- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

FOCUS OF THE WEEK

The October US inflation prints met expectations. Headline and core PCE were unchanged at 0.2% m/m and 0.3%, respectively, the same levels as a month ago. In response, the futures market increased the probability of a 25 bps December rate cut from 52.3% to 66.5%. The US Treasury 2Y yield fell a third session by 2.9 bps to 4.23%, its lowest close since 7 Nov. 10Y yield closed at 4.26%, near the month’s low of 4.22% seen on 1 Nov. US fiscal sustainability worries also appeared to have ebbed after Trump nominated prominent hedge fund manager Steve Bessent as US Treasury Secretary at the start of the week. The Fed remained unperturbed, focusing instead on the easing trajectory in the recent release of the Fed minutes.

There are two key takeaways from the Fed minutes. Firstly, the minutes offered a more cautious take on easing. Many participants think that it is “complicated” to assess the degree of restrictiveness on current monetary policy settings. In particular, the appropriate neutral rate is uncertain and may well be higher than what the Fed pencilled in for September (2.9%). From the market’s perspective, this is not new. Given resilient US data and upside growth and inflation risks, the market is barely pricing in three more cuts by the end of 2025. In any case, we still think the Fed would cut in December, but it could well signal an even slower pace of easing going forward.

Secondly, the Fed hinted on a “technical” adjustment in the RRP rate. Currently, the RRP rate stands at 4.55 bps, 5 bps higher than the FFR lower bound. The Fed is mulling to align the RRP to the FFR floor which would imply a 5 bps rate cut. A change is imminent and may precipitate as early as December’s FOMC meeting. Funds placed at the RRP facility has declined steadily from c.USD2.5tn to c.USD148bn. If the tweak occurs, the remaining funds could flow out into other short-term instruments, lowering short-term USD rates in general. That said, this looks to be a one-off adjustment on rate levels and short-end swap spreads. The motivations for the Fed could be to ensure sufficient liquidity ahead of uncertainty in 2025.

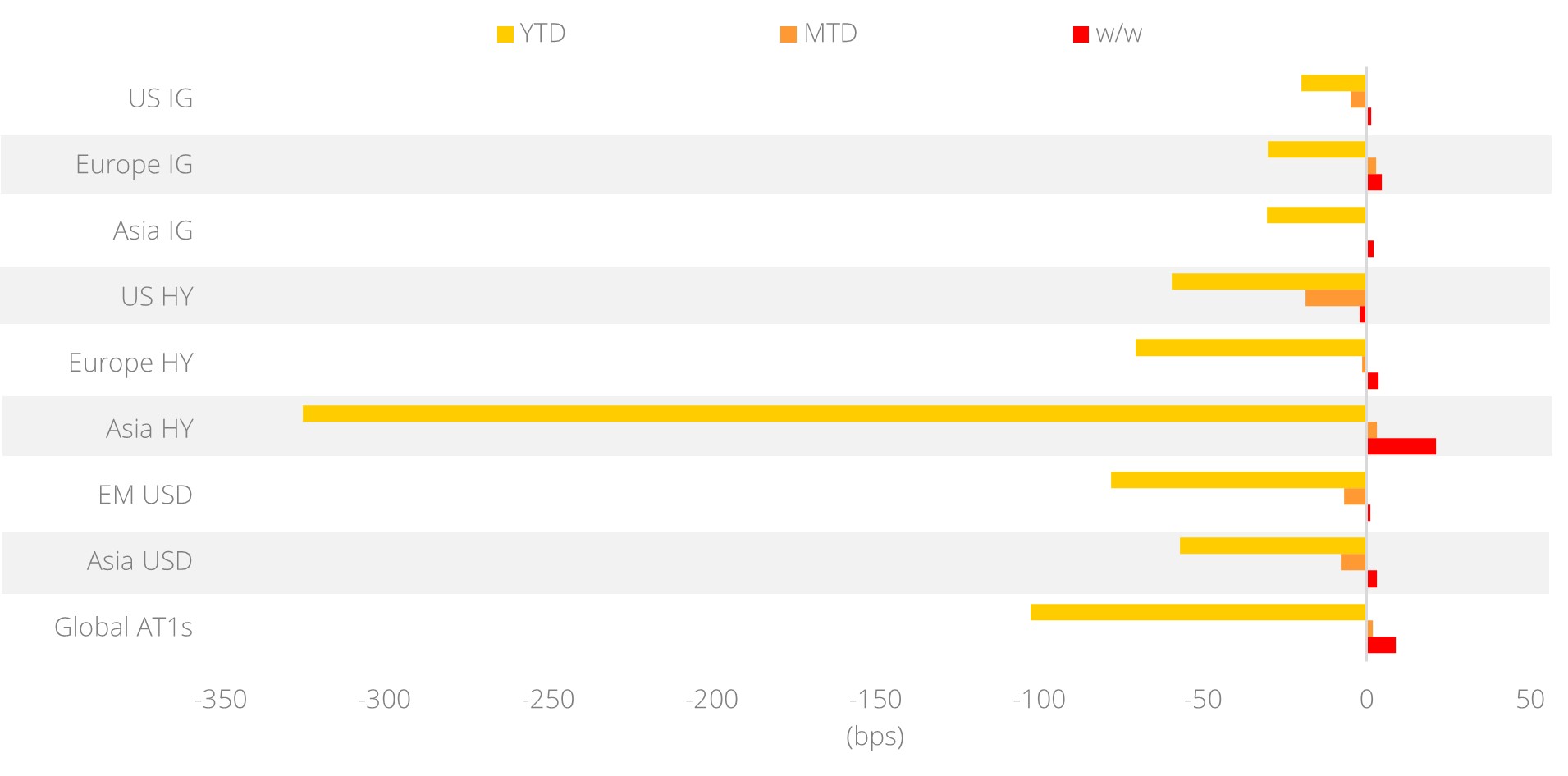

Figure 1: Changes in spreads

Source: Bloomberg, DBS

Download the PDF to read the full report.

Topic

Disclaimers and Important Notes

This email and the document(s) attached (collectively the ”Information”) are provided to you for your private use only and are purely indicative and for discussion purposes only. The Information is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The Information may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS Bank Ltd. nor any of its related companies or affiliates which includes DBS Bank (Hong Kong) Limited nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The Information may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. The Information does not have regard to the investment objectives, financial situation and particular needs of any specific person. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Companies within the DBS Group or the directors or employees of the DBS Group or persons/entities connected to them may have positions in and may affect transactions in the underlying product(s) mentioned. Companies within the DBS Group may have alliances or other contractual agreements with the provider(s) of the underlying product(s) to market or sell its product(s). Where companies within the DBS Group are the product provider, such company may be receiving fees from the investors. In addition, companies within the DBS Group may also perform or seek to perform broking, investment banking and other banking or financial services to the companies or affiliates mentioned herein.

The Information may include quotation, comments or analysis. Any such quotation, comments or analysis have been prepared on assumptions and parameters that reflect our good faith, judgement or selection and therefore no warranty is given as to its accuracy, completeness or reasonableness. All information, estimates, forecasts and opinions included in this document or orally to you in the discussion constitute our judgement as of the date indicated and may be subject to change without notice. Changes in market conditions or in any assumptions may have material impact on any estimates or opinion stated.

Prices and availability of financial instruments are subject to change without notice. In any event, past performance is no guarantee of future results, and future results may not meet our/ your expectations due to a variety of economic, market and other factors.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

If the Information has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

The investment product(s) mentioned herein is/are not the only product(s) that is/are aligned with the views stated in the research report(s) and may not be the most preferred or suitable product for you. There are other investment product(s) available in the market which may better suit your investment profile, objectives and financial situation.

The Information is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

Where the investment product(s) (including but not limited to bonds/debentures) are held by DBS Bank Ltd. (or its nominee) on behalf of the investor, the bank will provide custody services in respect of such holdings in accordance with the terms and services governing the custodian account. Should a credit event occur, the bank will take reasonable steps to forward to the investor any notice or other communication received in respect of such investment product(s). As the bank may not be privy to debt restructuring plans and/or other negotiations between the issuer and its creditors (due to the confidential nature of such discussions), the availability and flow of information may be greatly diminished in such circumstances.

Investment products falling within the PRIIPS Regulation (as defined below) are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the European Economic Area (the “EEA”). For these purposes, a retail investor means a person who is one (or more) of:

(i) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended, "MiFID II"); or

(ii) a customer within the meaning of Directive 2002/92/EC (as amended the "Insurance Mediation Directive"), where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or

(iii) not a qualified investor as defined in Directive 2003/71/EC (as amended, the "Prospectus Directive").

Consequently, no key information document required by Regulation (EU) No 1286/2014 (the "PRIIPs Regulation") for offering or selling the investments or otherwise making them available to retail investors in the EEA has been prepared and therefore offering or selling the investments or otherwise making them available to any retail investor in the EEA may be unlawful under the PRIIPS Regulation. For this purpose, DBS Group will assess whether the account’s beneficial owner (or, in the case of trust accounts, the settlor) is a retail investor in the EEA.

A PRIIP is any investment where the amount repayable to the investor is subject to fluctuations because of exposure to reference values or to the performance of one or more assets which are not directly purchased by the investor.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Dubai International Financial Centre: This communication is provided to you as a Professional Client or Market Counterparty as defined in the DFSA Rulebook Conduct of Business Module (the "COB Module"), and should not be relied upon or acted on by any person which does not meet the criteria to be classified as a Professional Client or Market Counterparty under the DFSA rules.

This communication is from the branch of DBS Bank Ltd operating in the Dubai International Financial Centre (the "DIFC") under the trading name "DBS Bank Ltd. (DIFC Branch)" ("DBS DIFC"), registered with the DIFC Registrar of Companies under number 156 and having its registered office at units 608 - 610, 6th Floor, Gate Precinct Building 5, PO Box 506538, DIFC, Dubai, United Arab Emirates.

DBS DIFC is regulated by the Dubai Financial Services Authority (the "DFSA") with a DFSA reference number F000164.

Where this communication contains a research report, this research report is prepared by the entity referred to therein, which may be DBS Bank Ltd or a third party, and is provided to you by DBS DIFC. The research report has not been reviewed or authorised by the DFSA. Such research report is distributed on the express understanding that, whilst the information contained within is believed to be reliable, the information has not been independently verified by DBS DIFC.

Unless otherwise indicated, this communication does not constitute an "Offer of Securities to the Public" as defined under Article 12 of the Markets Law (DIFC Law No.1 of 2012) or an "Offer of a Unit of a Fund" as defined under Article 19(2) of the Collective Investment Law (DIFC Law No.2 of 2010).

The DFSA has no responsibility for reviewing or verifying this communication or any associated documents in connection with this investment and it is not subject to any form of regulation or approval by the DFSA. Accordingly, the DFSA has not approved this communication or any other associated documents in connection with this investment nor taken any steps to verify the information set out in this communication or any associated documents, and has no responsibility for them. The DFSA has not assessed the suitability of any investments to which the communication relates and, in respect of any Islamic investments (or other investments identified to be Shari'a compliant), neither we nor the DFSA has determined whether they are Shari'a compliant in any way.

Any investments which this communication relates to may be illiquid and/or subject to restrictions on their resale. Prospective purchasers should conduct their own due diligence on any investments. If you do not understand the contents of this document you should consult an authorised financial adviser.

Hong Kong: This communication is from DBS Bank (Hong Kong) Limited (CE Number: AAL664) (“DBSHK”) which is regulated by the Hong Kong Monetary Authority (the "HKMA") and the Securities and Futures Commission. In Hong Kong, DBS Private Bank is the private banking division of DBS Bank (Hong Kong) Limited.

To the extent that DBSHK does not solicit the sale of or recommend any financial product to you or where any service is provided as a transactional execution service, DBSHK is not acting as your investment adviser or in a fiduciary capacity to you. If DBSHK solicits the sale of or recommends any financial product to you, the financial product must be reasonably suitable for you having regard to your financial situation, investment experience and investment objectives. No other provision of this document or any other document DBSHK may ask you to sign and no statement DBSHK may ask you to make derogates from this clause.

In any case, DBSHK has not given and will not give any representation, guarantee or other assurance as to the outcome of any investment based on the information provided. “Financial product” means any securities, futures contracts or leveraged foreign exchange contracts as defined under the Securities and Futures Ordinance (Cap.571 of the Laws of Hong Kong). Regarding “leveraged foreign exchange contracts”, it is only applicable to those traded by persons licensed for Type 3 regulated activity. The Information has not been reviewed or authorised by the HKMA, or any regulatory authority elsewhere.

The Information is provided to you as a “Professional Investor” (defined under the Securities and Futures Ordinance of Hong Kong) for your private use only and may not be passed on or disclosed to any person nor copied or reproduced in any manner.

Where this communication contains a research report, DBSHK is not the issuer of the research report unless otherwise stated therein. Such research report is distributed on the express understanding that, whilst the information contained within is believed to be reliable, the information has not been independently verified by DBSHK.

Singapore: This communication is from DBS Bank Ltd (Company Regn. No. 196800306E) ("DBS") which is an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore (the "MAS").

The advertisement has not been reviewed or authorised by the MAS, or any regulatory authority elsewhere.

The Information is provided to you as an “Accredited Investor” (defined under the Securities and Futures Act of Singapore) for your private use only and may not be passed on or disclosed to any person nor copied or reproduced in any manner.

Thailand: This communication is from DBS Vickers Securities (Thailand) Co., Ltd. (“DBSVT”).

The information contained in this communication is not intended to be either an offer, invitation or solicitation to buy or sell any securities, derivatives, or any other financial products or services, provide financial advice or investment advice, facilitate or take deposits, or provide any other financial products or financial services of any kind in any jurisdiction. The information contained in this communication is provided for information purposes only and is not intended to provide, and should not be construed as, advice.

This communication has not been reviewed by any regulatory authority in Thailand and has not been registered as a prospectus with the Office of the Securities and Exchange Commission of Thailand. Accordingly, any documents and materials, in connection with the offer or sale, or invitation for subscription or purchase of the securities, derivatives, or any other financial products or services, may only be circulated or distributed by an entity as permitted by applicable laws and regulations. DBS and DBSVT does not have any intention to solicit you for any investment or subscription in the securities, derivatives, or any other financial products or services, and any such solicitation will be made by an entity permitted by applicable laws and regulations.

United Kingdom: This communication is from DBS Bank Ltd., London Branch located at 9th Floor, One London Wall, London EC2Y 5EA. DBS Bank Ltd. is regulated by the Monetary Authority of Singapore and is authorised and regulated by the Prudential Regulation Authority. DBS Bank Ltd. is subject to regulation by the Financial Conduct Authority and limited regulation by the Prudential Regulation Authority. Details about the extent of DBS Bank Ltd., London Branch’s regulation by the Prudential Regulation Authority are available upon request.

Additional Disclaimer if MSCI ESG Data is Used

MSCI ESG Research LLC and its affiliates make no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI ESG data contained herein. The MSCI ESG data may only be used for your internal use, may not be further redistributed or used as a basis for any financial products or indexes. None of the MSCI ESG data can in and of itself be used to determine which securities to buy or sell or when to buy or sell them.

While ESG is one of the important selection criteria DBS takes into consideration for investment products, the primary consideration for any investment is a sound investment case and potential for investment returns balanced against risks. In some instances, given limited alternatives and giving consideration to all relevant factors regarding the investment, we may select products that have ESG ratings of BB or lower, with such ratings disclosed to you.