- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

Related Insights

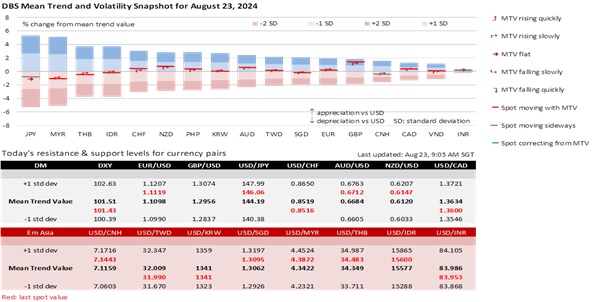

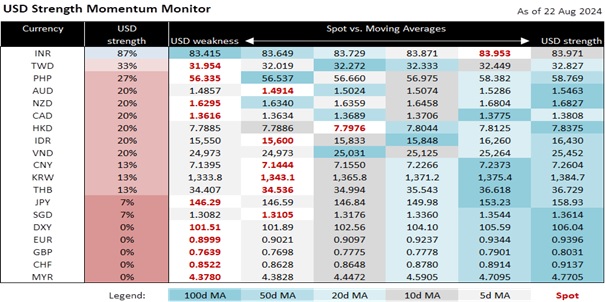

The DXY Index’s two-month decline hit a significant support level at 101. It remains to be seen if this is a pause or a turning point. The EUR, the most significant DXY component, is holding above 1.11 vs. USD, near the highs at the end of last year (1.1140) and July 2023 (1.1275). GBP/USD is also holding above 1.30, near the 1.3142 high last July. The Federal Reserve and the European Central Bank will likely pave, at the Kansas City Fed’s Jackson Hole Symposium today, the way for a synchronous rate cut at their monetary policy meetings in September. The Bank of England, however, may prefer to sit out September after its tight 5-4 vote to lower rates at its last meeting on August 1. Its temporary divergence with the ECB has seen the EUR/GBP cross rate retreat to 0.8490, following the rally from 0.8410 at the end of July to 0.8625 on August 8. Conversely, at a special parliamentary session today, the Bank of Japan should defend its decision to increase interest rate again through FY2025. USD/JPY has retreated to 146 after its corrective squeeze from 141.70 to 149.40 over August 5-15.

Fed Chair Jerome Powell will update the Fed’s monetary policy outlook when he speaks at 2200 SGT in Jackson Hole today. Per the FOMC Minutes for the July 30-31 meeting, many Fed officials support a 25 bps rate cut if incoming US data affirm the progress in lowering inflation amid a rising unemployment rate. Next week, the US PCE deflator and PCE core inflation will likely increase by 0.2% MoM in July, a pace the Fed will find comfortable delivering a rate cut in September. However, the YoY increase in headline inflation to 2.6% from 2.5%, and 2.7% from 2.6% for core inflation should support a normal 25 bps reduction in the Fed Funds Rate instead of the 50 bps cut discounted by the futures market. The Fed will assess the monthly jobs report on September 6 and the CPI report on September 11 before its FOMC meeting on September 17-18. The Fed will also revise its Summary of Economic Projections, which should continue to differentiate the Fed from its peers with a more predictable rate easing cycle. In June, the Fed forecast 25-50 bps of cuts in 2024, followed by 200 bps of reductions over 2025-2026. Hence, in the coming months, we cannot rule out, the possibility for the DXY to break below its 100-107 range seen in 2023-2024.

The European Central Bank should also hint at reducing interest rates in September at Jackson Hole. ECB Chief Economist Philip Lane is participating in a panel discussion, “Reassessing the effectiveness and transmission of monetary policy,” at 2245 SGT. The ECB minutes for the July 18 meeting indicated that the ECB members will approach the governing council meeting on September 12 with an open mind to re-evaluate the level of monetary restriction. The OIS futures see an 86.5% probability for a 25 bps cut in the deposit facility rate to 3.50% at the ECB meeting on September 12, a week before the FOMC meeting. Worries about sticky inflation eased after the Eurozone negotiated wage growth declined significantly to 3.6% YoY in 2Q24 from 4.7% in 1Q24. The Sentix Investor Index fell a second month to -13.9 in August after turning positive for a single month in June, with the present situation hitting a six-month low of -19 and expectations a four-month low at -7.9.

Quote of the day

”The Berlin Wall wasn't the only barrier to fall after the collapse of the Soviet Union and the end of the Cold War. Traditional barriers to the flow of money, trade, people and ideas also fell.”

Fareed Zakaria

23 August in history

In 1990, East and West Germany announced that they would unite on October 3.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.