- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

- Current risk premium seems to be on par with those seen at the onset of the Israel-Hamas conflict

- Middle East conflicts have muted impact on the markets with gold and oil serving as effective hedges

- Upside potential for oil; impact might be muted due to growing US dominance in crude production

- Geopolitical risk just one of many tailwinds for safe haven gold; risk-off episodes to boost demand

- Stay anchored in our CIO Barbell Strategy to mitigate short-term market volatility

The Japanese yen remains a central focus for carry trade unwinds; But rising Middle East tension also warrants close attention. While predicting developments on the ground is difficult, an all-out war seems to have been averted for now, with nations urging for de-escalation and diplomatic solutions.

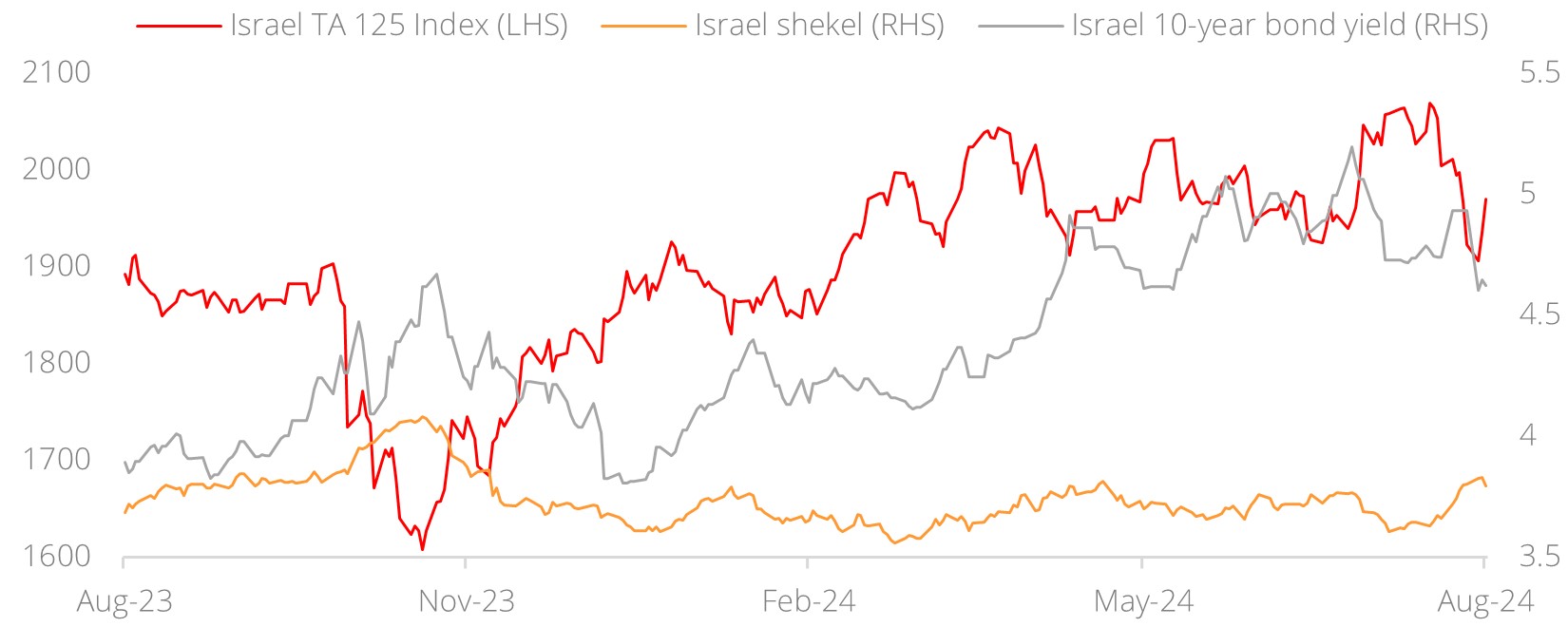

Risk premium on par with Oct 2023’s high. Amid heightened geopolitical risks, we assessed risk premiums relative to Oct 2023 by examining Israel’s local markets. Israel’s 10Y bond yields peaked at 4.7% last October before returning to pre-conflict levels of 3.8%. Reflecting recent tensions, bond yields have risen again, reaching a peak of 5.2% and currently hovering near the October high of 4.6%. Our analysis shows that risk premiums are now comparable with those seen at the peak in Oct 2023, the onset of the Israel-Hamas conflict.

Figure 1: Risk premia adequately priced

Source: LSEG Datastream, DBS

In contrast, Israel’s currency and equity markets have demonstrated more stability. The Israeli shekel and the Tel Aviv 125 stock market index have fully recovered from their October lows and are now approaching pre-conflict levels. Overall, investors seem cautiously optimistic, anticipating that the current tensions will eventually ease.

Historically, conflicts in the Middle East have limited impact on financial markets. Investors appear accustomed to such situations. Our analysis from when the Hamas-Israel conflict first erupted in October last year (link) revealed that beyond immediate headlines and reactions, Middle East conflicts have historically had a muted impact on financial markets. The most effective hedges against further escalation remain to be gold and oil.

Middle East tensions spell upside potential for oil. The impact of Middle East conflicts on global financial markets have traditionally been through oil prices. This is unsurprising as approximately a quarter of global crude production comes from the region, and a third of its related trade passes through the Straits of Hormuz; any disruptions to production and trade as a result of geopolitical conflict will materially impact global supply and raise prices. We saw this happen late last year on the back of attacks on ships in the Red Sea from Nov 2023 to Jan 2024, causing a c.5.5% increase in oil prices during the same period.

Impact will still be there, but possibly more muted. We believe this time is no different: an escalation in conflict between Iran and Israel presents upside potential for oil prices. However, the magnitude of the upside may not be as significant as some expect. This is due to two reasons: i) while the Middle East remains a key crude producer, the US has increased its production over time through its burgeoning shale supply, and this has reduced the former’s influence as a swing producer; ii) global supply chains have likely adjusted to the drop in tanker traffic in the Suez Canal by now. On point (ii), unless the escalation in conflict is severe enough to further reduce tanker traffic, we will likely not see significant oil price upside from trade disruptions specifically.

Safe haven gold a potential beneficiary. Gold has not had a shortage of tailwinds in recent times. Decelerating growth, easing inflation, and a softening labour market in the US are setting the stage for Fed rate cuts later in the year, and laying the foundation for further rallies for non-interest-bearing gold. Furthermore, central bank gold buying remains robust, driven by the threat of monetary debasement, fiscal sustainability concerns, and de-dollarisation. The US elections in November also present potential right-tail risk for the precious metal. Heightened geopolitical tensions add to that mix, giving gold yet more room for upside. Should the conflict between Iran and Israel escalate into all-out war, we believe gold will likely experience a short-term boost through elevated safe haven demand.

How much of a boost will bullion receive? Based on historical analysis of recent risk-off incidents, we found that gold rallies after such episodes lasted 13 days on average and resulted in an average price increase of 7.1% trough to peak. It is reasonable to assume that a war between Iran and Israel will likely result in a rally of similar length and magnitude. However, the exact impact will really depend on how the conflict plays out; should the conflict be contained between the two nations, the resultant rally will be a likely be a one-off event. However, if the conflict results in wider regional instability, we could see multiple gold rallies with each episode of escalation.

Stay with Barbell Strategy in uncertain times. Since the onset of the Israel-Hamas war in Oct 2023, our DBS CIO Barbell Strategy has demonstrated resilience, delivering a stellar return of 15.6%, outperforming the 14.8% return of the 50-50 composite of global equities and bonds index. As geopolitical tensions persist, we continue to advocate adopting our Barbell Strategy to build a robust investment portfolio during such challenging times. On the growth side, invest in companies that are well positioned to capture long-term secular trends and benefit as the world transits to a digital economy. On the income side, invest in dividend yielding equities such as REITs and bonds. The income nature of these assets will provide resilience to the overall portfolio. In addition, risk diversifiers such as gold, which have low correlations to equities and bonds, can further reduce portfolio volatility and drawdowns.

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

The information contained in this article has been obtained from sources believed to be reliable, but DBS makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Please refer to the Additional Terms and Conditions Governing Digital Tokens for DBS Treasures Customers for more specific risk disclosures on trading of digital tokens.

This information does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or enter into any transaction. It does not have regard to your specific investment objectives, financial situation or particular needs. It is not intended to provide, and should not be relied upon for accounting, legal or tax advice.

Cryptocurrency trading is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. Before you decide to purchase an investment product, you should read all the relevant documents and carefully assess if it is suitable for you. Invest only if you understand and can monitor your investmen. Diversify your investments and avoid investing a large portion of your money in a single asset type.

Trading in Cryptocurrencies or the instrument (“Instrument”), such as ETF, referencing or with underlying as Cryptocurrencies ("Crypto-Products”), such as Bitcoin ETFs, is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. By trading in Crypto-Products, you are exposed to the risks of both the Instrument and the Cryptocurrencies. Further, Crypto-Products listed on overseas exchanges may not be regulated in Singapore, and are subject to the laws and regulations of the jurisdiction it is listed in. Before you decide to buy or sell Cryptocurrencies or Crypto-Products, you should read all the relevant documents and carefully assess if it is suitable for you and/or seek advice from a financial adviser regarding its suitability. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single asset type.

To the extent permitted by law, DBS accepts no liability whatsoever for any direct, indirect or consequential losses or damages arising from or in connection with the use or reliance of this email or its contents. If this information has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses.

Please refer to Terms and Conditions governing your banking relationship with DBS for more specific risk disclosures on the Instrument (such as ETFs under Funds) and Digital Tokens.

This information is provided to you as an “Accredited Investor” (defined under the Securities and Futures Act of Singapore and the Securities and Futures (Classes of Investors) Regulations 2018) for your private use only. It is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, and may not be passed on or disclosed to any person nor copied or reproduced in any manner.

DBS (Company Registration. No. 196800306E) is an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore (the "MAS")