- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

Related Insights

- Balanced Advantage Funds24 Sep 2024

- The Importance of Gold in Your Investment Portfolio24 Mar 2024

- The Importance of Portfolio Reviews12 Feb 2024

The growth of Systematic Investment Plans (SIPs) in the last decade has been phenomenal, with numerous investors adding SIPs to their existing investment portfolio. Therefore, it is important for you to understand what they are, and how they can help you in wealth creation.

Growth and Potential of SIPs in India:

The Indian mutual fund industry has seen remarkable growth over the last decade, with Assets Under Management (AUM) increasing from Rs 8.26 trillion in 2013 to Rs 41.62 trillion in 2023. The growth of SIPs during this period has been significant, rising from a monthly book of Rs 4,050 crore in 2017 to Rs 13,686 crore in 2023. Despite this growth, the penetration of mutual funds in India remains low, with the GDP to AUM ratio standing at only 17%, compared to a global average of 75%.

What are Systematic Investment Plans?

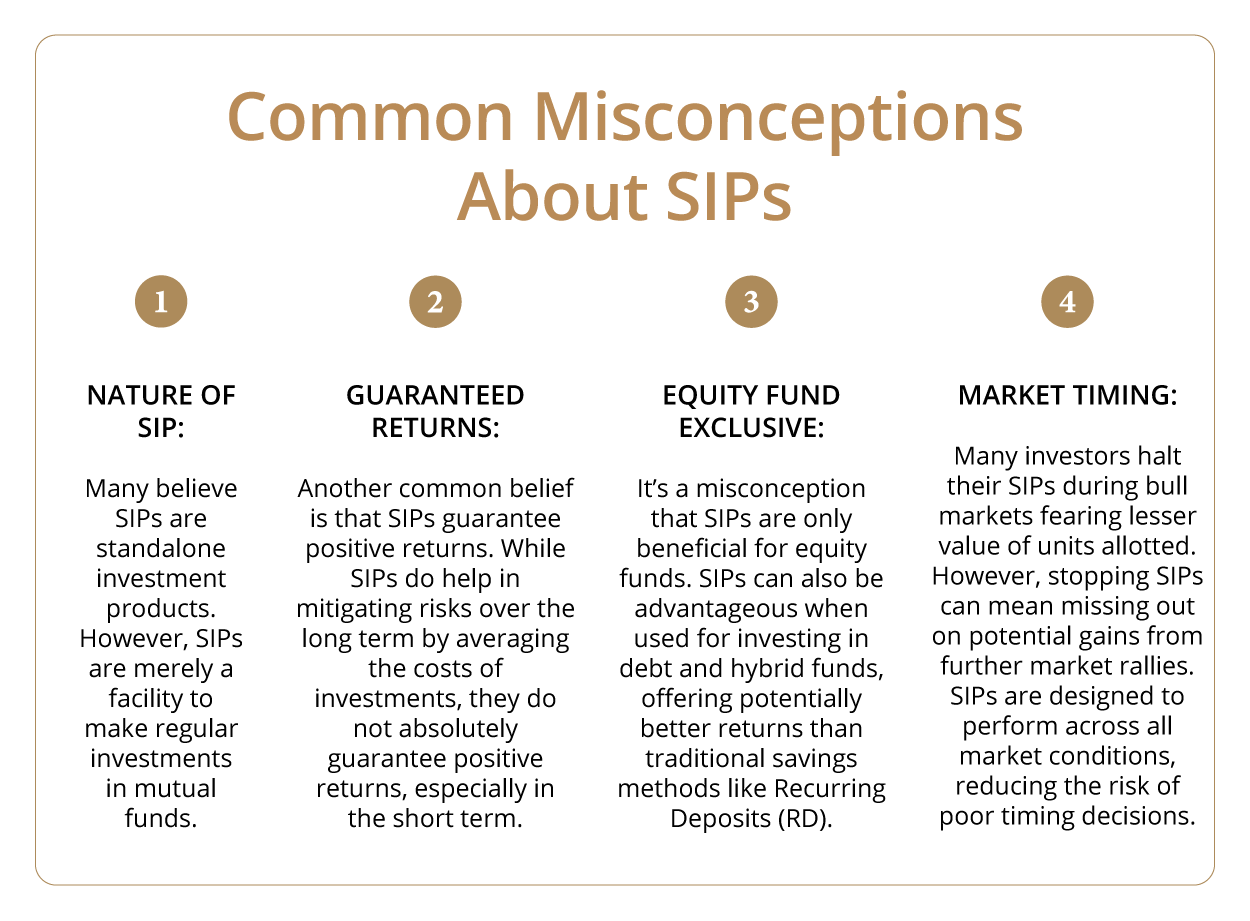

Systematic Investment Plans (SIPs) are a powerful strategy for building wealth over time, effectively transforming small, regular investments into significant financial growth. Moreover, contribution from SIP (Systematic Investment Plan) has been averaging above Rs 13,000 crore-mark every month since October 2022 and crossed Rs 20,000 core mark in May 2024. While SIPs offer numerous benefits, many myths surround their use and effectiveness. Here's a deeper look into these misconceptions, current market trends and the actual benefits of SIP investing.

Higher risk appetite along with need to earn superior post tax returns is reflected in the popularity of SIPs, as more investors seem to be choosing mutual fund schemes over the traditional fixed-return deposits.

SIPs in mutual funds stand out not just for their simplicity and accessibility but also for their strategic benefits including tax efficiency, liquidity, professional management, and diversification of investments. By debunking the myths and understanding the various benefits, investors could consider investing in SIPs to build substantial wealth over time, aligning their investments with both market opportunities and personal financial goals.

To conclude, SIP is an investment facility that is becomingly increasingly popular due to the small ticket investment amounts, simplicity in set up and the convenience of investing through various intermediaries such as through banks, online platform modes and Independent Financial Advisors (IFAs). Currently the Indian Mutual Fund industry is witnessing large inflows into SIPs, and suggest use Digital platform to make investment in SIP seamlessly.

Know More click here for more investment-related articles to help you understand how to be a better investor.

Contact Me get in touch with your Relationship Manager.

Download Now click here to download DBS digibank application.

Topic

Explore more

Wealth FeedThis article is for information purposes only. We recommend you get in touch with your investment advisor for any financial advise.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

DBS Bank India Limited – AMFI registered Mutual Fund Distributor (ARN-155319)

Related Insights

- Balanced Advantage Funds24 Sep 2024

- The Importance of Gold in Your Investment Portfolio24 Mar 2024

- The Importance of Portfolio Reviews12 Feb 2024

Related Insights

- Balanced Advantage Funds24 Sep 2024

- The Importance of Gold in Your Investment Portfolio24 Mar 2024

- The Importance of Portfolio Reviews12 Feb 2024