- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Equities: US equities fell amid sharpest monthly decline in US consumer confidence since Aug 2021, highlighting economic concerns; Asia ex-Japan equities declined amid tariffs concerns

- Credit: Credit spreads are more vulnerable when core inflation is too low rather than moderately high; at current levels, IG spreads should remain stable in 2025, supporting the call to stay invested in high-quality credit

- FX: Tariff narrative is coming back with a vengeance

- Rates: Market participants face a range of consideration this week and this uncertainty may keep US yields at their current depressed levels

- The Week Ahead: Keep a lookout for US Change in Nonfarm Payrolls; China CPI numbers

Related Insights

Major markets mostly decline amid weak US consumer confidence and tariff concerns. US equities fell as US consumer confidence index saw the sharpest monthly drop since Aug 2021. The February Conference Board consumer confidence index saw a 6.6% m/m decline, falling from 105.3 in January to 98.3 in February, reflecting growing consumer concerns over the economy. As such, the S&P 500 and NASDAQ lost 1.0% and 3.5% respectively. European stocks advanced despite uncertainty surrounding Trump’s tariffs. The STOXX 600 was up 0.6%.

Asia ex-Japan equities also fell with the CSI 300 and Hang Seng Index declining 2.2% and 2.3% respectively. The decline was driven by President Trump’s announcement of an additional 10% tariffs on Chinese imports on top of the 10% introduced earlier in February, set to take effect on 4 Mar. This week, keep a close watch on China’s two sessions which are expected to commerce on 4 Mar as well. This important political event will outline China’s policy direction for the year ahead and introduce key economic goals.

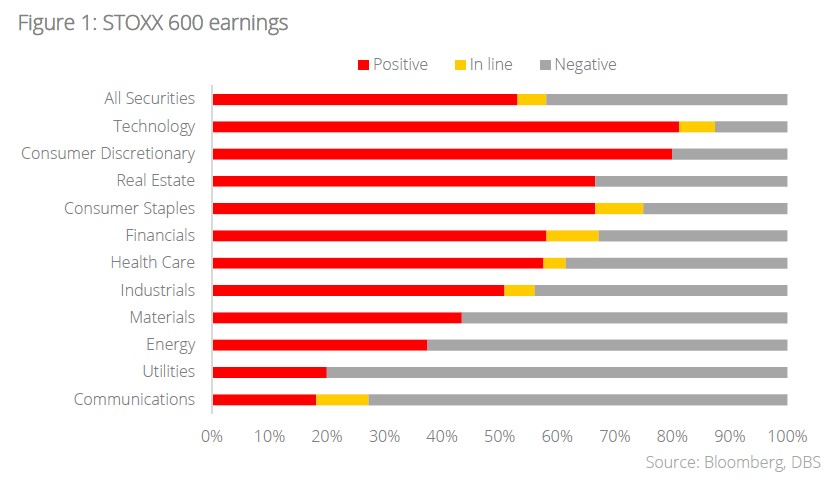

Topic in focus: STOXX 600 earnings surprise consistent with previous quarter. As we reach the midpoint of the earnings season with c.60% of the companies having reported their earnings (as of 28 Feb 2025), earnings surprises are largely in line with those seen from the previous quarter. So far, c.53% of companies have delivered positive earnings surprises with technology and consumer discretionary producing the highest positive earnings surprises at 81% and 80% respectively.

From a sectoral perspective, we continue to advocate exposure in Europe technology, especially in semiconductor where industry leaders hold strong IP and near monopolistic positioning within the market. Furthermore, the semiconductor space is expected to benefit from AI becoming increasingly commoditised as chipsets continue to hold a vital role in the AI ecosystem.

Within the consumer discretionary sector, we continue to favour the luxury segment, in particular “Quiet Luxury”. International tourist arrivals are expected to grow at c.12% y/y in 2025, surpassing 1.6bn visitors and exceeding pre-pandemic levels. Furthermore, the share of luxury purchases linked to tourist spending has recovered from 30% in 2023 to 35% in 2024 globally with the share expected to normalise to c.40% in 2025. “Quiet Luxury” companies stand to benefit as affluent consumers increasingly favour understated elegance and refined craftmanship over overt displays of wealth, positioning these companies for sustained growth.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.