breaking-new-ground

Breaking New GroundThe Accidental Banker: The unplanned journey into the world of banking

4 Aug 2023

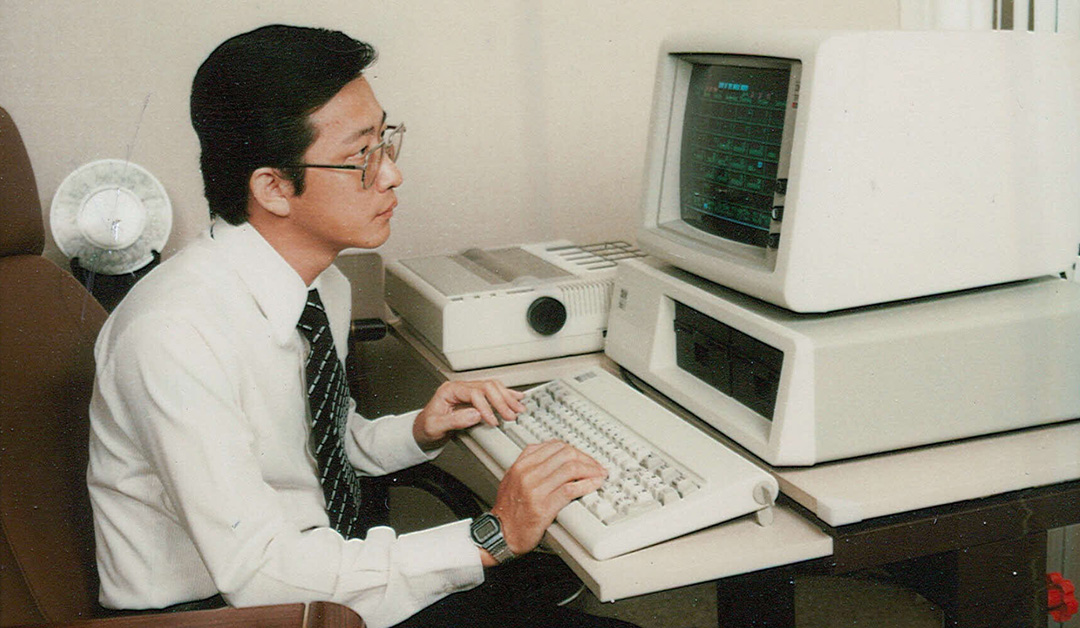

This is me during a pilot project in 1984 to test whether the electronic office concept could be applied to the bank. Photo: DBS

Soh Kim Soon worked at DBS from 1971 to 2000. His last-held position was Senior Managing Director - Logistics. During his tenure at the bank, he was instrumental in building and managing some of the bank’s largest businesses and has helped guide the technology revolution.

I joined DBS, then known as The Development Bank of Singapore Ltd, on 6 April 1971. I had just completed three years of full-time national service in the Singapore Armed Forces (SAF). I had been mulling over my career options.

I applied to a few organisations including DBS. The latter was the first to revert with a job offer and I accepted. I found DBS interesting for several reasons. It was a new organisation. As such growth and career prospects should be better. It has a pivotal role in Singapore’s economic transformation. It provided long term loans and equity to industry. It was a development financing institution and was evaluating projects using methodologies along the lines of those used at the Asian Development Bank (ADB) and the World Bank.

I had graduated with 2nd upper honours in History and Geography. I had no knowledge of finance. Needless to say, I found the job description quite daunting. But my interviewers assured me that the bank was not into rocket science, and I can quite easily learn on the job from the older officers who had joined earlier. In the early days of the Bank, there was no formal training programme. We have to learn on the job.

I was offered the role of a Project Analyst and my job was to evaluate projects and make recommendations on financing and equity participation. In its early years, DBS was doing a lot of private equity investment before the term “private equity” became a popular term in Singapore. DBS invested in a great variety of projects ranging from financial services to shipyards, electronics, hotels, elevators and steel mill and other industrials.

On joining the bank, I was left alone for around three weeks to read up on old cases and to interact with the older officers. That was the only training I had. After about three weeks, my honeymoon ended when another officer who had joined about six months earlier threw in the towel. I was asked to take over his portfolio.

On taking over the portfolio, I faced an urgent application for financing and equity participation. The applicant was an Australian company wishing to do waste disposal in Singapore using dumpster trucks. I had to drag a more senior officer along to hold my hand when I had my first meeting. It was my first major project and I had to present the proposal to the bank finance committee which was chaired by the Chairman. Although initially nervous, the session with the committee was a happy one as the late Mr Howe Yoon Chong was very supportive.

After about one year with the Bank, I was assigned to the shipping division to work for Mr Ang Kong Hua who was the manager in charge. In the early years of Singapore’s industrialisation, shipbuilding and ship repairing were identified as a priority sector. The British had left behind their naval bases which the government converted into commercial shipyards. Hence Keppel and Sembawang Shipyard were established. At the same time, Neptune Orient Lines (NOL) was also started as a national shipping line. At the same time Japanese shipbuilders such as Ishikawa Harima Heavy Industry (IHI), Mitsubishi Heavy Industry and Hitachi were invited to start shipyards for repair and shipbuilding in Singapore.

In 1972, I went with my boss Mr Ang Kong Hua to study ship financing in countries known for their expertise in this area. We visited ship financing banks in Japan, London and Germany. Our assignment was to put up a proposal to Ministry of Finance to have a ship financing scheme to support the export credit of ships to be built in Singapore yards. This was done after our trip and for many years the scheme was administered by DBS on behalf of the government. Through this early start DBS built up its expertise in ship financing and enjoyed a very successful run-in ship financing for many years. DBS continues to be a dominant player in this sector till this day.

From left to right: Mr Chong Kie Cheong, myself, former DBS Chairman the late Mr Ngiam Tong Dow and then Prime Minister Mr Goh Chok Tong during the Shanghai branch opening in 1996. Photo: DBS

I spent the first 10 years of my career in project financing and equity investment under what is now known as corporate banking. The bank’s corporate banking group was organised into four different divisions focusing on different industries. In the late 70s the corporate banking group was headed by two vice presidents, myself and the late Mr Tan Keng Boon.

Eventually I became the overall head covering all the divisions in 1979 when my co-head left. With this development I also took charge of the petroleum and petrochemical sector. As soon as I took charge of this portfolio, a much discussed on and off petrochemical project with Sumitomo Chemical suddenly became alive again. With the destruction of Mitsui’s petrochemical plant in Iran during the Iran-Iraq war the prospects of a petrochemical plant in Singapore begin to look bright again.

The petrochemical project was a huge undertaking and was a project much sought after by the Economic Development Board (EDB). It encompasses a naphtha cracker at the centre with several downstream projects. It was a Japan-Singapore project. On the Japanese side, Sumitomo Chemical led a consortium of Japanese companies and on the Singapore side Temasek as well as DBS took up stakes in both the central cracker and downstream projects. On the Singapore side the negotiating team comprised of myself, Dr Chua Yong Hai from Temasek and Lee Yock Suan from EDB. DBS was also a financier for the project. Working with JP Morgan and Bank of Tokyo, a syndicated facility was arranged for the project.

The project had a slow start in the early years but subsequently proved to be quite profitable. Temasek and DBS sold off their stakes to Shell eventually.

In 1982, I was asked to take on a completely different assignment which took me out of banking. I was promoted in that year to Senior Vice President (SVP). The bank came out with a new organisation chart. Information Technology, which used to be a small unit under the finance division was upgraded to a new division on its own and the bank called it “Data Resources” to reflect the importance of information as a resource. Although a reluctant candidate I was asked to head the division to spearhead the bank’s drive in the strategic use of Information Technology.

It was an appointment that I did not expect nor looked forward to as I have no experience in IT. In asking me to take on this job, then President Mr Patrick Yeoh explained that the bank had recognised the critical role of IT and intended to invest big money into this area. The bank needed someone senior who is business-driven to lead the division and the bank chose me. I indicated my willingness to take on the challenge for two years but expressed the wish to move back to banking after that. I did not realise then that this portfolio was to stay with me for the next 18 years. Although I subsequently returned to head other banking and business portfolios in the bank, the IT portfolio always stayed under my purview. When I retired from the bank in 2000, Ops and Technology was still under my portfolio.

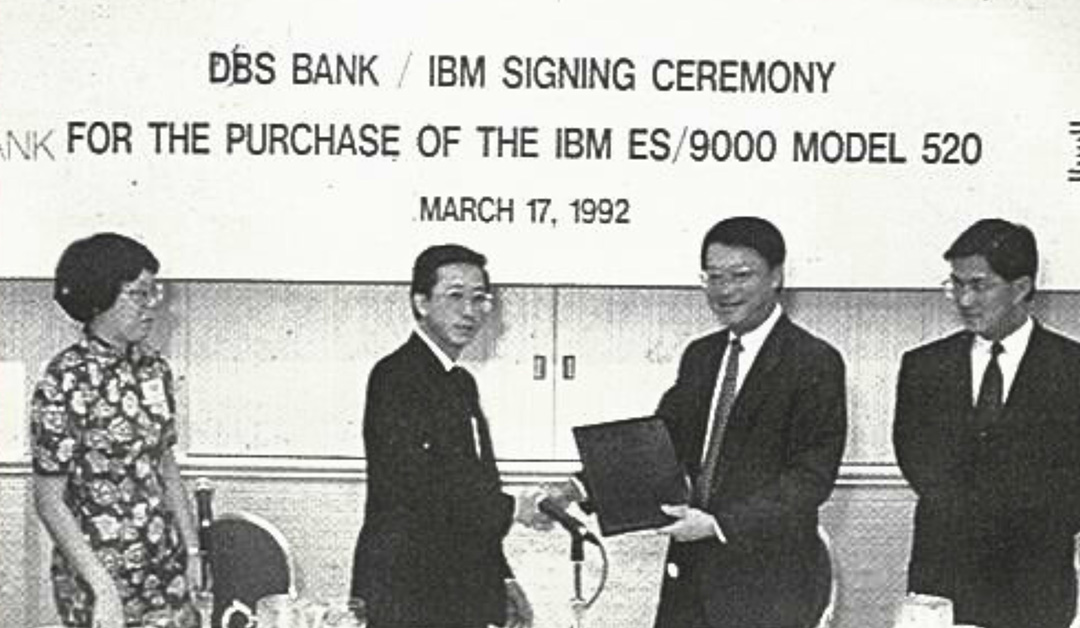

Taken in 1992, when the bank invested $14.5 million in computer power. Standing from left to right: Yee Jee Hong, myself and the two directors from IBM, Philip Ng and Lawrence Wee. Photo: DBS

Taking charge of IT was a very satisfying experience for me during my career in the bank. I quickly grasped the strategic role of IT and how to manage it as a strategic resource. I also understood quickly why they needed someone who is business-driven. I was supported fully by top management and had a first-class team working for me as DBS only hired the best. I developed a good relationship with the National Computer Board which was in its early days and very zealous about its mission. Their mission was to lead Singapore into the computer age. They had very bright scholars working for them and were more than happy to share their knowledge on cutting edge technology with industry.

Prior to 1982, DBS IT was in its infancy as the bank was largely a long-term financing institution and was not really a full-service commercial bank like UOB, OCBC or OUB. As such, it was an opportunity to build an IT platform from scratch without any constraint of legacy systems. The bank could have taken the easy way out by implementing what the other banks have installed. Instead, we choose to go on a completely different platform from the other local banks. We looked at what banks were doing worldwide. In particular, the bank was looking for technology and vendors that could support growth.

My task was also made easier as the bank was willing to invest heavily in technology. I had no problem getting approvals for my IT budgets. We looked towards the international stage to see what banks elsewhere were doing and selected systems relevant to Singapore. At times we had to persuade vendors to come to Singapore as we are a small market and did not have their priority.

For many years, the bank was at the forefront in the use of technology and was known for innovative solutions like autosave, pioneering IPO application through ATMs which in turn led to many applications through the ATMS such as rights issues, and COE application. The bank’s innovative and strategic use of technology was recognised when the National Computer Board launched the National IT awards in 1992 to recognise organisations that made strategic use of technology. In the inaugural award in 1992, DBS won in the private sector category. DBS’ achievement was documented into a case study for the School of Accountancy and Business at NTU.

DBS’ success was due to its culture of willingness to take calculated risks when it comes to use of technology as well as getting business users to lead IT projects. It was willing to try new technology and the process was user-driven rather than technology-driven. Many systems were developed inhouse and even when the bank bought packages, the philosophy was to negotiate for the source codes so that the bank could do its own customisation and enhancements.

During the 1990s DBS even sold software systems to other banks abroad. DBS provided IT services to banks in China, Thailand, Vietnam and Mauritius. These services were provided through DBS Computer Services Pte Ltd, which was chaired by me.

All in all, I spent close to 30 years in DBS from 1971 to 2000. I was an accidental banker because when I joined the Development Bank of Singapore in 1971, it was a long-term development financial institution, not a bank. However, in 1971, when the Singapore government decided to promote Singapore as a financial centre, foreign banks were encouraged to come into Singapore. With this development, the government decided to allow DBS to convert into a full-fledged commercial bank.

In the first 20 years of its development, the bank was moulded very much by its then Chairman and President, the late Mr Howe Yoon Chong. Not only did the bank succeed financially, it was also a place where people wanted to work. Turnover at DBS was very low, even though the bank was not that competitive in pay. The bank had very high standards of ethics and corporate governance. This was something that customers and those who dealt with the Bank appreciated. The culture and working environment were something staff treasured tremendously. The bank had a very transparent system and even junior officers were encouraged to voice their opinion. The bank treated its staff, customers, business partners and competitors honourably and fairly. That was the DBS culture and value system put in place by Mr Howe. It was the DBS way.

Being purpose-driven is part of our DNA. From our inception as the Development Bank of Singapore, DBS has believed in the importance of purpose-driven transformations. Building on this illustrious heritage, DBS has continued to pioneer ground-breaking innovations over the years, culminating in the bank being studied as a model for digital transformation, with Harvard Business School (HBS) being the latest academic institution to capture the bank’s digital transformation journey in a case study in 2022.