- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Notion of “US exceptionalism” thrown off-course as policy uncertainties introduce financial risks

- Signs of macro weakness on the rise with Atlanta Fed GDPNow now pointing to a -2.4% decline in GDP

- Equities: Stay Neutral, pivot away from crowded trades in US; Seek opportunities in Europe and China

- Bonds: Capitalise on any spike in yields to switch from cash into bonds

- Gold: Overweight safe haven gold as volatility and uncertainty are tailwinds for bullion

Policy chaos and growth fears triggered US selloff. Trump 2.0 has been a game-changer. All expectations of a continuation of “US exceptionalism” post-Trump’s election victory are now thrown off-course as the chaos of the new administration introduced acute financial and stagflation risks to the system. From the flip-flops on tariffs to the Transatlantic Alliance breakdown as the US dialed back on postwar American foreign policies and ceased being the “primary guarantor” for Europe’s security – these signal that the age of disruption has arrived, and market movements are clearly reflecting this paradigm shift.

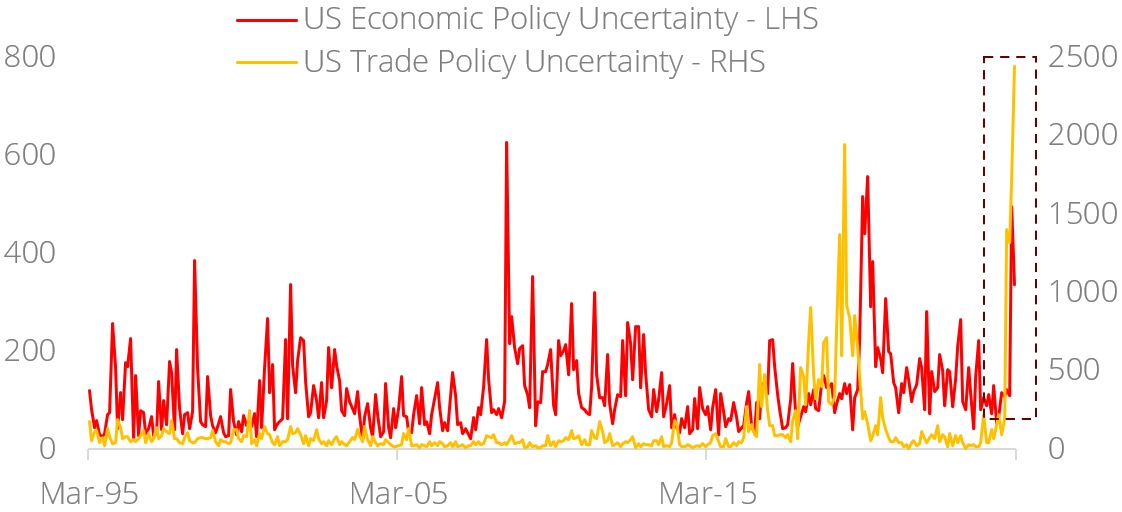

Adding on to the proverbial wall of worries is the revival of growth fears as policy uncertainties hit an all-time high and weigh on both business and consumer confidence. ISM Manufacturing has fallen to 50.3 in February while the Atlanta Fed GDPNow is now pointing to a -2.4% decline in GDP. And yet despite the growth moderation, inflationary pressure remains stubbornly high, restricting the Fed’s ability to cut rates.

Make Europe Great Again; The pivot away from crowded trades. Trump’s “transactional” style of policy making and his undermining of the NATO alliance has clearly galvanised European leaders and created a European unity not seen in decades. Germany’s “Whatever It Takes” moment on the easing of fiscal conservatism is, perhaps, a telling moment that Europe-at-large is entering stimulus mode just when the US is engulfing itself with policy uncertainties. The implications for these shifts on portfolio construction are significant and our recommendations are:

Equities

- Stay Neutral on equities while pivoting away from crowded trades in the US. The very notion of “de-risking” from US equities is now a reality under the “America First” policy agenda. Funds are switching out of US given (i) the market’s valuation premium to rest of the world and (ii) expectations of a darkening economical and geopolitical mood.

- Seek opportunities in Europe (eg defence, financials). Germany’s "Whatever It Takes" moment in particular, translates to the end of fiscal conservatism and unleashes strong economic stimulus. According to Kiel Institute, GDP growth could increase by 0.9-1.5% per year if nations (i) increase defence spending to 3.5% of GDP (vs NATO's target of 2%) and (ii) purchase weapons manufactured domestically in Europe.

- Seek opportunities in China (eg technology). Investors are warming up to Chinese equities as DeepSeek’s technological breakthrough spurs a reconsideration of the market’s attractiveness (trading at steep valuation discount to the rest of the world).

- In the US, seek defensive exposure to healthcare while staying engaged on technology. Capitalise on volatility to add to core positions via structured products.

Bonds

- We previously highlighted that a Trump presidency is not bond Kryptonite. Despite the market consensus that a Trump presidency may lead to a higher-and-higher yield environment due to tariff-driven inflation, our contrarian opinion was that it could also trigger a growth slowdown that conversely results in lower yields. We saw this play out in the previous round of tensions in 2019, and history appears to be repeating itself today.

- Investors should continue to capitalise on any spike in yields to switch from cash into bonds as we pivot towards a cutting cycle in global monetary policy. Stay up in quality with A/BBB and only make selective picks in BB that can weather a potential growth slowdown. Remain with a duration barbell – overweighting 2-3Y bonds to minimise cash reinvestment risk and 7-10Y bonds to capitalise on wider spread premiums.

Gold

- CIO has long touted gold as an important portfolio risk diversifier, and while 2024 played out extremely well for holders of bullion from a return perspective, 2025 has, thus far, been a better illustration of its role as an uncertainty and volatility hedge. Since the start of the year, markets have been roiled by tariffs, geopolitical conflicts, and the arrival of DeepSeek, but through it all, gold has remained resilient and even scaled new all-time highs.

- Its role as an uncertainty hedge was put on display when gold staged a strong rally in January due to tariff fears. Worries that bullion, which has historically been exempt from import duties, might get tariffed in the future due to stockpiling on the New York commodities exchange. This led to a 127% increase in COMEX gold inventory levels since the US election in November last year.

- Amid the latest market sell-off on recession fears, gold has remained notably stoic, once again, reflecting its properties as a safe haven asset and store of value during times of market volatility. Should economic momentum wane, gold will also be well positioned for such a scenario as central banks will likely respond with rate cuts, which is typically a tailwind for gold.

Portfolio Approach: The best strategy in an era of volatility. The DBS CIO Barbell Strategy has outperformed S&P 500 and Nasdaq by 4.1 %pts and 9.1 %pts respectively this year, and this drives home the importance of embracing a portfolio approach in an era of heightened geopolitical and policy uncertainties. Our Overweight calls on gold and bonds are paying off handsomely this year as their resilience offset the volatility in equity markets.

Figure 1: US policy uncertainties surged

Source: Bloomberg, DBS

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

The information contained in this article has been obtained from sources believed to be reliable, but DBS makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Please refer to the Additional Terms and Conditions Governing Digital Tokens for DBS Treasures Customers for more specific risk disclosures on trading of digital tokens.

This information does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or enter into any transaction. It does not have regard to your specific investment objectives, financial situation or particular needs. It is not intended to provide, and should not be relied upon for accounting, legal or tax advice.

Cryptocurrency trading is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. Before you decide to purchase an investment product, you should read all the relevant documents and carefully assess if it is suitable for you. Invest only if you understand and can monitor your investmen. Diversify your investments and avoid investing a large portion of your money in a single asset type.

Trading in Cryptocurrencies or the instrument (“Instrument”), such as ETF, referencing or with underlying as Cryptocurrencies ("Crypto-Products”), such as Bitcoin ETFs, is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. By trading in Crypto-Products, you are exposed to the risks of both the Instrument and the Cryptocurrencies. Further, Crypto-Products listed on overseas exchanges may not be regulated in Singapore, and are subject to the laws and regulations of the jurisdiction it is listed in. Before you decide to buy or sell Cryptocurrencies or Crypto-Products, you should read all the relevant documents and carefully assess if it is suitable for you and/or seek advice from a financial adviser regarding its suitability. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single asset type.

To the extent permitted by law, DBS accepts no liability whatsoever for any direct, indirect or consequential losses or damages arising from or in connection with the use or reliance of this email or its contents. If this information has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses.

Please refer to Terms and Conditions governing your banking relationship with DBS for more specific risk disclosures on the Instrument (such as ETFs under Funds) and Digital Tokens.

This information is provided to you as an “Accredited Investor” (defined under the Securities and Futures Act of Singapore and the Securities and Futures (Classes of Investors) Regulations 2018) for your private use only. It is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, and may not be passed on or disclosed to any person nor copied or reproduced in any manner.

DBS (Company Registration. No. 196800306E) is an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore (the "MAS")