- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

Related Insights

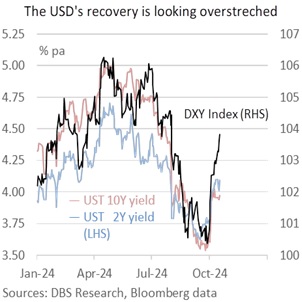

The DXY Index’s recovery looks overstretched after having appreciated 3% so far this month. Although the Fed has rolled back the market’s expectations for more of last month’s 50 bps rate cut, it plans to follow up with two 25 bps cuts on November 7 and December 18 after the US Presidential Elections on November 5. With this month’s rise in the US Treasury bond yields stalling near 4%, the DXY should be lower, around 102 instead of higher and close to 104.

Speculators may be overly optimistic about Trump 2.0 or a re-enactment of the DXY’s late rally into former President Donald Trump’s surprise win at the 2016 US Presidential elections. While the race to the White House on November 5 is tight between Trump and Vice President Kamala Harris, the Democrats are better prepared this time around. According to the polls, neither the Republican nor the Democratic Party are expected to control both the Senate and the Lower House. The GOP won the majority in both houses in 2016, while the Democratic did the same in 2020.

Moreover, the US federal debt has ballooned during the Trump and Biden presidencies and has become an issue amid de-dollarisation worries. Hence, the economic policies in the next presidential term will likely be constrained, much less become an inflation problem issue. US inflation bottomed near 0% in late 2015 and, by mid-2016, showed signs of rising towards the 2% target, prompting a Fed hike every quarter between December 2016 and December 2018. Today, more Fed officials are confident that inflation will fall to the 2% target in 2025, mulling the possibility of returning rates to neutral.

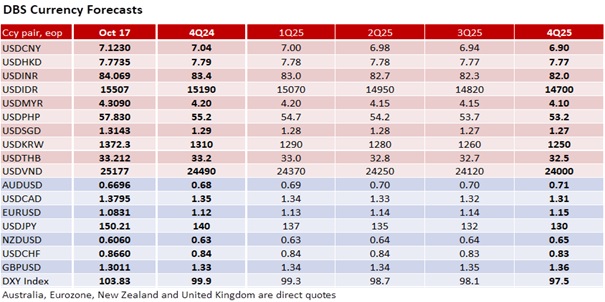

Our view remains that the US economy will slow down to 1.7% in 2025 from 2.3% this year, and the Fed Funds Rate will decline another 200 bps to 3% between November 2024 and September 2025.

We also want to leave some thoughts on China before the weekend. The Chinese government started to cool its property sector in 2016 and intensified measures in 2020. This contrasted sharply with the measures over the past month aimed at putting a floor to its struggling real estate sector. Since Trump’s first tariffs in 2018, China has responded with direct retaliation and strategic adjustments aimed at reducing reliance on the US while bolstering domestic industrial capabilities and international partnerships.

Quote of the Day

“Calls for walling America off with high tariffs on friends and competitors alike or by treating even our closest allies as transactional partners are deeply misguided.”

US Treasury Secretary Janet Yellen, speech to the Council of Foreign Relations on Oct 17, 2024

October 18 in history

In 1867, US took formal possession of Alaska from Russia, after paying USD7.2 million in the Alaska Purchase.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.