- Banking

- Wealth

- Privileges

- NRI Banking

- Treasures Private Client

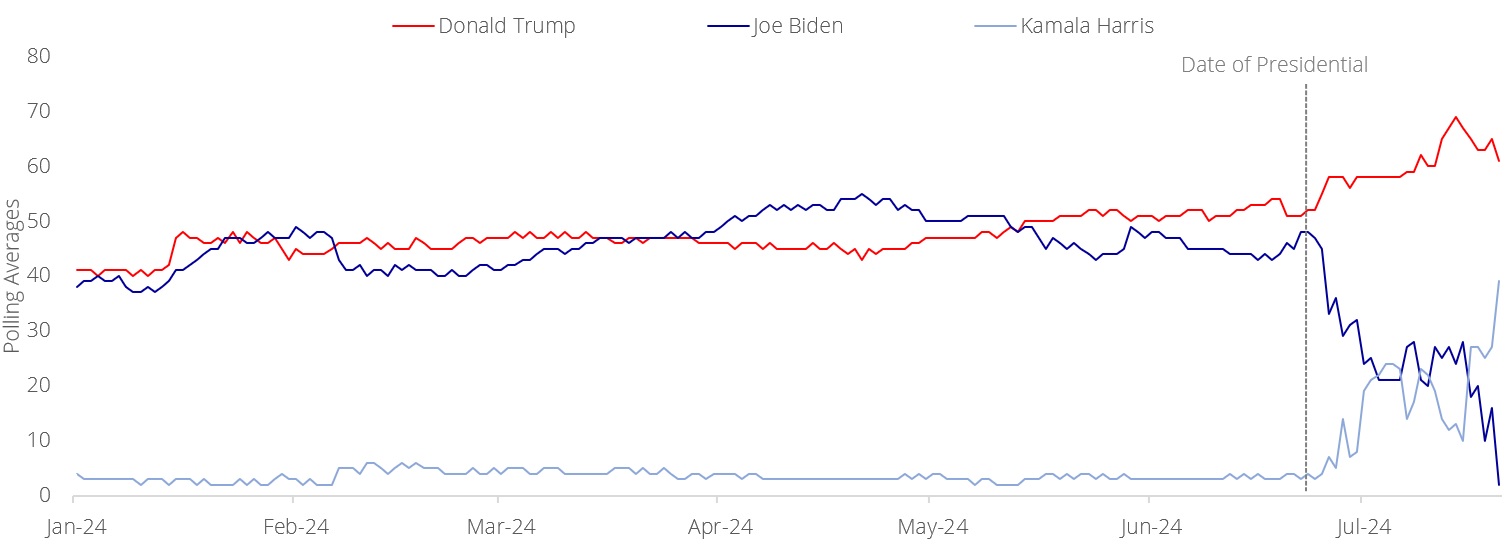

- Rising bets on a Trump victory warrant a closer examination of its impact on fixed income markets.

- Historically, limited differences in credit spreads between Democratic and Republican presidencies.

- In both cases, credit spreads appear to tighten over the 12 months after elections.

- 10Y UST yields appear to inhabit lower ranges under Republican presidencies...

- ...contradicting market consensus of a hypothetical Trump presidency.

Related Insights

- USD Rates: Firm data versus position unwind 26 Jul 2024

- CNY rates: Strong demand for short-end CGB 25 Jul 2024

- USD Rates: Steepening still the core trade 25 Jul 2024

Turning of the tides. It takes only moments to alter destinies – incumbent President Joe Biden’s poor showing in the Presidential debates has led to an abrupt end in his bid for re-election. What was initially a tight toss-up between two leading candidates has now evolved into a clear lead by the Republican nominee Donald Trump. Even then, he was not without his own destiny-altering moment; the ex-President had to literally dodge a bullet in a botched assassination attempt to take pole position in this presidential race. Now that the dust has settled, it is perhaps a little safer for fixed income investors to look ahead to ascertain what a second Trump administration might imply for the markets.

Elections themselves have limited impact on credit risk. Quantitatively, the first thing to note is that credit spreads show little variance between a Republican or Democratic presidency; an intuitive observation given that other factors (corporate balance sheet strength, profitability, monetary policy, liquidity etc.) have a larger and more direct influence on spreads. Interestingly, under both sides, spreads exhibit a tendency to decline in the 12 months after elections – likely as the markets are relieved of a key quadrennial risk event.

Presidencies and the yield curve. The yield curve however does seem to show slight differences – Under Republican presidencies, curves appear to flatten in the one-year period before and after elections, while democratic presidencies see steepening in the same timeframe. Once again, the data on average shows little discrepancy between Republican or Democratic presidencies, but it is interesting to note that the ranges can be quite variable – for example, the 10Y UST yield under Republican presidencies appear to inhabit a lower range of yields two years after elections, while the range under Democratic presidencies appears quite wide.

This runs against the current consensus that a second Trump regime would almost certainly lead to higher 10Y yields due to runaway deficits and debt; one would recall that it is in fact the Republican party that historically leans towards fiscal conservatism (referencing the “Tea Party” movement of 2009). These consensus assumptions therefore warrant further investigation.

Would a Trump presidency lead to higher yields? Conventional assumptions remain that a second Trump term would pave the way for another round of unfunded corporate tax cuts, potentially aggravating the runaway US federal government debt problem that the US Congressional Budget Office (CBO) projects to reach 166% of GDP by 2054. We encourage investors to take a slightly contrarian view, given that Trump’s second term could look quite different from his first for a few reasons:

1. It is difficult to cut corporate taxes much further from here. The 2017 Tax Cuts and Jobs Act (TCJA) permanently reduced corporate tax rates from 35% to 21%. To reduce taxes by the same magnitude again would be extremely difficult, seeing that those savings did not go as far towards domestic investment as they did to fund share buybacks. It would also be much more unpopular to Trump’s voter base today to reduce taxes for multinational corporations with a liberal bias.

2. Trump prefers lower rates. In his first presidential term, Donald Trump was not uncomfortable with blurring the lines on Fed independence, overtly criticising the Fed on social media for aggressively raising rates during his term as president. With policy rates today nearly double those of his first term, it is difficult to imagine that he would be more comfortable about it now. Seeing as interest payments are a large contribution to the CBO’s debt projections, this could help to partly arrest the deficit spiral.

3. Tariffs would put a lid on potential growth of the economy. While tariffs are inflationary and could encourage re-shoring of manufacturing activity, we note that it does still result in efficiency losses that decreases potential economic growth which can ultimately lead to lower bond yields. Trump’s first term is illustrative – while tax cuts did initially supercharge expectations of strong growth and provided cover for a Fed hiking cycle, tariffs and trade tensions eventually dampened the global outlook which resulted in 10Y UST yields falling all the way down to c.1.5% even before the pandemic.

A Trump presidency is not bond Kryptonite. Based on the above, we believe that a Trump presidency may not lead to the higher-and-higher yield environment that fixed income investors fear; investors should therefore capitalise on any spike in yields to switch from cash into bonds as we pivot towards a cutting cycle in global monetary policy.

Source: PredictIt, Bloomberg, DBS

Download the PDF to read the full report.

Topic

This information herein is published by DBS Bank Ltd. (“DBS Bank”) and is for information only. This publication is intended for DBS Bank and its subsidiaries or affiliates (collectively “DBS”) and clients to whom it has been delivered and may not be reproduced, transmitted or communicated to any other person without the prior written permission of DBS Bank.

This publication is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to you to subscribe to or to enter into any transaction as described, nor is it calculated to invite or permit the making of offers to the public to subscribe to or enter into any transaction for cash or other consideration and should not be viewed as such.

The information herein may be incomplete or condensed and it may not include a number of terms and provisions nor does it identify or define all or any of the risks associated to any actual transaction. Any terms, conditions and opinions contained herein may have been obtained from various sources and neither DBS nor any of their respective directors or employees (collectively the “DBS Group”) make any warranty, expressed or implied, as to its accuracy or completeness and thus assume no responsibility of it. The information herein may be subject to further revision, verification and updating and DBS Group undertakes no responsibility thereof.

All figures and amounts stated are for illustration purposes only and shall not bind DBS Group. This publication does not have regard to the specific investment objectives, financial situation or particular needs of any specific person. Before entering into any transaction to purchase any product mentioned in this publication, you should take steps to ensure that you understand the transaction and has made an independent assessment of the appropriateness of the transaction in light of your own objectives and circumstances. In particular, you should read all the relevant documentation pertaining to the product and may wish to seek advice from a financial or other professional adviser or make such independent investigations as you consider necessary or appropriate for such purposes. If you choose not to do so, you should consider carefully whether any product mentioned in this publication is suitable for you. DBS Group does not act as an adviser and assumes no fiduciary responsibility or liability for any consequences, financial or otherwise, arising from any arrangement or entrance into any transaction in reliance on the information contained herein. In order to build your own independent analysis of any transaction and its consequences, you should consult your own independent financial, accounting, tax, legal or other competent professional advisors as you deem appropriate to ensure that any assessment you make is suitable for you in light of your own financial, accounting, tax, and legal constraints and objectives without relying in any way on DBS Group or any position which DBS Group might have expressed in this document or orally to you in the discussion.

Any information relating to past performance, or any future forecast based on past performance or other assumptions, is not necessarily a reliable indicator of future results.

The information contained in this article has been obtained from sources believed to be reliable, but DBS makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose.

If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. The sender therefore does not accept liability for any errors or omissions in the contents of the Information, which may arise as a result of electronic transmission. If verification is required, please request for a hard-copy version.

This publication is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

If you have received this communication by email, please do not distribute or copy this email. If you believe that you have received this e-mail in error, please inform the sender or contact us immediately. DBS Group reserves the right to monitor and record electronic and telephone communications made by or to its personnel for regulatory or operational purposes. The security, accuracy and timeliness of electronic communications cannot be assured.

Please refer to the Additional Terms and Conditions Governing Digital Tokens for DBS Treasures Customers for more specific risk disclosures on trading of digital tokens.

This information does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or enter into any transaction. It does not have regard to your specific investment objectives, financial situation or particular needs. It is not intended to provide, and should not be relied upon for accounting, legal or tax advice.

Cryptocurrency trading is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. Before you decide to purchase an investment product, you should read all the relevant documents and carefully assess if it is suitable for you. Invest only if you understand and can monitor your investmen. Diversify your investments and avoid investing a large portion of your money in a single asset type.

Trading in Cryptocurrencies or the instrument (“Instrument”), such as ETF, referencing or with underlying as Cryptocurrencies ("Crypto-Products”), such as Bitcoin ETFs, is highly risky and prices can be very volatile. All investments come with risks and you can lose your entire investment. By trading in Crypto-Products, you are exposed to the risks of both the Instrument and the Cryptocurrencies. Further, Crypto-Products listed on overseas exchanges may not be regulated in Singapore, and are subject to the laws and regulations of the jurisdiction it is listed in. Before you decide to buy or sell Cryptocurrencies or Crypto-Products, you should read all the relevant documents and carefully assess if it is suitable for you and/or seek advice from a financial adviser regarding its suitability. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single asset type.

To the extent permitted by law, DBS accepts no liability whatsoever for any direct, indirect or consequential losses or damages arising from or in connection with the use or reliance of this email or its contents. If this information has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error-free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses.

Please refer to Terms and Conditions governing your banking relationship with DBS for more specific risk disclosures on the Instrument (such as ETFs under Funds) and Digital Tokens.

This information is provided to you as an “Accredited Investor” (defined under the Securities and Futures Act of Singapore and the Securities and Futures (Classes of Investors) Regulations 2018) for your private use only. It is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation, and may not be passed on or disclosed to any person nor copied or reproduced in any manner.

DBS (Company Registration. No. 196800306E) is an Exempt Financial Adviser as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore (the "MAS")

Related Insights

- USD Rates: Firm data versus position unwind 26 Jul 2024

- CNY rates: Strong demand for short-end CGB 25 Jul 2024

- USD Rates: Steepening still the core trade 25 Jul 2024

Related Insights

- USD Rates: Firm data versus position unwind 26 Jul 2024

- CNY rates: Strong demand for short-end CGB 25 Jul 2024

- USD Rates: Steepening still the core trade 25 Jul 2024