- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Equities: Global equities rallied this week with notable gains in tech stocks and small caps

- Credit: With the Fed poised to cut rates, high-quality credit is expected to continue to outperform cash, mirroring historical trends

- FX: Potential for DXY to fall below its 101- 107 range since Dec 2022; appreciation biases in EUR/USD and GBP/USD are intact above respective support levels of 1.10 and 1.30

- Rates: Limited room for more rate cuts if the economy soft lands; the start of the Fed cut cycle may well herald a rise in longer-term UST yields

- The Week Ahead: Keep a lookout for US Change in FOMC Rate Decision; Japan BOJ Target Rate

Related Insights

Broad Market gains driven by Fed rate cut anticipation. The US market enjoyed its best week of 2024, fuelled by shifting expectations around the Federal Reserve's upcoming meeting. Markets now foresee a higher chance of a 50 bps rate cut, following mixed economic data and comments from former Fed President Bill Dudley. The S&P 500 and NASDAQ gained 4% and 6% respectively, driven by the strong performance of technology stocks, particularly in the semiconductor sector. Small-cap stocks also saw a robust uptick during the week, reflecting a broader market rotation towards economically sensitive segments.

European markets saw gains this week with the STOXX Europe 600 up 1.9%, driven by the European Central Bank's quarter-point rate cut to 3.5%. Japan’s stock markets showed mixed results with the Nikkei 225 rising 0.5% while the broader TOPIX Index fell 1.0%. Strengthening yen and expectations of additional rate hikes by the Bank of Japan influenced market dynamics. The Hang Seng Index retreated 0.4% for the week despite stronger-than-expected export growth, the deflationary pressures and slowing core inflation have intensified calls for more substantial policy measures.

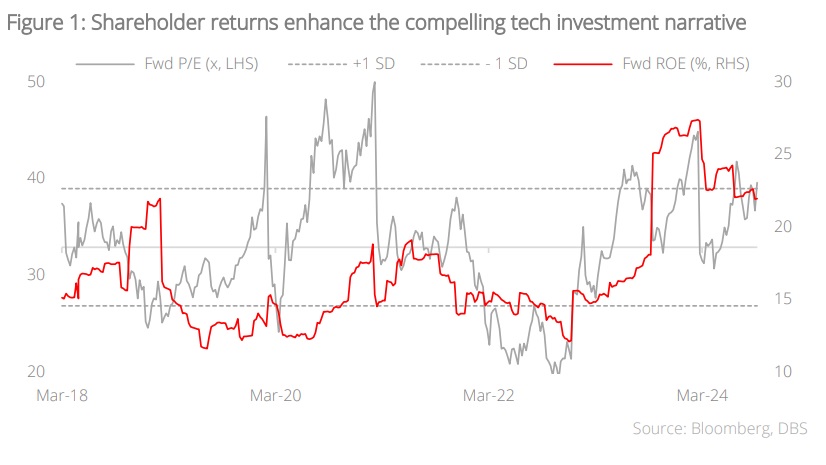

Topic in focus: Reaffirm strong conviction on Big Tech companies. We anticipate sustained earnings growth for Big Tech, driven by enduring secular trends, including the global digital transformation and burgeoning AI sector. As it is nascent, AI is poised for substantial expansion with the total addressable market expected to reach USD2.6tn by 2032. This structural growth, underpinned by AI and digitalisation, should continue to enhance shareholder returns for major tech companies which are currently delivering returns above 20%.

Additionally, the resilience of IT spending, despite economic fluctuations and crises, further supports the technology sector’s growth trajectory. This ongoing commitment to IT investment will drive innovation across both hardware and software sectors. Short-term catalysts, such as NVIDIA’s new chipset and expected US Federal Reserve rate cuts, are likely to rejuvenate market sentiment and support technology stocks. We maintain a positive outlook on Big Tech and the technology sector and advocate for a strategic re-engagement with these high-growth assets by using the I.D.E.A. framework to identify key winners across technology verticals.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.