- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Equities: US equities hit record highs on the Fed's rate cut and strong data; Japanese and Chinese markets also gained, boosted by the Fed's decision despite weaker economic indicators

- Credit: The materialisation of Fed rate cuts is opportune for deploying cash to credit and securing against cash reinvestment risk

- FX: DXY to depreciate into 95-100 range through 2025 amid Fed’s rate cutting cycle; US Presidential elections on 5 Nov not expected to support the greenback

- Rates: Current backdrop benign for Asia local currency govvies; tailwinds for IndoGBs amid BI monetary easing and weak USD

- The Week Ahead: Keep a lookout for US Change in FOMC Rate Decision; Japan BOJ Target Rate

Related Insights

US equities reached all-time highs amid Fed cut and strong economic data. US equities surged to record highs as markets reacted to the Fed’s decision to cut interest rates by 50 bps, marking the first rate cut since Mar 2020. The rate cut came amid mixed sentiment with some critics arguing that the Fed acted too aggressively, given the strong economic data. Retail sales came in better than expected (0.1% vs -0.2% consensus), while initial jobless claims fell to its lowest in three months, signalling consumer strength. The S&P 500 and Dow Jones gained 1.4% and 1.6% respectively with both closing at new all-time highs.

Over in Asia, Japanese equities rose; Nikkei 225 was up 3.1% as the combination of a weaker yen, Fed’s rate cut, and BOJ’s decision to hold rates steady supported equities. Chinese equities were also up over the week with the SHCOMP and Hang Seng up 1.2% and 5.1% respectively, driven largely by the Fed’s rate cut. However, domestic economic data remained weak with August industrial production falling below expectations and retail sales showing signs of slowing.

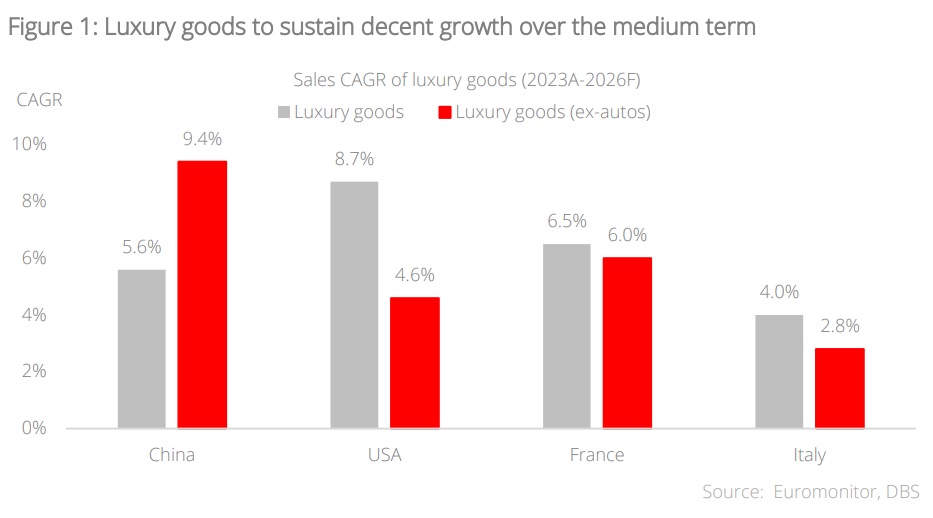

Topic in focus: Evolving luxuries. Following a strong rebound in 2021-22, the global luxury sector is grappling with challenges from slowing economic growth and dampened consumer spending. Last year saw a slowdown across Europe and the US, while China’s initially strong performance decelerated in the second half, leading to slowing sales and an uneven performance. McKinsey forecasts the sector to grow by 3–5% this year, down from 5–7% in 2023. A 2024 survey by PwC suggests that shoppers are shunning luxury items in favour of essentials; about 40% of respondents anticipate that they will be spending less or nothing at all on luxury goods over the next six months.

Still, we believe pockets of growth exist. Markets such as Japan are emerging as new growth areas; Savills’ Global Luxury Retail 2024 Outlook shows that while new store openings fell 12% in China, the wider Asia Pacific region reported an increase in new store activity. Tokyo and Singapore were key behind this increase, helped by a pick-up in tourism and a weak yen. During China’s eight-day Golden Week holiday in October last year, Hainan emerged as a top hotspot for tax-free shopping, highlighting opportunities in strong domestic travel. We maintain luxury as a long-term structural growth sector; in particular, widening income gaps will highlight less price-sensitive and more exclusive, experiential-driven demand. As the industry continues to be challenged by near-term headwinds, stay with quiet luxury brands that can adapt to changing preferences and are able to maintain a connection beyond material satisfaction, thereby becoming more resilient against economic downturns.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.