- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

Related Insights

- US exceptionalism challenged with rising trade tensions 13 Mar 2025

- Recalibrating our FX forecasts 12 Mar 2025

- US recession fears and “ReArm EU” hurdles 11 Mar 2025

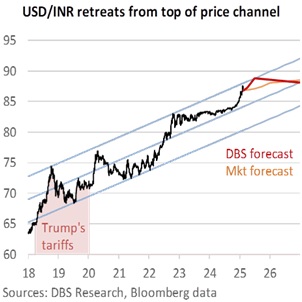

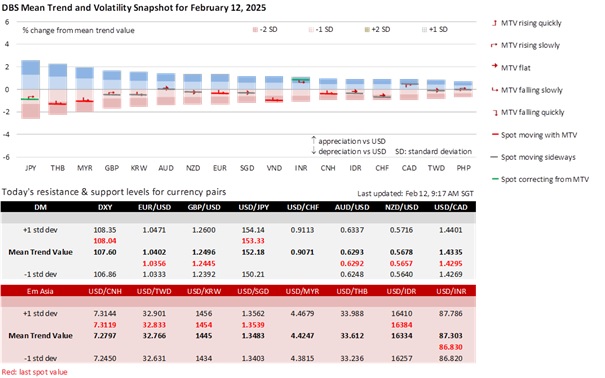

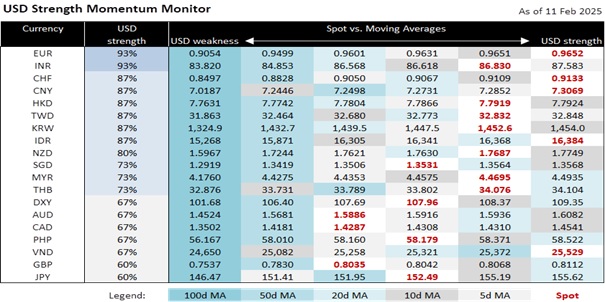

The INR experienced an impressive recovery of 0.7% to 86.8 per USD, its strongest one-day rally since 2022. The Reserve Bank of India reportedly intervened heavily on Monday and Tuesday to quell an unusual buildup of speculative short INR positions, which weakened INR to almost 88 on Monday. The RBI maintained that it was not targeting any specific level and was intervening to smooth out volatility.

Nonetheless, pulling the INR back from record lows would help defuse currency-related tensions for the meeting between Indian Prime Minister Narendra Modi and US President Donald Trump today. Although India has record trade deficits, it is America’s tenth-largest trade deficit partner. Modi’s goal is to avert Trump’s reciprocal tariffs by addressing his criticisms about high tariffs on American goods (e.g., electronics, medical equipment, chemicals), limited access of US good into India, and his desire for India to increase US defence and energy product purchases.

Despite this, we maintain our forecast for USD/INR to rise to 88.8 by mid-2025 on the USD’s haven status from Trump’s tariffs and the Fed delaying rate cuts to 2H25. We also see the RBI lowering rates by another 50 bps in 2Q25; today’s CPI inflation is expected to slow to 4.5% yoy in January from 5.2% in December.

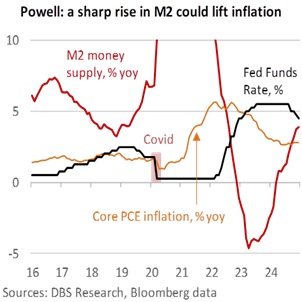

The DXY Index corrected 0.4% lower to 107.93 after three days of gains. There were no surprises at Fed Chair Jerome Powell’s semi-annual testimony before the Senate Banking Committee. The Fed was not rushing to lower interest rates because the US economy remained strong with a broadly balanced labour market that did not add to price pressures. While inflation was somewhat elevated, it appeared well-anchored.

However, Powell said a sharp increase in M2 money supply might result in some inflation. He reckoned the neutral rate had risen significantly from its pre-pandemic lows. New York Fed President John Williams added that the current policy stance was modestly restrictive. Powell said the Fed was waiting for more details on Trump’s tariffs to assess their impact on inflation.

Today, Powell will testify again before the House Financial Services Committee following the release of US CPI data. Markets see both headline and core inflation remaining sticky at 0.3% MoM in January. However, USD bulls and the US bond market will be watchful for upside surprises in the year-on-year numbers. Consensus expects CPI inflation to remain unchanged at 2.9% yoy, excluding food and energy prices, to slow to 3.1% in January from 3.2% in December. The US Treasury 10Y yield rose a fourth day by 3.9 bps to 4.535% overnight.

Quote of the Day

“Always after a defeat and a respite, the Shadow takes another shape and grows again.”

J.R.R. Tolkien

February 12 in history

The last Emperor of China abdicated in 1912 at the age of 6.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related Insights

- US exceptionalism challenged with rising trade tensions 13 Mar 2025

- Recalibrating our FX forecasts 12 Mar 2025

- US recession fears and “ReArm EU” hurdles 11 Mar 2025

Related Insights

- US exceptionalism challenged with rising trade tensions 13 Mar 2025

- Recalibrating our FX forecasts 12 Mar 2025

- US recession fears and “ReArm EU” hurdles 11 Mar 2025