- Trade

- Bank Guarantee/SBLC

- Bank Guarantee

Bank Guarantee / Standby Letter of Credit

Provide assurance and peace of mind to your beneficiaries

- Trade

- Bank Guarantee/SBLC

- Bank Guarantee

Bank Guarantee / Standby Letter of Credit

Provide assurance and peace of mind to your beneficiaries

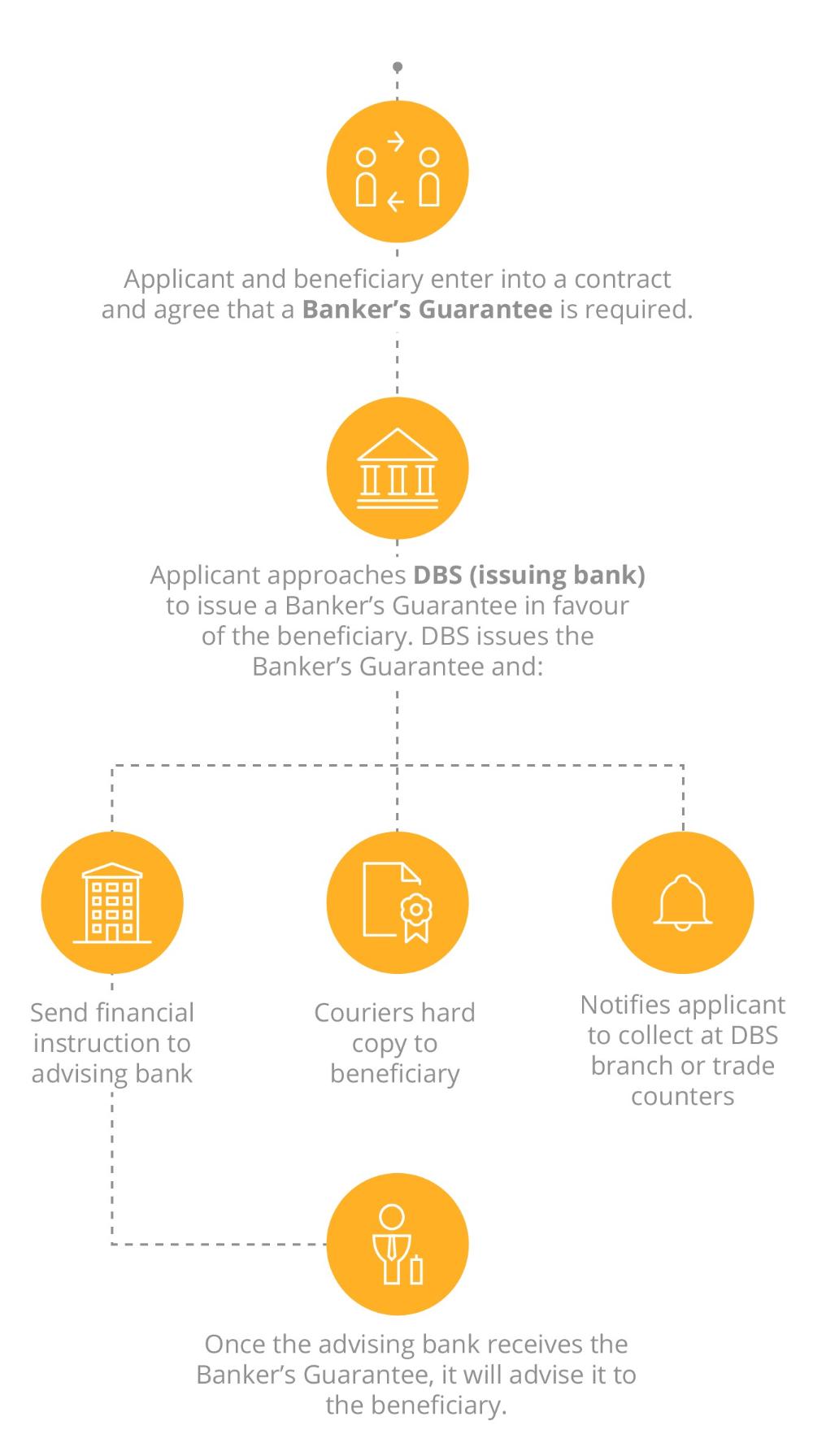

An independent undertaking

Bank Guarantees are independent undertakings which help to mitigate payment risks for the beneficiary

Submit your application through any DBS branch, or DBS IDEAL

Added assurance

We will pay to your beneficiaries upon receipt of a claim that complies with the terms of the guarantee

Easy collection

Pick up your bank guarantee from any of our DBS branches

Uses of Bank Guarantee / Standby Letter of Credit

1. Payment Guarantee - Protects the beneficiary if the applicant fails to honour the payment under their contract.

2. Bid Bond - Enables the applicant (bidder) to use DBS credit to support the bid. Can also be used to assure the successful bidder that the contract will be met.

3. Performance Bond - Some bidding contracts require the successful bidder to provide a performance guarantee to protect against a default.

4. Financial Guarantee - This helps the applicant’s overseas subsidiaries obtain financing or credit facilities from banks.

- The Guarantee can be issued by DBS India or by our overseas branches/correspondents, according to the guarantee format provided by the applicant

- Guarantees issued in favour of beneficiaries must be for a specific amount, expiry date and claim period

- Guarantees should not be assigned to other parties

- Guarantees are subject to Indian law and the jurisdiction of the Indian courts

Schedule a callback via this online form.

Alternatively, you can reach us at 1800 103 6500 / 1800 419 9500

Email: [email protected]

| Where do I find a Bank Guarantee/Standby Letter of Credit format? | |

| The format is usually provided by the issuing bank or the beneficiary of the Bank Guarantee/Standby Letter of Credit. Alternatively, you may get a copy from your Relationship Manager or contact us at [email protected]. |

Simply submit your application form and a copy of the guarantee format at any of our Branches or via IDEAL™. Alternatively, please send us an email at [email protected] and we will be glad to assist you.

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?