affiliates, including any relationship officers for the purposes of or in connection with interactions with the Client or providing services/facilities to the Client or processing transactions pertaining to the Client's Demat Accounts; and

- to enable DBS BANK to centralize or outsource its data processing and other administrative operations to the DBS BANK’s head office, its holding company, affiliates or third parties located in India and engaged by DBS BANK for any such services/operations.

- The particulars given and declarations made by the Client in the Demat Account opening form, other declarations are true and any changes will be informed to DBS BANK immediately. The Client further confirms that DBS BANK is nor liable and responsible neither for any incorrect information given to DBS BANK nor for any false declaration furnished to DBS BANK and the consequential effects thereon.

- The Client confirms that the authorisation and consent given above regarding Client’s information shall be valid till written communication of withdrawal of Client’s consent is acknowledged by DBS Bank. The Client agrees that provision of DP Services could be suspended/discontinued, if Client withdraws consent regarding Client’s information.

- The manner of closure of Demat Account shall be governed by the terms mentioned in Rights & Obligations (“R&O”) document as prescribed by SEBI.14. Any sum that may be payable by DP to Client will be subject to all applicable laws, including any withholding tax requirement, foreign exchange restriction or control. Client agrees and acknowledge that pursuant to the foregoing, DP may perform, or cause to be performed withholding of any monies payable to Client, deposit any such monies into a sundry or other account and/or retain such monies pending determination of the applicability of such withholding tax requirement, foreign exchange restriction or control. DP will not be liable for any losses that may be incurred by reason of such withholding, retention or deposit.

- The Client understands and agrees that all information coming from National Securities Depository Limited (NSDL) / Central Depository Services (India) Limited (CDSL) is provided on 'as is' basis and DBS BANK does not guarantee or warrant the accuracy, timeliness, completeness, merchantability or fitness of the information for any particular purpose. Neither DBS BANK nor any of its affiliates nor their directors, officers and employees will be liable to or have any responsibility of any kind for any loss that the Client may suffer as a result of relying on the above information from NSDL / CDSL.

- The Client agrees that for any updates related to the information received from NSDL and CDSL, the Client shall seek confirmation from his/her /its respective Demat Service Branches.

- The Client agrees and confirms that DBS BANK shall not be liable if any transaction does not fructify or may not be completed or for any failure on part of DBS BANK to perform any of its obligations under these Terms and Conditions if performance is prevented, hindered or delayed by a Force Majeure event (defined below) and in such case its obligations shall be suspended for so long as the Force Majeure event continues.

- "Force Majeure Event" means any event due to any cause beyond the reasonable control of DBS BANK, including without limitations, unavailability of any communication systems, breach, or virus in the processes or payment or delivery mechanism, sabotage, fire, flood, explosion, acts of god, civil commotion, strikes or industrial action of any kind, riots, insurrection, war, acts of government, computer hacking, unauthorized access to computer data and storage devices, computer crashes, malfunctioning in the computer terminal or the systems getting affected by any malicious, destructive or corrupting code or program, mechanical or technical errors/failures or power shut down, faults or failures in telecommunication etc.

- "Mobile Banking" refers to the mobile banking services offered by DBS BANK through digibank app to the Client including but not limited to services such as enquiry about balance in the Demat Account, details about transactions in the Demat Account, view dematerialization status and any other service as DBS BANK may decide to provide from time to time through mobile banking applications / other applications.

- OTHER HOLDERS OF DEMAT ACCOUNT refers to such holders other than the first holder of the Demat Account. The Client agrees that the Mobile Banking service for Demat Account is available only to the first holder of Demat Account. DBS BANK reserves right to consider any deviation to the above at it sole discretion.

- The Client agrees that the Demat Account shall be linked to the Client ID of the first holder and will be accessible through Mobile Banking. The Client agrees that in case the Demat Account is jointly held by the Client, DBS BANK will construe that the other holders of the Demat Account have authorized the first holder to access / view transactions done in demat account and all the transactions done by the first account holder shall be binding on all the other joint holder of the Demat Account.

- In case Delivery Instruction Slip (DIS) is not opted at the time of account opening, the Client Master List copy will be sent via email only to the registered email ID of the first holder of the Demat Account

- DBS BANK as DP will not be liable for any action taken or authorized to be taken or for any claim, loss, damages or expenses arising in connection with any such action or omission except in so far as the same results from bad faith, willful default or negligence on the part of DBS BANK.

- Neither DBS BANK, nor any of its, agents shall be liable for any failure to perform its obligations, to the extent that such performance has been delayed, hindered or prevented by systems failures, network errors, delay or loss of data due to the above and in circumstances of acts of God, floods, epidemics, quarantine, riot or civil commotion and war, or for any reason beyond their control.

- DBS BANK as DP, will not be responsible for the title, validity or genuineness of any securities which have been dematerialized and notified subsequently by the Registrars of any defects in its title/validity which has resulted in a reduction of the dematerialized holdings of the client and the consequences thereon. These terms and conditions shall be governed by laws of India and courts of Mumbai shall have non-exclusive jurisdiction in respect of any disputes or differences between the parties. I/We hereby agree, declare and confirm that I/We have read and have understood the above-mentioned terms and conditions and I/we hereby agree to abide by and to be bound by the same as are in force and as amended from time to time.

e-Voting Platform of NSDL

For accessing the e-Voting Platform of NSDL, please visit https://eservices.nsdl.com

Attention Investors

"Prevent Unauthorized Transactions in your demat account --> Update your Mobile Number with your Depository Participants. Receive alerts on your Registered Mobile for all debit and other important transactions in your demat account directly from NSDL on the same day."

"KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary."

Explore more

InvestingNRI Banking

Resident Indian Account

Need Help?

Contact us 1860 267 1234 / 1800 209 4555

Only from SG 800 852 6186

For Int'l +91 44 6685 4555

Or have someone contact you

Others

- Other Banking Accounts

- Currency Exchange Rate

- Related Links

- Changes in ODI

- Changes in LRS

- RTGS / NEFT Facilitation centre

- Security and You

- Careers

- Social Good

- Cyber Security

- Sitemap

- Annual Report

- Banking Forms

- Commission Structure for Investments Products

- Commission Structure for Insurance Products

- Grievance Redressal

- Important Announcements

- Unclaimed Deposits - RBI's UDGAM

- Unclaimed Deposits - Search Customer

- Regulatory Disclosure

- Time limit for loan disposal & service delivery

- Treasures Savings Account Charges & Fees

- Current Account

- Interest Rates

- Unparliamentary Language

- List of Repossessed Properties