- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

Related Insights

US President Donald Trump continued to attack Fed Chair Jerome Powell for not cutting interest rates, sending the DXY Index and S&P 500 Index lower by 1% and 2.4%, respectively. However, the US Treasury 10Y yield firmed 8.6 bps to 4.41% despite the futures market’s bet for four Fed cuts this year. While Trump asserted that monetary easing was necessary to prevent an economic downturn, the market reaction suggested otherwise. This month’s declines reflected diminished confidence in the administration’s economic stewardship – abrupt policy reversals on tariffs, a lack of policy coherence, and political pressures on independent institutions. Given the circumstances, bond yields may keep rising even if Powell gives in to Trump’s demand for rate cuts.

The Fed’s independence is a cornerstone of US economic credibility, ensuring that the monetary policy decisions are based on economic data rather than political pressures. Trump’s public criticisms of Powell, including labelling him a “major loser” and expressing eagerness for his termination, have unsettled financial markets. More US lawmakers like Republican Senator John Kennedy – who praised Powell for having the “tiger blood” to do what he thought was right – need to stand up and publicly affirm support for Powell and the Fed’s independence.

Meanwhile, the Trump administration is probably under strain from an overloaded 100-day agenda, including more than 75 countries seeking trade negotiations during the 90-day pause on elevated reciprocal tariffs. US Treasury Scott Bessent also faces a narrowing window to implement Trump’s fiscal agenda – the extension of tax cuts by the end of 2025. Bessent cautioned about going on a warning track in May or June, emphasizing an urgency to resolve the debt ceiling before reaching the X-date.

If Trump is serious about revitalizing American manufacturing, he should understand that it goes beyond tariff adjustments and supply chain shifts. It also depends on the institutional integrity – the Fed’s independence and fiscal responsibility – that form the foundation of America’s reputation as a safe, reliable, and rule-based economic system. China’s emergence as the factory of the world post-WTO accession was not built on currency depreciation but on a strengthening CNY that signalled stability and confidence to global manufacturers.

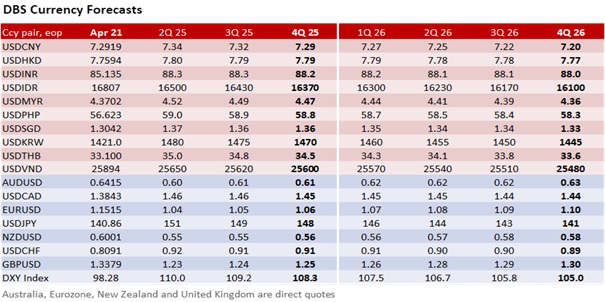

As of yesterday, the DXY Index has lost 10% of its value since Trump’s inauguration in January. The DXY is also below the psychological 100 level, at risk of a full retracement to 90, the Covid-19 low in early 2021. Further losses cannot be ruled out if Trump’s policies undermine the credibility (institutional stability and integrity, sound monetary policy, and fiscal discipline) painstakingly rebuilt after the Global Financial Crisis.

Quote of the Day

“It takes 20 years to build a reputation and five minutes to ruin it. If you think about it, you’ll do things differently.”

Warren Buffett

April 22 in history

In 1864, the US Congress passed the Coinage Act of 1864 that permitted the inscription “In God We Trust” to be placed on all coins minted as the US currency.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.