- Save

- Invest

- Borrow

- Pay

- More

- NRI Banking

- Customer Services

Earnest Money Meaning

Understanding Earnest Money Deposit meaning and significance.

Key Takeaways

- Earnest Money Deposit or EMD is a type of deposit paid by home buyers to sellers.

- Buyers pay EMD to sellers of properties and other government and private projects.

- It is usually a token amount paid to the seller, indicating your interest in buying property.

- Indian Banks offer loans for EMD amounts to enable you to apply for Government-backed housing projects.

- EMD is fully refundable if the bidder or buyer does not win the bid against the property.

When it comes to high-ticket investments like buying a home or securing high-value government or private projects, you typically need lump-sum amounts. You may also find other buyers interested in the same assets, and the seller may receive multiple offers. However, you can convince sellers and assure them of your buying intentions by offering a small deposit, also known as Earnest Money Deposit. Find Earnest Money Deposit meaning and significance in this article.

What is the Meaning of Earnest Money?

Earnest Money, also known as Earnest Money Deposit or EMD, is a form of deposit that buyers pay sellers in good faith as an assurance of interest in purchasing high-ticket items or while making significantly large transactions. The deposit gives buyers the time required to sort out their finances, evaluate the investment, and conduct inspections, before closing a deal. In the context of the Indian real estate market, an earnest deposit is commonly referred to as a 'token amount'. Once the seller accepts your offer, you get a certain number of days to make the deposit.

EMD is not limited to real estate investments alone. Government and private projects also allow Earnest Deposit, wherein sellers must go through a bidding war and pay the EMD to the respective companies. Here, EMD is also known as Bid Bond, Bid Security or Tender Security.

What are the Earnest Money Deposit Schemes in India?

Government housing agencies sell residential plots and built-up houses in India. Let us say they are in the process of selling a flat. For one flat, there will be multiple buyers. However, to be considered a buyer for that flat, all applicants must pay an Earnest Deposit. The applicant who wins the bid gets to buy the flat. The remaining applicants get their deposit back. To provide individuals with a chance to bid for the flat, some banks in India issue loans for the Earnest Deposit amount. For instance, if the EMD to bid for a flat is INR 10 Lakh, the bank will lend you 100% of the amount with nominal interest rates. Here are some features of taking an EMD Loan:

- 100% loan amount disbursement

- Lower interest rates and processing fees

- Minimum to no pre-payment penalties

- Repayment tenures up to a year

What is the Eligibility & Documentation Required for Earnest Deposit Scheme Loans?

- Eligibility: You should be a Resident Indian, at least 21 years old and must fulfil all other Urban Development Authorities (UDA) eligibility criteria.

- Documents: You should provide your ID and address proof, PAN Card, income proof documents like salary slips, bank statements, Income Tax Returns, balance sheets, business licenses, TDS certificate, and other documents required by the lending bank.

Final Note

Now that you know earnest money deposit meaning, you can consider this facility while making high-value transactions. An EMD paves the path for you to make high-value investments and buys you the time you need to complete the transaction. You can consult your bank for terms and conditions associated with EMD loans.

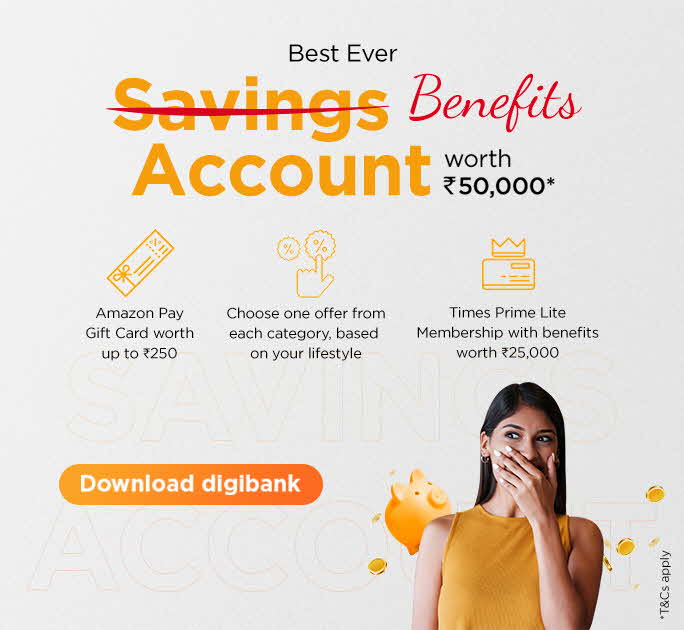

Download the digibank by DBS app to get started and open your savings account with us.

*Disclaimer: This article is for information purposes only. We recommend you get in touch with your income tax advisor or CA for expert advice.