- Banking

- Wealth

- NRI Banking

- Customer Services

Related Insights

- Between Fed rate cuts and trade tensions 16 Oct 2025

- EUR and JPY catch a breather that may last15 Oct 2025

- MAS holds steady as growth surprises 14 Oct 2025

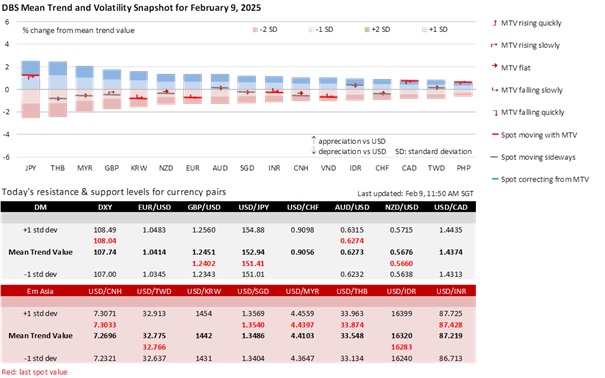

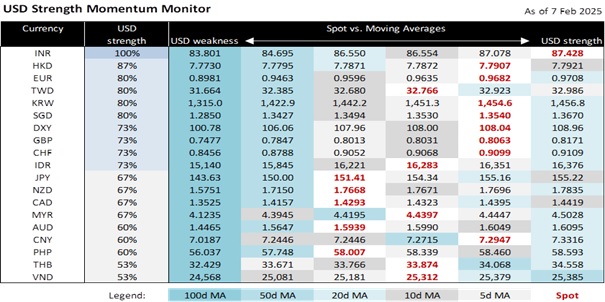

Key events should support the greenback this week – US President Donald Trump pushing for “reciprocal tariffs” early this week, Fed Chair Jerome Powell’s semi-annual testimony to the US Senate Banking Committee on February 11, and sticky US CPI inflation data on February 12.

Expect the questioning at Powell’s testimony to reflect partisan divisions. Republican senators will likely agree with Trump’s criticism that the Fed was not lowering rates fast enough. Democratic senators will likely express concerns about Trump’s policies (universal tariffs, tax cut extension, and deportation of illegal migrants) reigniting inflation.

US Treasury Secretary Scott Bessent recently explained that the Trump administration was less concerned about the policy rate and more worried about the rise in the US Treasury 10Y yield after the jumbo 50 bps cut in September. Since the Trump Trades, 10Y bond yield differentials have driven the USD against the JPY, EUR, GBP, CHF, and CAD. European and commodity-led central banks have been lowering rates because they consider Trump’s tariffs a larger threat to their weak economies than inflation.

We expect Powell to remain cautious about lowering interest rates. In the latest University of Michigan survey of consumers, one-year inflation expectations spiked from 3.3% in January to 4.3% in February, its highest reading since November 2023. Despite the lower nonfarm payrolls in January, the unemployment rate fell to 4% with average hourly earnings rising to 4.1%. We expect Wednesday’s CPI and core inflation to remain sticky at 2.9% yoy and 3.1%, respectively, well above the 2% target. We see the Fed delaying rate cuts to 2H25 before keeping them steady at 4% throughout 2026. Previously, we expected two cuts to 4% in 1H25, followed by two more to 3.50% in 2026.

We maintain our call for EUR/USD to decline to parity by mid-year. Per the CFTC Commitment of Traders report, speculative bets against the EUR have increased to the largest levels since early 2020. The OIS market sees the European Central Bank lowering the deposit facility rate by another 75 bps to the 2% inflation target in September. More so after the ECB’s latest estimation of the neutral interest rate at 1.75-2.25%. Trump also warned that the EU could be next to face tariffs. The upcoming German federal elections on February 23 will likely result in a fragmented Bundestag and increase the difficulty of forming a stable and sustainable coalition government.

We see AUD/USD heading lower towards 0.60. The Oz’s rebound from this year’s low of 0.61 on February 3 stalled at 0.63 last week. We expect the Reserve Bank of Australia to lower the cash rate target by 25 bps to 4.10% at the February 18 meeting. CPI and trimmed mean inflation have returned to the 2-3% target range. GDP growth faltered below 1% for the first time since 2020, with per capita GDP in recession. Although the US runs trade surpluses with Australia, the RBA worries about Trump’s tariffs hurting China and Asia, Australia’s top export region. AUD is also a free-floating commodity-led currency highly exposed to risk sentiment in global financial markets.

Quote of the Day

“Instead of me having a breakdown, I’m focusing on me having a breakthrough.”

Terrell Owens

February 10 in history

In 1996, IBM’s Deep Blue defeated chess champ Gary Kasparov, a milestone in the history of AI.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates & Digital Assets)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related Insights

- Between Fed rate cuts and trade tensions 16 Oct 2025

- EUR and JPY catch a breather that may last15 Oct 2025

- MAS holds steady as growth surprises 14 Oct 2025

Related Insights

- Between Fed rate cuts and trade tensions 16 Oct 2025

- EUR and JPY catch a breather that may last15 Oct 2025

- MAS holds steady as growth surprises 14 Oct 2025