- Banking

- Wealth

- NRI Banking

- Customer Services

- US: Fed cuts rate by 50 bps, stressing that upside risks to inflation have diminished and the downside risks to employment have increased

- Japan: BOJ likely to signal additional rate hikes in the coming months, potentially at a faster pace to reach a terminal rate higher than expected

- China: Further slowdown as industrial production continues to decelerate amid weak consumption sentiment and higher unemployment

- Singapore: Driven by modern services, particularly finance and insurance, Singapore’s services trade continues to gain importance

Related Insights

- US Equities 4Q25 | Navigating Cross-currents15 Oct 2025

- Video 4Q25: Ride the Trend13 Oct 2025

- CIO Market Pulse – Twin Fears13 Oct 2025

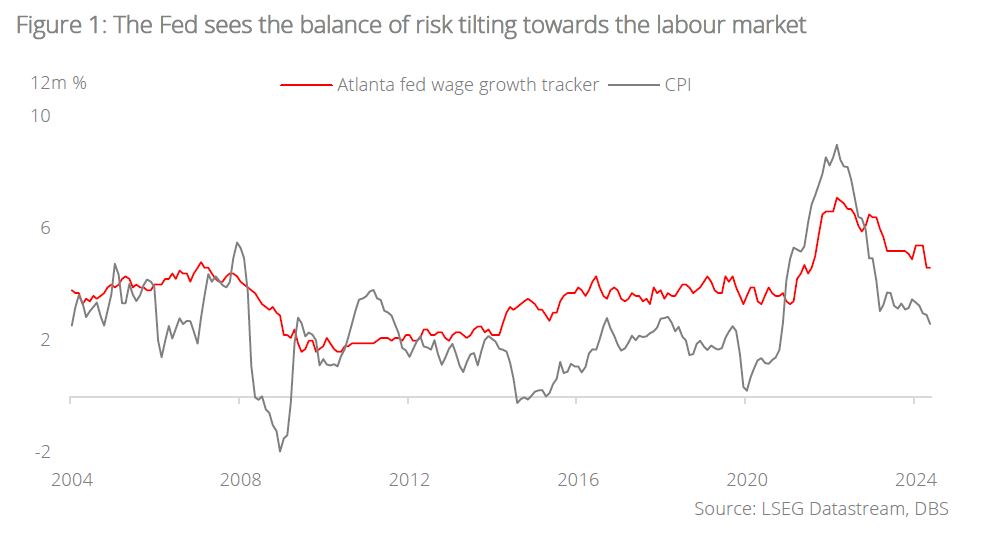

US: Fed pivots toward supporting the labour market. The US Federal Open Market Committee cut the Fed Funds rate by 50 bps at the conclusion of its 17-18 Sep meeting. The decision marked a sharp pivot from the Fed’s stance at mid-year when committee members saw higher inflation and a stronger labour market. Fed officials now see 20-30 bps in lower inflation in the 2024-25 horizon while about 20-40 bps in higher unemployment rate during the same period. With forecasts for inflation heading toward 2% and unemployment toward 4.5%, the Fed sees the balance of risk tilting towards the labour market. Today’s policy easing and a substantial change in median forecasts on inflation, unemployment, and Fed Funds rate should be seen in that context.

While we expected the Fed to go for a more cautious approach, given the latest decision, we have revised our forecasts for the Fed Funds rate considerably. We now see the Fed cutting by an additional 50 bps this year, followed by another 100 bps in 1H25. There would be room for an additional 50 bps in cuts in 2H25, in our view. This would take the Fed Funds rate down to 3% by the end of next year, in line with the neutral rate.

Fed Chair Powell stressed that the upside risks to inflation have diminished and the downside risks to employment have increased. He cited data on payrolls growth which has softened compared to earlier this year, as well as the weaker prints on nominal wage growth and jobs-to-workers gap. While conceding that economic growth is still robust, Powell underscored the risk management approach to monetary policy with the need to support the labour market going forward deemed as a higher order of priority.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- US Equities 4Q25 | Navigating Cross-currents15 Oct 2025

- Video 4Q25: Ride the Trend13 Oct 2025

- CIO Market Pulse – Twin Fears13 Oct 2025

Related Insights

- US Equities 4Q25 | Navigating Cross-currents15 Oct 2025

- Video 4Q25: Ride the Trend13 Oct 2025

- CIO Market Pulse – Twin Fears13 Oct 2025