- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- US: Policymakers to navigate US Inflation and long-term yield pressures

- Singapore: Budget 2025 aims to alleviate cost of living while featuring long-term initiatives to sustain economic growth

- Indonesia: BI’s focus is on monetary policy and supporting economic growth as the government consolidates fiscal policies

- Thailand: Gradual economic recovery faces rising external threats from US tariffs and geopolitical uncertainties

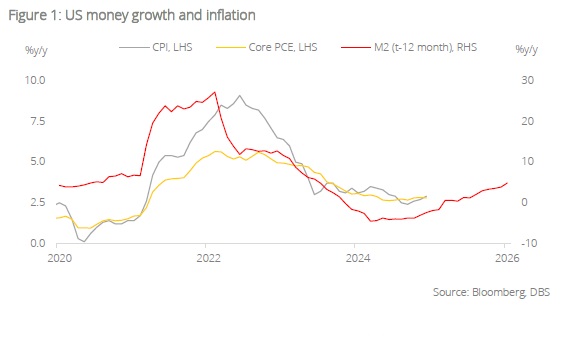

US: Options to contain long-term yield. A tight labour market, strong retail demand, and seasonal factors are adding heat to US inflation readings with January headline and core CPI surprising on the upside. A monetary dimension appears to be at play too. After contracting through most of 2024, US broad money supply growth has picked up. M2 growth is a decent predictor of core inflation a year from now, as seen in the chart below. The Fed needs to watch out as the relationship points to well above 3% core inflation ahead.

Treasury Secretary Bessent has shifted the market’s attention towards containing 10Y US Treasury yields, rather than President Trump’s pressure on the Fed to cut the Fed Fund Rate (FFR). Given that US funding costs are more closely tied to longer term yields, not shorter-term rates (which the Fed directly controls), this intuitively makes sense. However, the US’s burgeoning fiscal deficit (7.2% on a rolling 12-months basis) and robust growth momentum are putting significant upward UST yields.

The most obvious way to bring long-term yields lower is to reduce the budget deficit. Bessent, as part of his 3-3-3 plan, wants to bring the deficit down to 3%. Sticky spending (comprising Medicare, Social Security, defence, and interest outlays) make up about 64% of total expenditure. There is simply not much room for meaningful spending drops until the Medicare and Social Security costs are addressed. Moreover, Trump’s flagship TCJA (currently set to expire in end 2025) will likely be fully extended, adding an estimated USD400bn to the budget deficit annually. Tariffs can be used to raise revenues but these likely need to be universal. According to the CBO’s estimate, 10% universal tariffs may reduce the deficit by USD2.1tn over ten years. Given significant uncertainties on the policy front and the risk skew towards more spending, we see meaningful budget consolidation as a low probability-high impact option.

The Fed has several tools to lower interest rates but these are only used during extraordinary circumstances. Currently, the Fed is running QT at a cap of USD60bn a month. It will probably be difficult for the Fed to unitise these measures at a time when the US economy is firm. Operationally, the Fed should be acting countercyclically to smooth out economic cycles. Rates should therefore be high. If fiscal dominance becomes a theme, the Fed may lose independence and act in coordination with the Treasury to manage financing costs.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.