- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Equities: Global equities declined due to weaker-than-expected economic reports, including a sharp decline in consumer sentiment and contracting services sector

- Credit: With the Fed possibly contemplating an end to quantitative tightening, investors should consider deploying cash to credit and securing against cash reinvestment risk

- FX: The tariff and US exceptionalism themes are both fading

- Rates: UST yields which have been buoyant could face downside risk if economic data weaken; risk-off sentiment last Friday exhibits some of this vulnerability

- The Week Ahead: Keep a lookout for US Change in Initial Jobless Claims; Japan Industrial Production Number

Global equities face losses from disappointing data. US major indexes posted their worst performance of 2025 with the Dow and NASDAQ both declining 2.5%, while the S&P 500 shed 1.7%. Economic data showed a slowdown in business activity as Services PMI dropped into contraction territory at 49.7, its lowest reading in over two years. Consumer sentiment plummeted by nearly 10% with inflation expectations rising to 4.3%. Walmart's weak guidance added to concerns over consumer spending, while geopolitical and tariff uncertainties fuelled broader market risk aversion.

The STOXX Europe 600 Index rose 0.26% as optimism about the potential resolution of the Russia-Ukraine conflict boosted Europe equities. Japan’s stock markets fell over the week with the Nikkei 225 losing 0.95% due to yen strength and rising Japanese government bond yields. Bolstered by government support for private enterprises, along with renewed optimism in the tech sector, the Shanghai Composite and Hang Seng Index advanced 0.97% and 3.8% respectively.

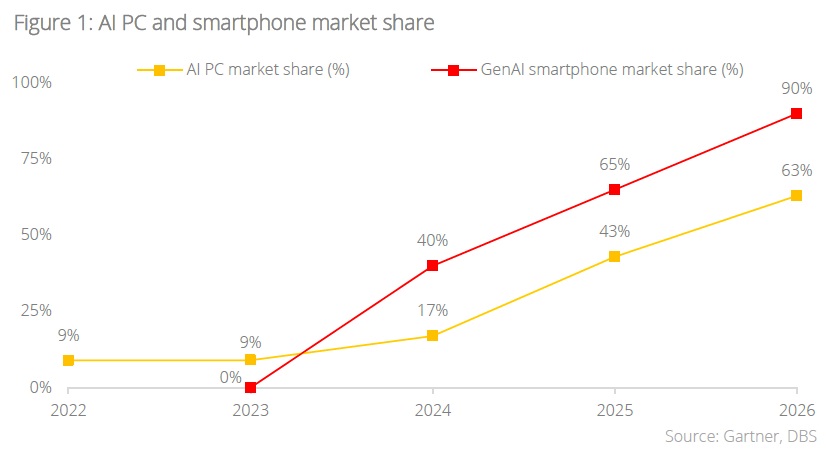

Topic in focus: Global consumer electronics benefitting from AI integration. AI-powered devices are rapidly driving growth in the consumer electronics market. Advancements in AI spanning generative AI, personalised experiences, and enhanced processing power, are fuelling a robust expansion with AI-embedded smartphone and PC shipments projected to grow at CAGRs of 29% and 58% respectively from 2024 to 2028. Market leaders in smartphones like Apple, Samsung, and Xiaomi command shares of 19%, 18%, and 14% respectively, while Lenovo, HP, and Dell hold 24%, 20%, and 15% in the PC sector. Increased demand for AI PCs, accelerated by the shift from Windows 10 to Windows 11, along with the rollout of GenAI smartphones—further boosted by the wealth effect in emerging markets like India and Southeast Asia—are set to expand the installed base significantly.

Strong earnings in consumer electronics have underscored this trend with companies such as Dell and Sony outperforming expectations due to robust demand for AI servers, PCs, gaming, and imaging products. While Apple faces delays in its AI-Siri rollout, Asian brands like Xiaomi and TDK are benefitting from premiumisation and recovery in smartphone sales, along with increased demand for sensors and storage. Overall, OEMs of smartphones and PCs are well-positioned to capitalise on the growing appetite for AI-enabled devices.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.