- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Comments to restrict chipmaking equipment export & US supply chain policy won't hinder tech prospect

- Development in AI will intensify revenue upside & profitability of global technology leaders

- We maintain convictions on the outlook of global tech leaders, underpinned by a multitude of reasons

- CIO I.D.E.A. strategy is well positioned to benefit from this secular uptrend

- CIO I.D.E.A. strategy has delivered impressive returns, outperformed composite of tech funds

Political noises unwarranted. Recent comments on restricting the exports of chipmaking equipment, possible US tightening policy on Taiwan supply chain, and investor rotation into small capitalisation counters have sent share prices of upstream technology leaders, software developers, and equipment makers into a tailspin. The rationale and details are sketchy at the current juncture, and actual implementation and effects remain unascertained.

Policy restrictions around technology firms are not new and have been in place since the middle of the past decade. However, it has not deterred the development and investment returns of the sector as global demand has stayed robust. Thus far, government-restraining policies have limited impact on the well-being and commercial importance of technology industries. We believe it will be the same this time around.

We maintain our conviction that the fundamentals and investment viability of the sector will remain impervious to political upheaval.

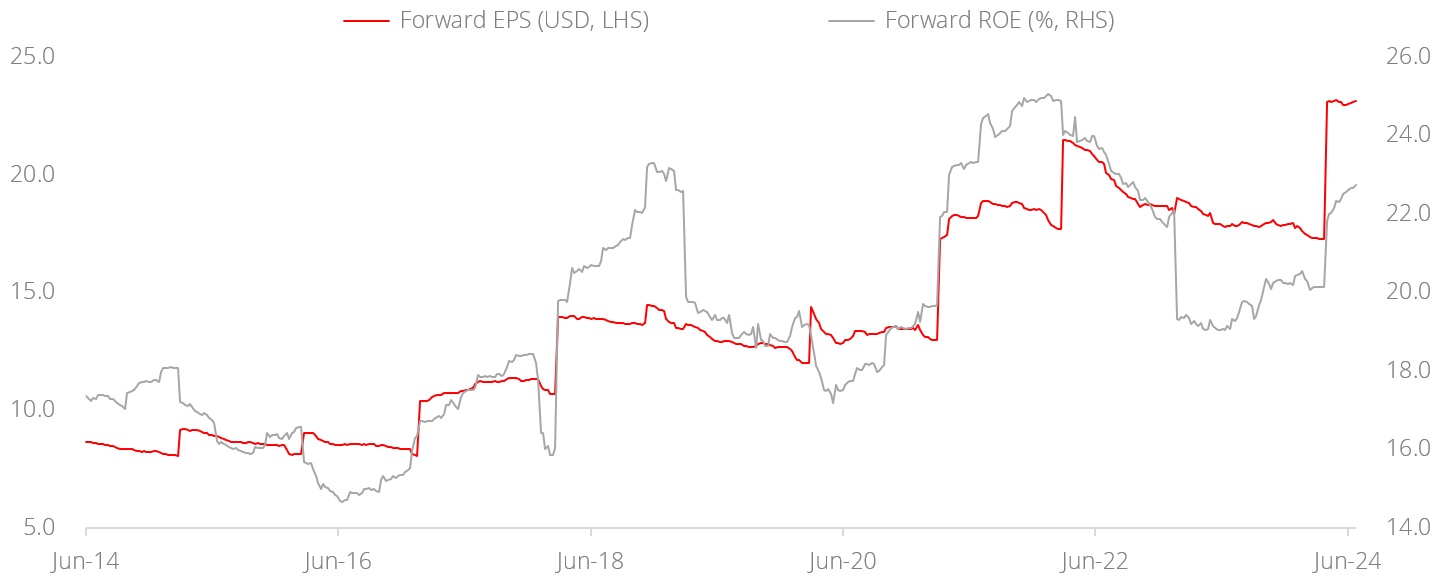

Sea change driven by the formidable development in artificial intelligence (AI) for electronics, automotive, automation, energy transition, cloud, and data analytics will further augment the long-term outlook of technology. This phenomenon will intensify the revenue upside and profitability among global technology industry leaders as demonstrated by the bifurcation in revenue directions between Big Tech firms and the broader markets over past cycles.

Notably, the future across various technology verticals is projected to grow from strength to strength, boosted by the dynamic permeation of AI-powered functions and devices, and backed by the innovative nature, closely knitted supply chains, and strong pricing power of technology firms.

A bright future powered by AI. The protracted upside potential of technology industries continues to be driven by sustained demand for multi-functional chipsets, an increased number of microprocessors required to power an immense volume of devices, and proliferation of more complicated software applications. The secular permeability of AI and development of AI-embedded devices have thus far proven to be irreversible trends.

This will drive a significant transition to cloud and software-as-a-service (SaaS) that offer users cost-effectiveness, efficiency, scalability, and reliability. Against this backdrop, the total addressable markets (TAM) for AI and software are projected to reach USD2.6tn and USD1.8tn respectively by 2032; a significant size by any industry standard.

Maintain conviction call on global technology. Notwithstanding their ongoing outperformance, we maintain our conviction on the outlook of global technology leaders. Factors supporting our constructive views include:

- Earnings of Big Tech firms are projected to grow at mid-to-high teens over the next two to three years, outpacing other sectors. This is reinforced by innovation, strong end demand, pricing power, and broadening of device adoptions.

- Technology firms have amassed huge amounts of cash over the past four to five years. For example, Big Tech firms have collectively accumulated a cash equivalent of more than USD200bn in their balance sheets. This war chest will enhance their ability to perform accretive acquisitions and weather market headwinds.

- Companies can circumvent policy restrictions by setting up overseas capacity and supply chains to serve local demand using technology that is less susceptible to such limitations.

- Similar to the market conditions of 2020, the expected rate cut by the US Fed will release more liquidity into the markets. These funds are anticipated to seek opportunities which offer sustainable long-term returns, where technology sits near or at the top of the list.

- The enormous TAM and growth potential are evidential of the prominent investment outlook of our secular technology themes.

- The rotation among sectors is a common feature across capital markets but we expect the core investment positions to remain with technology, supported by compelling fundamentals and tailwinds.

The recent market volatility provides a good opportunity for investors to re-engage technology leaders. The valuations are justified by resilient growth quality and earnings tailwind as the AI-driven breakthrough is all but in its early innings.

Anchoring the CIO I.D.E.A. The CIO I.D.E.A. framework, positioned at the growth side of the CIO Barbell Strategy, is well placed to benefit from these secular uptrends. This strategy identifies and invests in secular investment themes revolving around winners in Innovators, Disruptors, Enablers, and Adapters. Besides having technology as a core part of the strategy construct, the CIO I.D.E.A. is essentially a diversified, growth-centric strategy which also comprises of high-quality secular themes of energy transition, quiet luxury, life sciences, space, and digital media.

Since its inception, the strategy has delivered impressive returns across cycles by outperforming the composite of leading global technology funds and demonstrated resilience against global equities.

The recent development will not deter the steadfast future of technology. When the dust settles, investors will once again focus on investment opportunities which have a proven track record of delivering consistent and impressive returns and are less susceptible to political disturbances.

Figure 1: Technology – Strong earnings and compelling shareholder returns

Source: Bloomberg, DBS

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

The information contained in this article has been obtained from sources believed to be reliable, but DBS makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Please refer to the Additional Terms and Conditions Governing Digital Tokens for DBS Treasures Customers for more specific risk disclosures on trading of digital tokens.

This information does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or enter into any transaction. It does not have regard to your specific investment objectives, financial situation or particular needs. It is not intended to provide, and should not be relied upon for accounting, legal or tax advice.

Cryptocurrency trading is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. Before you decide to purchase an investment product, you should read all the relevant documents and carefully assess if it is suitable for you. Invest only if you understand and can monitor your investmen. Diversify your investments and avoid investing a large portion of your money in a single asset type.

Trading in Cryptocurrencies or the instrument (“Instrument”), such as ETF, referencing or with underlying as Cryptocurrencies ("Crypto-Products”), such as Bitcoin ETFs, is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. By trading in Crypto-Products, you are exposed to the risks of both the Instrument and the Cryptocurrencies. Further, Crypto-Products listed on overseas exchanges may not be regulated in Singapore, and are subject to the laws and regulations of the jurisdiction it is listed in. Before you decide to buy or sell Cryptocurrencies or Crypto-Products, you should read all the relevant documents and carefully assess if it is suitable for you and/or seek advice from a financial adviser regarding its suitability. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single asset type.

To the extent permitted by law, DBS accepts no liability whatsoever for any direct, indirect or consequential losses or damages arising from or in connection with the use or reliance of this email or its contents. If this information has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses.

Please refer to Terms and Conditions governing your banking relationship with DBS for more specific risk disclosures on the Instrument (such as ETFs under Funds) and Digital Tokens.

This information is provided to you as an “Accredited Investor” (defined under the Securities and Futures Act of Singapore and the Securities and Futures (Classes of Investors) Regulations 2018) for your private use only. It is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, and may not be passed on or disclosed to any person nor copied or reproduced in any manner.

DBS (Company Registration. No. 196800306E) is an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore (the "MAS")