- Save

- Invest

- Borrow

- Pay

- More

- NRI Banking

- Customer Services

How to do Premature Withdrawal of Fixed Deposit

Learn how to do premature withdrawal of Fixed Deposits and penalties involved

Key Takeaways

- With Fixed Deposits, you must invest funds at a pre-decided interest rate for a fixed tenure.

- Despite the stipulated tenures, banks allow you to withdraw your FD prematurely.

- You typically have to pay penalties for premature withdrawals.

- The interest rate may change if you opt for premature withdrawal.

- You can initiate premature closure of FD online and offline.

Fixed Deposits (FDs) are secure investments that allow you to earn guaranteed returns at fixed interest rates. These attributes make them an appealing investment option to many. However, when you invest money in an FD, it is blocked for a pre-decided tenure. However, if you need funds urgently, you may opt for Premature withdrawal of Fixed Deposits. Learn about the procedure and penalties involved with premature withdrawals of FDs in this article.

Premature Withdrawal of Fixed Deposits

As is apparent from the term ‘premature withdrawal’, you can withdraw your FD before the stipulated tenure ends. This facility comes in handy if you have invested in an FD but require funds during a cash crunch. While banks allow you to withdraw the FD before the deposit term ends, they levy penalties on premature withdrawals.

Penalty for Premature Withdrawal of Fixed Deposit

When you prematurely withdraw the bank FD, banks levy a penalty to compensate for the same. The penalty typically depends on when you withdraw the FD during the stipulated tenure, as per the terms and conditions stated by the bank. Typically, the penalty charges range from 0.5 to 1% of the rate of interest.

Interest Calculation After Premature Withdrawal of FD

Method 1

Say you invested INR 1 lakh for 2 years at an interest rate of 7%. We can also assume that the interest rate applicable for 1 year is 6.5%. After completing 1 year, you prematurely withdraw from the FD, earning interest at 7%. However, the bank will recalculate the interest at revised FD rates, which is 6.5% - 1% = 5.5% which is the new interest rate.

Method 2

Suppose you invest in an FD of Rs 1 lakh for 2 years and at an interest rate of 6%. Now, assume that the rate of interest for 1 year is 7% at the time of booking. The penalty levied in case of premature withdrawal is 1% of the effective rate of interest, which is the lower of the rates. If you withdraw after the completion of 1 year, you have earned interest at 6%. However, the bank will calculate interest on the effective rate of 6% - 1% = 5%, which is the new interest rate.

How to Do Premature Withdrawal of Fixed Deposit?

You can initiate premature closure of FD either online or offline. You can visit the bank branch for premature offline closures and submit the required form, documents, and FD receipt. You can also close the FD online via your internet banking account. The bank calculates the amount payable after levying the penalty and deposits the funds back into your source bank account within a few hours to one working day.

Alternatives to Premature Withdrawal of Fixed Deposit

While unexpected events can arise, consider these alternatives before prematurely withdrawing from your Fixed Deposit (FD):

- Loan against FD: Take advantage of a loan secured by your current FD. This keeps your interest profits growing and permits you to access funds without violating the terms of the deposit.

- Partial Withdrawal: You may be able to take out part of your FD from certain banks. This might let you maintain a portion of your deposit while taking care of urgent necessities.

Keep in mind that there can be extra costs or fees associated with these selections.

Choosing the Right FD

When choosing the ideal Fixed Deposit (FD), you must consider the following things:

- Tenure: Select a term that corresponds with your financial objectives. While lengthier tenures may result in higher interest rates, shorter tenures provide greater flexibility.

- Interest Rate: Examine the various banks' interest rates and select the one that provides the best deal for the length of time for which you want to take a loan.

- Interest Payout Frequency: Depending on your financial situation, choose from monthly, quarterly, or cumulative interest payout options.

- Early Withdrawal Penalty: If you think you'll need access to your money before it matures, be aware of the early withdrawal penalty.

You can select an FD that best suits your interests and optimizes your returns by carefully weighing these variables.

Final Note

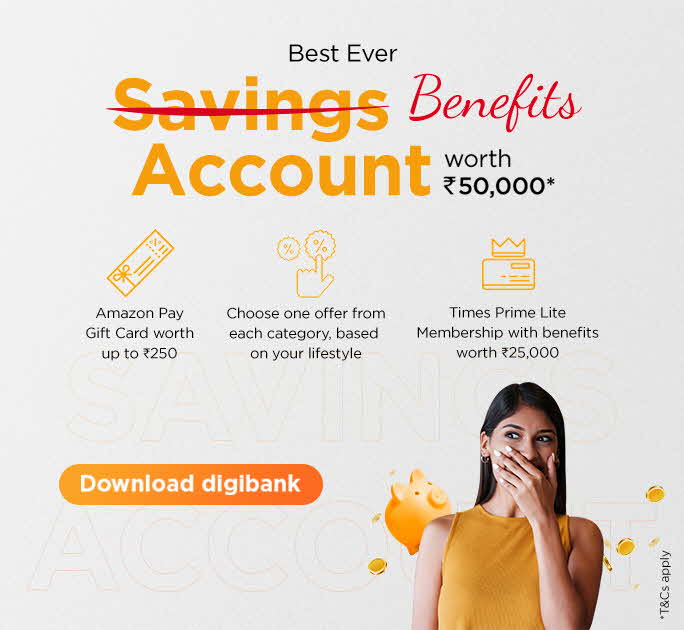

At DBS Bank, you can open a Fixed Deposit within minutes and earn attractive interest rates. Book your FD online from the comfort of your home and withdraw it prematurely if needed through the digibank mobile app and internet banking platforms.

If you prefer to save time and effort, and open an FD account remotely, then download DBS Bank app right away!

Frequently Asked Questions (FAQs)

-

What are the disadvantages of premature withdrawal of a fixed deposit?

A fixed deposit usually carries a penalty for early withdrawal, which lowers your total interest returns. It may also interfere with your long-term investing and financial planning objectives.

-

How to avoid premature withdrawal of fixed deposit?

Plan your finances properly and save money for emergencies to prevent making early withdrawals. If needed, think about other choices such as making partial withdrawals or taking loans against your FD.

-

What are the new RBI guidelines for premature withdrawal of Fixed Deposits?

The RBI declared in 2023 that premature withdrawal would be allowed for accounts upto Rs.1 crore, with the threshold previously being Rs.15 lakhs.

*Disclaimer: This article is for information purposes only. We recommend you get in touch with your income tax advisor or CA for expert advice.