- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

Related Insights

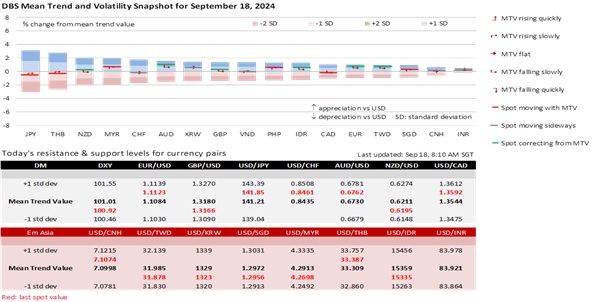

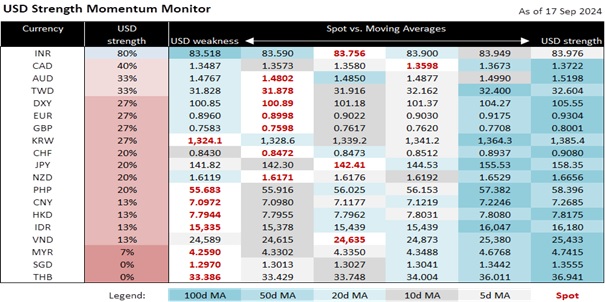

The USD has rebounded, with the DXY index trading to 101 as short USD positions are squared ahead of FOMC. Market expectations for this week’s FOMC decision lie on the dovish side, with futures pricing in a 2/3 chance of a 50bps rate cut compared to a 25bps cut. Should the Fed disappoint markets and signal a gradual, calibrated pace of rate cuts, there may well be a knee-jerk rebound in the USD as short-end rates reprice higher. Still, we expect a softening USD in the medium term due to the larger scope for Fed rate cuts compared to other central banks in this cycle, and the high valuation of the USD relative to fundamentals. A high US federal debt burden may also pose tail risks for the USD, especially if there is an unexpected recession that triggers more fiscal spending.

USD/JPY had rebounded to 142 amid USD strength, and also spurred by comments from Japan’s Finance Minister Suzuki yesterday that he is watching FX moves closely. While Suzuki had made comments over the undesirability of rapid FX moves in the past, this is the first time his comments were made in the context of a strengthening JPY, rather than a weakening JPY. We don’t see this as prelude for any market intervention to sell JPY, but it is perhaps aimed to reassure and temper JPY volatility in the event of an FOMC shock today. In the event of market shocks, JPY could also outperform the other safe haven CHF. Corporate Switzerland has grew highly concerned over excessive CHF strength unlike corporate Japan over the JPY (which is weak), and there are prospects of a larger SNB rate cut next week, in contrast to a BOJ that is waiting to hike rates.

USD/CNH is consolidating around 7.10, with onshore markets returning today from holidays. Chinese data released over last weekend were uniformly weak, with retail sales, industrial production, and fixed asset investment all underwhelming expectations. We remain of the view that RMB will lag gains in other Asian currencies for this Fed rate cut cycle. China could accept some RMB gains, but not too much given the need to support growth. While there is new RMB positivity from Harris leading Trump in polls, this by no means imply that tariff threats from the US are over, though the worst-case scenario has become unlikely. The Biden administration had proposed to prohibit low-value Chinese exports to the US from being eligible for exemption from tariffs, which was a long-standing rule for de minimis imports. Given US election and political uncertainty, we expect a political risk premium to keep RMB gains in check.

Quote of the day

“Description begins in the writer’s imagination. But should finish in the reader’s.”

Stephen King

September 18 in history

Old Faithful Geyser was observed and named by Henry D. Washburn in 1870.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.