- Banking

- Wealth

- NRI Banking

- Customer Services

- Muted financial markets reaction to Middle East crisis

- Key source of volatility will arise from surging energy prices and its knock-on effects on inflation

- Further developments are contingent on whether this conflict can be contained

- Historical data suggest a marginal increase in oil price and slight pullback in equities

- Stay with quality growth plays for equities and the Liquid+ Strategy for credit

Related Insights

Muted market reaction. The Israel-Hamas conflict is tragic from a humanitarian standpoint, and we hope the tension will be contained in the coming months. In financial markets, the impact has been minimal thus far. As with past conflicts in the Middle East, a key source of market volatility will arise from surging energy prices, and its knock-on effects on inflation and the broader economy.

As news of the conflict broke, the expected increase in energy prices took hold, with commodities rallying some 5% when the market re-opened on Monday (9 October). However, the classic flight-to-safety and selldown in risk assets did not materialise:

- US Dollar Index was only slightly higher while UST 10-yr yield saw a modest decline

- Global equities closed higher

So where do we go from here? Whether this crisis escalates further into a long-drawn affair which may significantly impact the global economy will depend on whether the geopolitical upheaval can be contained and not trigger intense involvement of other nations. There are no easy answers – it all hinges on how the situation evolves over the next few days.

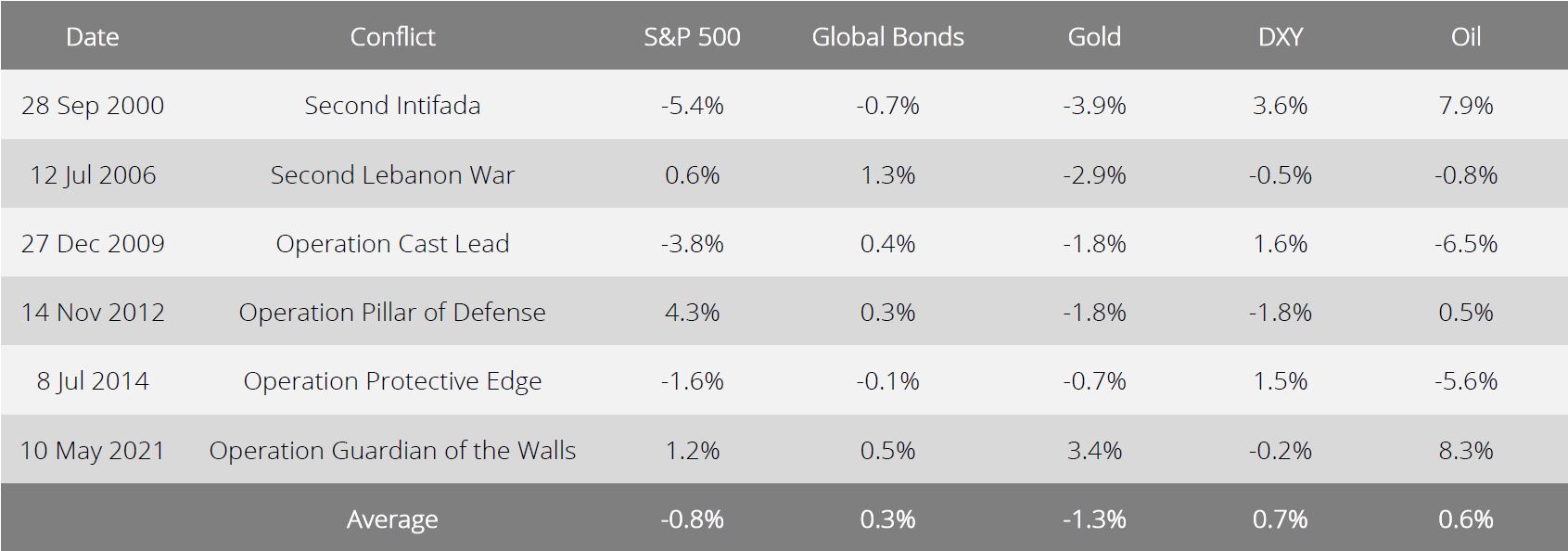

Middle East conflicts: Historically muted impact on financial markets. Beyond current headlines and knee-jerk reactions, our analysis of past data suggests that market reaction to these conflicts in the longer-term were minimal. Since 2000, there were a total of 6 of such conflicts. On average:

- Oil price was up 0.6% one-month after the conflict, while the S&P 500 dipped 0.8%

- Safe haven assets such as bonds and the US Dollar Index (DXY) were up 0.3% and 0.7% respectively. Contrary to conventional wisdom, gold has fallen 1.3% on average

Barring further escalation, we believe this time shall be no different and overall impact on risk assets will be limited.

Tactical strategies for volatile times: Stay with quality. Listed below are our tactical strategies in the current environment:

- Equities: The main impact on equities will come via the inflation-bond yield channel. But with the UST 10-yr yield having already moved up 100 bps over the recent quarter, and a reasonable degree of downside already priced into equity markets, the impact from the crisis will be muted. Investors are advised to stick with quality plays and companies that benefit from secular trends.

- Credit: While the upheaveal is likely to have marginal negative effect on credit spreads from a sentiment perspective, we opine this conflict has no direct impact on overall corporate credit risk. Nonetheless, in the face of rising geopolitical headwinds, we continue to advocate our Liquid+ Strategy of high quality, short duration bonds to add stability to a portfolio.

- Rates: Impact on long-end bond yields will be muted, especially after the recent 100 bps move on the UST 10-yr yield. While the potential increase in energy prices (and by extension, inflation) could push long-end yields higher, this will be likely be offset by higher demand for safe haven assets.

Figure 1: Relationship between oil and inflation

Source: Bloomberg, DBS

Table 1: Major Israel-related conflicts since 2020

Source: Britannica, Journal of Conflict Studies, Institute for Middle East Understanding, Bloomberg

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.