- Save

- Invest

- Borrow

- Pay

- More

- NRI Banking

Top 11 Benefits of Savings Account

Explore the many benefits of a Savings Account

TLDR Points

- A Savings Account bears interest on the deposit amount

- It is a safe way to keep your money

- It helps to reach financial goals

- It is the first step towards getting credit from the bank

- It helps to pay instantly for purchases

- It automates bill payments

- It keeps track of income for income tax purposes

Introduction

“Do not save what is left after spending, but spend what is left after saving.” —Warren Buffet

Whether you are saving money to go on that expensive Mediterranean cruise next year or opening a fixed deposit next month, a savings account is a saviour for every individual’s banking needs. Long gone are the days when you needed a bank account just to keep your money safe. Today, a savings bank account is your security guard, accountant, financial safety net, wealth partner, all rolled into one.

If you still don’t have a savings account, read on to know why you should.

Key Benefits of a Savings Account

Listed below are the seven benefits that come with holding a Savings Account and having a debit card:

-

Keeps your money safe

When you open a savings account, your mind is at peace, knowing that your money is in a secure electronic banking system.

-

Gives you a steady interest

The tortoise from the ‘Hare and the Tortoise’ story would be proud of a savings account. Why? Because just like the tortoise, accumulated interest moves ahead slowly and steadily.

-

Inculcates financial discipline

Cash is more easily accessible when kept at home. This leads to many frivolous spending and reduced savings. However, with a savings account, you will use it only for needed expenses. Furthermore, it helps to meet your goals, too. For example, got your eye on a cool 250cc motorbike? You can open a separate fixed deposit account and transfer a part of your savings regularly until you reach your financial goal to make a lumpsum withdrawal to buy the bike.

-

First step towards getting credit

When you have a fair amount of balance every month in your savings account, the bank will find you reliable enough to extend credit to you. You can get a credit card or a loan from your bank if they perceive that your monthly income can cover the credit or EMIs.

-

Enables instant payment services

You can use your debit card to pay for your purchases instantly. You can also link your debit card to an e-wallet or UPI service to make transfers from your account to other personal or business accounts. In short, without a Savings Account, you won’t have a debit card, and without a debit card, you may not have instant payment services.

-

Enables automated bill payments

A pile of bills is yet another indicator of adult life. The tedious process of paying bills every month can be automated using your savings account linked debit card. You can instruct your bank to pay your bills with the money from the account automatically.

-

Helps with your income tax returns

Since all your income gets credited to your Savings Account, it will be easy to calculate your gross annual income. You needn’t spend hours pulling your hair, trying to compile all your revenues. Moreover, you can download your bank account statements for income proof when filing your income tax returns.

-

Earn interest on your savings

Let your savings work for you by earning interest in a savings account. While the interest rates may be modest, it’s better than letting your money sit idle. Every bit of interest adds up, making your savings grow over time and putting your funds to good use.

-

Digital services

Convenient digital banking services are provided by most banks. Using a computer or smartphone, you can pay bills, check balances, transfer money, and more.

-

Safest Investment Option

One of the safest locations to save your money is a savings account. You can feel secure knowing that your deposits are protected up to a specific amount.

-

Minimum Investment Amount

Generally, a modest initial investment is required to create a savings account. Because of this, everyone can use it, regardless of their financial situation.

Open Savings Account in 3 Easy Steps

- Download the digibank by DBS mobile app on your smartphone or visit the DBS Bank website and use your phone to scan the QR code to get the app.

- Fill in the required personal information in the digital Savings Account opening form.

- Upload scanned copies of your ID and address proof, such as your PAN Card or Aadhaar Number, to complete the KYC process.

DBS Bank will contact you to finalize the KYC (Know Your Customer) process. Once done, you can activate your savings account

Open Savings Account

in 3 easy steps

Aadhar Card + PAN Card + Video KYC

= Account opened!

Conclusion

There are several benefits of having a savings account. It doesn’t just bring about financial discipline but also makes everyday transactions easier. It gives you access to credit facilities and helps keep track of your income tax returns. You can hold the account in your name or with a joint holder. The compelling reason to open a joint account is the choice you have. A bank account is now gone beyond conventional safekeeping; with it, you can access so much more.

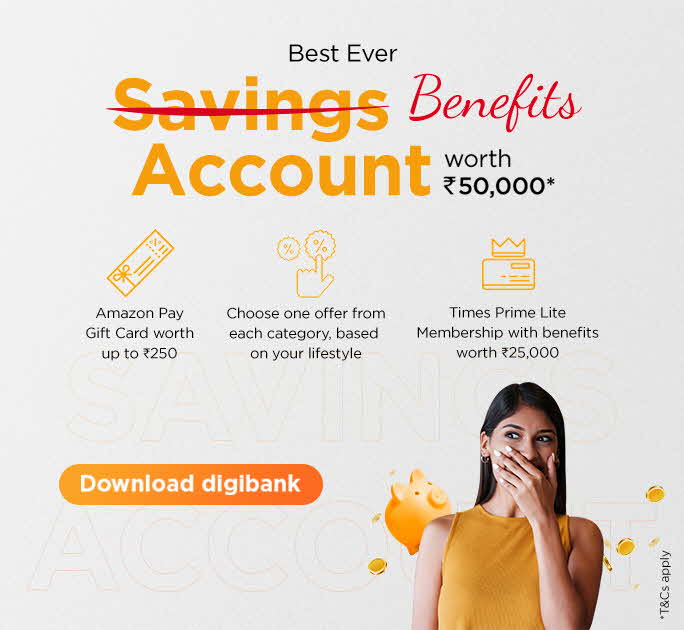

With DBS Bank, you can open a digital savings account and make your life easier and more meaningful right away. Open fixed deposits, recurring deposits, even mutual funds. Are you a shopaholic, you’ll find offers on your debit card too! So why wait? Download DBS Bank app now.

Frequently Asked Questions

-

Can I use my savings account if I travel to another city or state in India?

Yes, you can utilize ATMs, internet banking, and bank branches all around India to access your savings account.

-

When is the interest credited in a savings account?

Usually, interest on savings accounts is credited every three months. The precise date, though, might change based on the specific bank's regulations.

-

Can an NRI open a savings account?

Yes, non-resident Indians (NRIs) are able to open some kinds of savings accounts in India, including NRO accounts (non-resident ordinary). These accounts are governed by foreign exchange laws and have certain limitations.