- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

Related Insights

On April 29, US President Donald Trump will hold a rally in Michigan to commemorate his first 100 days in office. Choosing Macomb County, a significant region for the US automotive industry, is a deliberate move to galvanise support for his “Make America Great Again” (MAGA) vision of revitalizing American manufacturing and protecting domestic jobs that resonate with his core supporters.

Hence, Trump’s decision to roll back specific auto sector tariffs appears strategically timed to coincide with his 100-day milestone to showcase his responsiveness to industry concerns. Despite the 3.8% rebound in the S&P 500 Index this week, it is still down 10.8% from its all-time high on February 19. The tariff exemptions on certain auto parts have been explicitly temporary, as are those on technology products such as smartphones and laptops. The 25% tariff on foreign-made cars will still take effect on May 3.

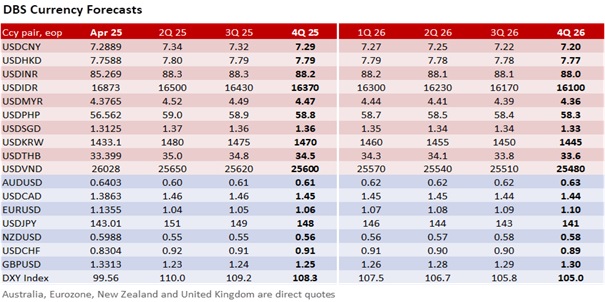

To project a more market-friendly image, Trump also softened his tone on Fed Chair Jerome Powell, stating he has “no intention” of firing him. However, the US Treasury 10Y bond yield remains supported at 4.30% while the DXY Index is still capped at 100, with investors unconvinced that Trump would end his threat to the Fed’s independence and the USD’s global status. Trump will likely resume his criticism of Powell if the Fed keeps interest rates unchanged at the May 7 FOMC meeting, especially as his administration pushes to finalize the fiscal bill extending his 2017 tax cuts by Independence Day.

Neither is China convinced by Trump’s gesture to be “very nice” to de-escalate the ongoing trade war with China, suggesting that the high tariffs on Chinese imports would “come down substantially” contingent on a trade deal. China was determined not to be drawn into trade talks until the Trump administration agreed to dialogue based on mutual respect and equity and meet its prerequisite to lift US tariffs. The US trade negotiations with Japan and South Korea are progressing slowly, with definitive agreements elusive, leaving uncertainty about the 90-day pause on US reciprocal tariffs set to expire in July.

Overall, investors remain sceptical. Trump’s conciliatory gestures this week could not erase the past couple of months of heightened market volatility driven by his sudden policy reversals and the use of policy uncertainty as a negotiating tool. There is a need to monitor how Trump’s policies are broadening beyond immediate trade worries, prompting global investors to re-evaluate the US as a stable investment destination. The Norwegian Government Pension Fund Global, the world’s largest sovereign wealth fund, reported a USD40 loss in the first quarter due to negative returns in the tech sector driven by US trade policies. The Financial Times reported that China’s state-backed investments have paused investments in US-based private equity companies due to the US-China trade war.

Quote of the Day

“I’m not upset that you lied to me. I’m upset that from now on I can’t believe you.”

Friedrich Nietzsche

April 25 in history

Bell labs announced the first solar battery made from silicon in 1954.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.