- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

Related Insights

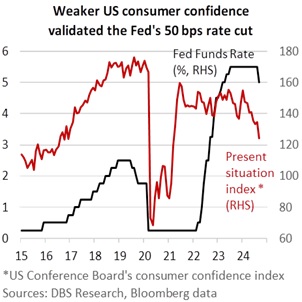

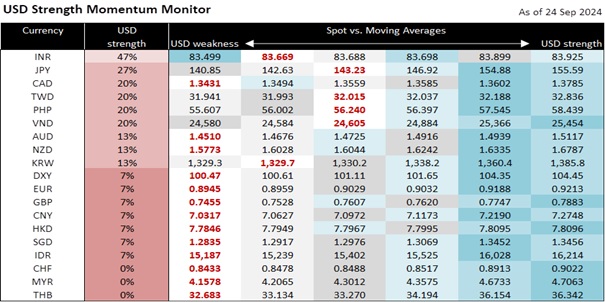

The DXY Index depreciated 0.4% to 100.47, its weakest closing level for the year. The futures market is not ruling out another 50 bps cut at the FOMC meeting in November after the US Conference Board’s weak consumer report. The headline consumer confidence index declined to 98.7 in September from an upwardly revised 105.6 in August; consensus had expected a slight improvement to 104 from the previously estimated 103.3. Despite the overall index nearing the bottom of its two-year range, the present situation index fell to its lowest level since March 2021. Conducted before the last FOMC meeting on September 18, consumers turned negative on current business conditions and were less complacent about the labour market. The weak consumer confidence report validates the Fed’s decision to deliver a larger 50 bps rate cut to 5% to avert a further cooling in the labour market. We maintain the view for the DXY to head below 100 based on our expectations for more Fed cuts to 4.5% by the end of this year and 3% by the end of 2025.

On a positive note, the consumer confidence index’s expectations index remained above the 80 threshold, which usually signalled a US recession ahead. Investors drove the Dow Jones Industrial Average and the S&P 500 Index to new lifetime highs, hopeful that more Fed rate cuts would result in a soft landing of the US economy and underpin profits. They also brushed aside Fed Governor Michelle Bowman’s explanation against her colleagues’ larger 50 bps cut, which she viewed as a premature declaration of victory over inflation. More attention will likely be paid to Fed Chair Jerome Powell’s remarks tomorrow, most likely about the Fed’s recalibrated stance that a further loosening of the labour market was no longer necessary to bring inflation down to the 2% target.

Apart from a rebound in tech stocks, investors were also heartened by the positive spillover effects of China’s stimulus measures announced yesterday. The People’s Bank of China cut the reserve requirement ratio and 7-day repo rate to boost liquidity, lowered the home loan rates and downpayment ratios to underpin the property sector, and announced new swap facilities and a relending programme to stabilize the Chinese stock market. The Shanghai Composite Index surged 4.2% to 2863, rebounding a second time from this year’s critical support level around 2700. Against the prospect of more Fed cuts amid China’s policy support for its economy and markets, CNY has scope to play catchup to the recovery in Asian currencies. Yesterday, the offshore USD/CNH hit 7.00 for the first time since May 2023, trailed closely by the onshore USD/CNY ahead of the Golden Week holiday (October 1-7). We see USD/CNY and DXY eventually breaking below their psychological 7.00 and 100 levels, respectively.

Quote of the day

“Obstacles are those frightful things you see when you take your eyes off your goal.”

Henry Ford

September 25 in history

In 1926, Henry Ford announced an 8-hour, 5-day work week for workers at the Ford Motor Company.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.