- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- The Fed’s policy shift amid Trump’s unpredictable policymaking has heightened uncertainty, making private equity an attractive asset class for its antifragile performance

- Private equity has historically outperformed during policy uncertainty and rate stress

- Middle market buyouts are a key contributor to private equity outperformance. However, success is heavily dependent on skilled managers who can optimise deals through lower leverage and profitability enhancements

- With valuations suppressed yet poised to rise, now is an opportune time to invest in private equity, particularly in middle-market segments

The winds of change in the macroeconomic landscape are swelling rapidly. Within days of President Trump’s inauguration, the world has had to deal with trade tariffs, a breakthrough in AI technology with DeepSeek, and a pause in the Fed cutting cycle, just to name a few. While the public markets have shown some fragility in the midst of all this uncertainty, the asset class of private equity seemingly continues to stand out for its resilient performance. With risks not expected to abate under a new regime, we think it is an opportune time for investors to continue to build portfolio resilience through private equity exposure.

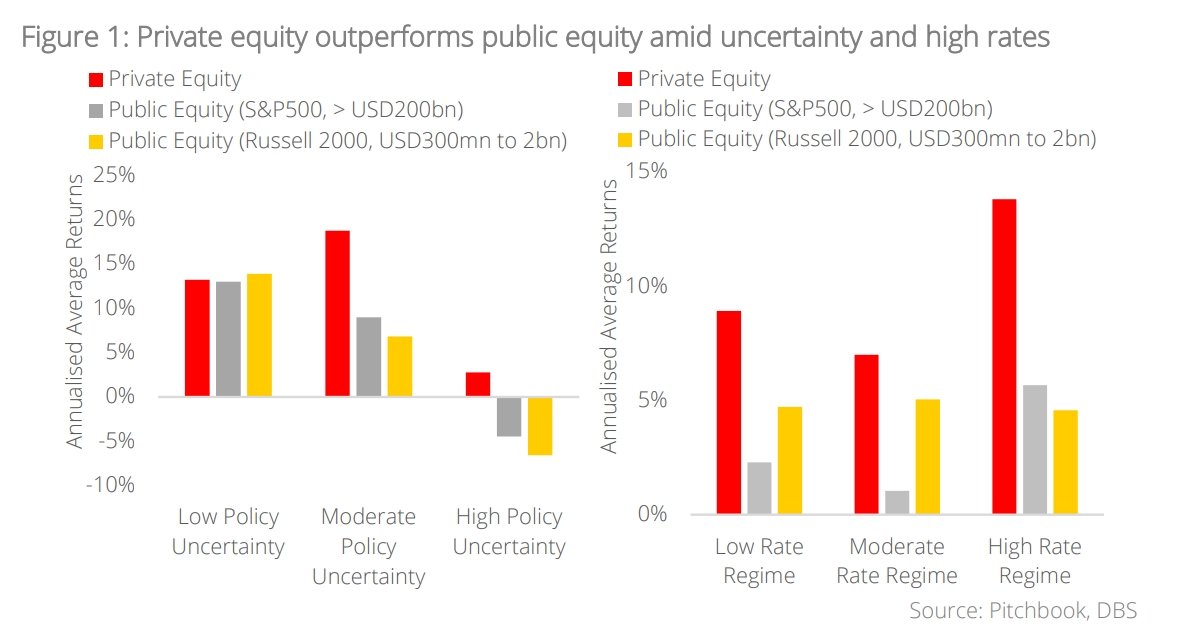

Private equity has historically outperformed both large- and mid-cap public equivalents under both high policy uncertainty and high-rate regimes. When policy uncertainty is high, stock markets registered significant drawdowns, whereas private equity registered strong positive returns on average. This is unsurprising given that private assets generally exhibit strong negative correlations to stock market returns (current: -0.65), underscoring their diversification benefits. Noteworthily, private equity performance even displayed an anti-fragile streak, registering an uptick in performance against rate stress. Intuitively, high interest rates should precipitate higher cost of financing, diminish distributions (via dividend recapitalisation), and depress valuations – all of which ought to bode poorly for private market investors. However, the reality appears to be more nuanced. A deeper look, reveals that private equity’s antifragility during rate stress may likely stem from investors’ influence over portfolio companies.

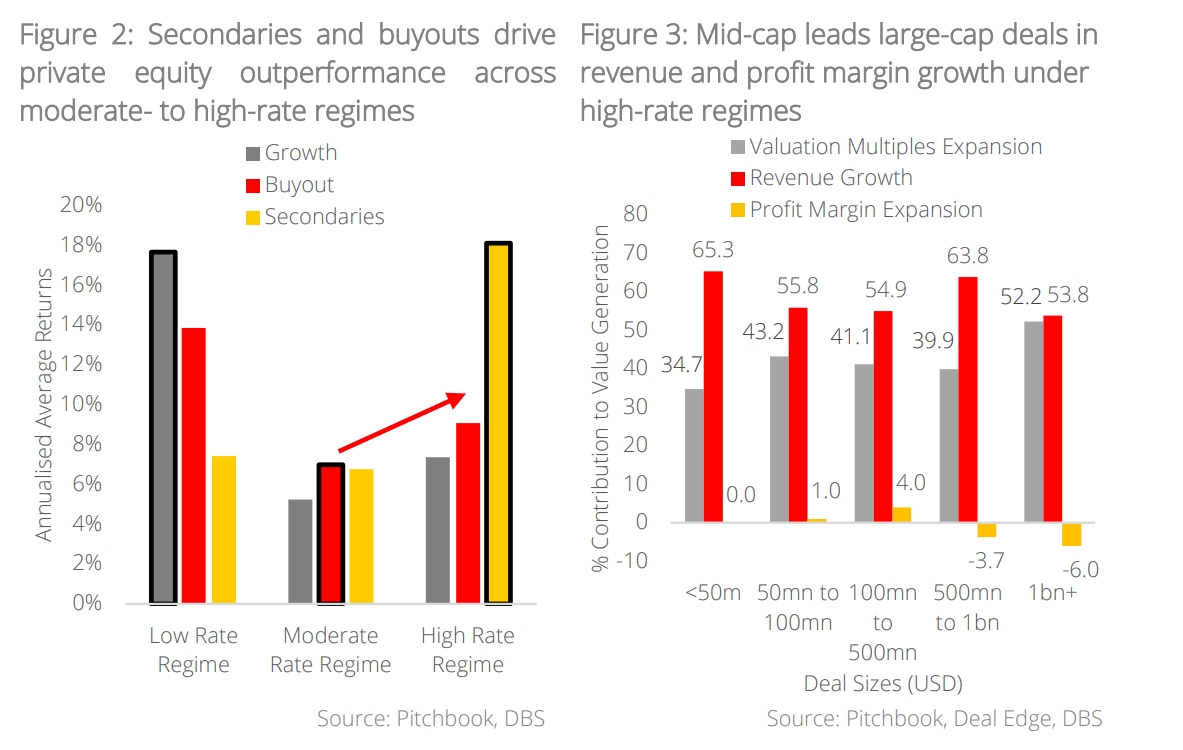

Investors, by virtue of gaining controlling stake, have the flexibility and agility to optimise company efficiency and structure deals in a manner that is the most optimal under prevailing macroenvironment. Under moderate- to high-rate environments, investors can structure deals with lower leverage, improved profitability, and faster exit distributions. In practice, these translate to prioritising (i) middle market deals which offer significant value generation through revenue and profitability optimisations, rather than relying on leveragedriven multiple arbitrage; (ii) mid-cap buyouts which provide majority ownership in fundamentally sound, low-debt companies; and (iii) secondaries which allow flexible exits to generate distributions and avail portfolio rebalancing opportunities without using additional debt. Breaking down the outperformance of private equity indeed reveals buyouts and secondaries as key contributors of private equity returns across moderate- to high-rate environments.

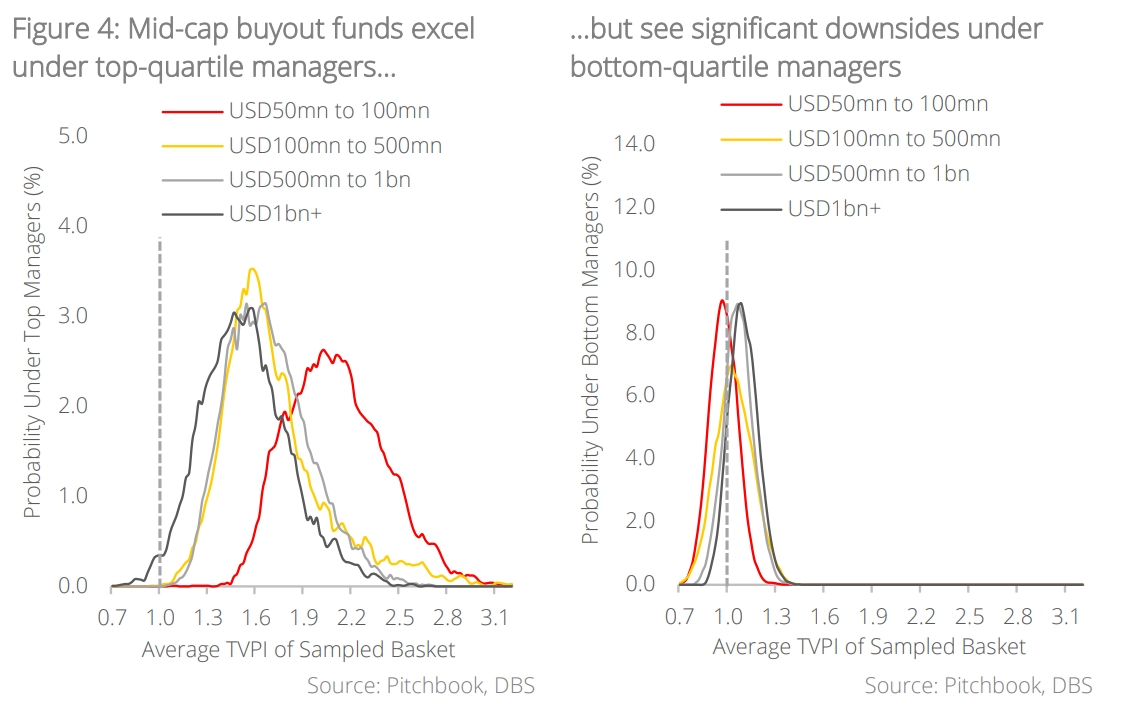

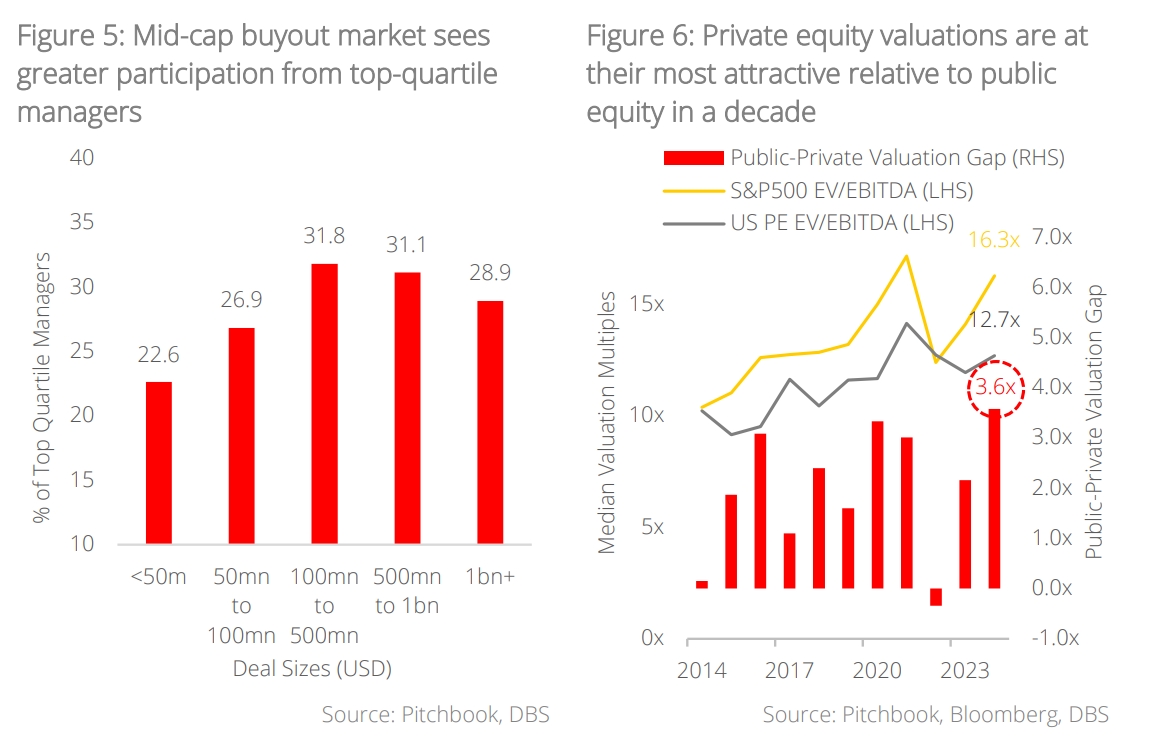

While middle market buyouts present a compelling investment case in a high-rate environment, it is important to highlight that not all mid-cap buyout segments offer the same risk-reward, and success depends heavily on manager selection. Empirically, from 2014 to 2024, the mid-cap segment of USD50mn to 100mn exhibited the greatest probability of upside compared to larger cap deals. However, this trend is heavily contingent on the quality of managers. Under bottom-quartile managers, the same mid-cap segment displayed the highest likelihood of loss-making (more than 50%), reversing the trend seen with stronger managers. This empirical observation underscores the critical role of managers in optimising deals outcomes. Notably, there is a growing proportion of top-quartile managers in the mid-cap segments, and this will undoubtedly further improve the odds of success in middle market private equity investments going forward.

Finally, opportunities for value plays continue to exist in private equity. For new investors, a golden window of opportunity has opened up as the 2022 dip in valuation multiples bottomed out following the Fed’s decision to embark on an easing trajectory in late 2024. The Fed’s recent rate pause will temporarily suppress multiples and extend this opportunity window. Fundamentally, the easing cycle should persist – albeit gradually – and this should support a steady uplift in multiples. Trump’s deregulatory and pro-growth policies, coupled with private equity managers’ focus on profitability and deleveraging, will aid multiple expansion in private equity even as rates remain elevated. For existing investors, private equity multiples are trending upward on a 5-year trailing basis. The booming secondaries market also avail opportunities for rebalancing and capitalising on low entry multiples. Importantly, private equity remains undervalued relative to public counterparts. The valuation gap with the S&P500 now stands at 3.6x, marking the most significant divergence in at least a decade, and highlights private equity’s relative attractiveness.

In summary, amid a changing macroeconomic environment, middle market private equity buyouts stand out as resilient investments. They offer strong potential for value generation, particularly when executed by seasoned managers with a proven record of optimising profitability without relying on leverage. A skilled manager’s ability in navigating complexities whilst fostering growth will ultimately determine long-term returns. With relatively attractive valuations, investors who commit capital now can secure favourable entry points before further market shifts.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.