spreading-our-wings

Spreading our wingsConcerted transformation: How DBS synced its strengths to become a regional Treasury & Markets powerhouse

By DBS and The Nutgraf, 7 Feb 2025

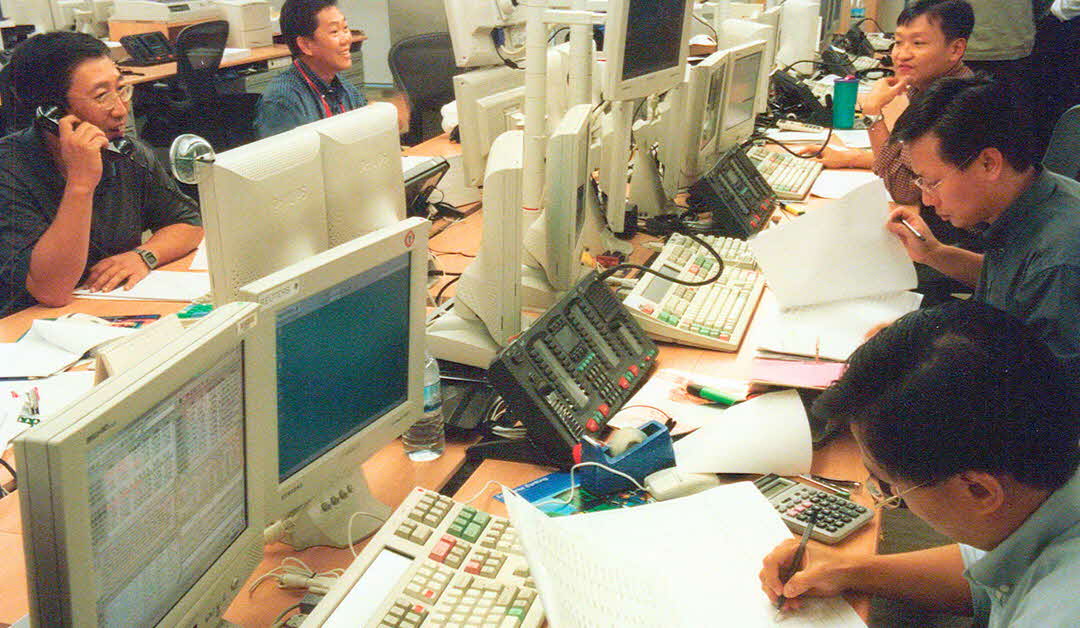

Mr Frank Wong (4th from the left) with the Treasury and Markets team in 2000. Photo: DBS

The articles in this series are presented jointly by DBS and content agency The Nutgraf. The Nutgraf team interviewed alumni and employees to uncover these lesser-known stories about the bank, and its key contributions to Singapore.

Taking a deep breath, Mr Frank Wong strode into a DBS conference room and beamed at the expectant faces of the bank staff there. They were waiting anxiously to hear the low-down on his mind-boggling USD 100 million plan to transform the bank’s small treasury and markets (TM) unit into a billion-dollar regional powerhouse within five years.

He was more than prepared to answer any of their questions. After all, this was only the 17th time that Mr Wong, who joined DBS as TM managing director in 1998 had conducted the same presentation to different teams across the bank.

“I did all the presentations personally, because I felt so fervent about the need to convince the staff that we are creating a very different business. We needed everyone on board together,” he recalled.

And rightly so. The plan was an ambitious one: transform DBS into the go-to Asian bank for treasury and markets activities across the region.

Spotting opportunity amid crisis

The 1997-1998 Asian Financial Crisis dealt a massive body blow to the region, which resulted in an economic winter for many of Asia’s largest economies.

The region’s currency crisis also sent many Asian and foreign financial institutions running for cover from a spike in credit and currency risks, with some scaling back regional expansion plans and deals to limit exposures.

This gave DBS a unique opportunity to step in. Having a top-class TM unit, which would fill a critical gap in Asia for treasury and markets solutions, particularly those denominated in Asian currencies, was critical to helping it become a top regional financial institution.

Drawing on its inherent strengths like a strong capital base, robust risk management and good corporate governance, it was raring to catapult its TM unit into the ranks of Asia’s most important and competitive players.

Even during the crisis, DBS had a solid capital adequacy ratio of 15.6% in 1998. That made it “one of the strongest Asian financial institutions”, its 1998 annual report pointed out.

What DBS needed to channel its ambition into action was talent.

The chief executive officer (CEO) then, Mr John Olds – recruited by the late senior minister Lee Kuan Yew himself in 1998 – was tasked with carrying out the top leadership’s vision of becoming “a regional bank with global reach”.

Mr Olds was formerly one of the senior managing directors of J.P. Morgan, a global bank active in Asia’s capital markets. He wasted no time in working with DBS chairman S Dhanabalan and the bank’s chief operating officer Ng Kee Choe to restructure DBS and bring in world-class talent.

Within a year, the C-suite had hired 24 veteran bankers across different roles.

One of them was Mr Wong, who had worked at J.P. Morgan as well as other global banks like Citibank and NatWest Markets.

He quickly recognised that DBS’ team, who was already experienced in managing credit risks from “running a tight commercial banking and retail banking business”, had strong potential to unlock regional growth, starting with treasury and markets.

This got him thinking, “How could we capitalise on DBS’ strengths to make it a vibrant regional bank that all customers across Asia want to do business with?”

Enter the TM transformation

The answer lay in identifying “a unique positioning” for DBS.

In those days, DBS was the undisputed leader in Singapore-dollar treasury products. What’s more, its November 1998 acquisition of POSB turned it into Southeast Asia’s largest bank with assets totalling SGD 99 billion, while entrenching its dominance in local money markets and the Singapore dollar bond market.

But to become a highly relevant player for Asian markets, DBS needed a full-fledged TM business for Asian currencies.

“We needed to build a reputation as the best, most seasoned, most experienced risk solutions providers for Asia’s financial markets and for Asian currencies,” said Mr Wong.

Foreign banks were dominant in offering Asian customers financial market solutions denominated in key currencies such as the USD and EUR. But offering products denominated in Asian currencies was a different ball game.

Foreign banks were conservative about country risks in Asia, especially after the financial crisis. So they shied away from investing in the infrastructure to understand these risks, leaving the field wide open for DBS to occupy this niche.

To become the region’s go-to risk intermediary for financial products in Asian currencies, DBS needed to rapidly develop the capabilities to price, warehouse and distribute risks.

“That meant investing in the people, products, innovation, risk management systems, legal and back-office support, and an entire infrastructure to support the growth of this regional role,” explained Mr Wong. “This way, foreign banks would not be able to compete against our full-scale offerings and our deep understanding of Asian currency risks.”

Leading the Asian growth curve

With the green light from Mr Olds, Mr Wong worked with a team of DBS staffers and McKinsey consultants to craft a USD 100 million investment case for creating a regional TM franchise that would ride on the region’s rapid post-crisis recovery.

This strategy synced with the DBS board’s vision of positioning the bank for an Asian 21st century. The leadership had already expressed its “overriding confidence in the region” in the 1998 annual report: “We are confident that DBS, and the region, will grow at high levels once the recession ends.”

“Indeed, fast-growing Asian economies led by China, whose GDP would surge from about USD 1 trillion in 1999 to almost USD 18 trillion today, would feed huge intra-regional trade and investment flows over the next two decades – and counting,” observed Mr Wong.

Facilitating these flows and helping customers tap the region’s meteoric macroeconomic trends would earn the TM unit USD 500 million in revenue in two years and a billion dollars within five years, Mr Wong told the board of directors. The board backed his vision – even with the risks involved.

Years later, during a chance meeting with other banks’ top executives in an airport lounge, he was asked: “How did DBS’ treasury and markets team become so successful?”

While he was not about to reveal TM team’s secret sauce, he offered a key tip, “It starts from the board.”

He explained, “To implement dynamic plans similar to what we conceived, the board must endorse it, with a strong understanding of calculated risks. That makes DBS uniquely strong.”

Synchronising mindsets

The next task was to get all hands on deck – from the revamped and enlarged TM team, to the staff across the front office, mid-office and back-end functions who needed the right mindset as well as technical and specialised skills to support TM’s increasingly sophisticated operations.

TM’s team would grow from 80 to 230 people within three years. This included about 20 new key managers with international banking experience hired in 2000.

Employees working in the dealing room in 2000. Photo: DBS

One way that the expanded team built camaraderie was by mingling in a café that was specially built next to TM’s new dealing room. “The staff were working long hours and preferred to stay in the dealing room. So instead of going out to get coffee, they would come to this café, have drinks and snacks, talk about issues, and develop friendships and team spirit,” recalled Mr Wong.

One new joiner was Mr Andrew Ng, who came in as Vice-President and later rose to become Managing Director and Group Head of TM in 2008.

His mandate was to build up DBS’ trading capabilities in Asian currencies, starting with forex rates and derivatives. As a banking veteran who cut his teeth at several major foreign institutions, Mr Ng was keen to share his experience and fresh perspectives with his team mates – but first, he chose to sit quietly in a corner of the TM office.

“I sat in the very back row – to observe and show that I’m part of the team. I focused first on building trust – that I’m coming here to help, not to substitute anyone,” he recalled.

Over time, he would steer the TM unit towards diversifying its revenue base away from trading activities and into higher-margin customer sales.

“Today, sales contribute about 60% of income and the rest is from trading. This mix has changed dramatically over the years – which is exactly what I had set out to do. To build a strong TM franchise, we needed to do more sales which can feed the growth of the trading business,” explained Mr Ng.

That required a mindset shift for other segments of the bank. “At that time, the consumer and corporate banking units were focused on doing loans, rather than cross-selling treasury and markets products. Their risk appetite and understanding of risk management also had to adjust.”

The impetus for growing TM’s sales business deepened when the 2008 Global Financial Crisis hit. Banks started to deleverage from structured products and trading margins were compressed.

Mr Piyush Gupta, who joined DBS as CEO in 2009, accelerated the bank’s shift to boost fee income by cross-selling TM’s products to customers across the board, from corporate to consumer and private banking clients.

“Piyush understands cross-sell and collaboration. He also helped drive culture change as well as a digital mindset to scale the business with technology – all this helped me a lot to change mindsets,” recalled Mr Ng.

The push for innovation and efficiency

Technology would become a hallmark of TM’s transformation as well.

In 2000, DBS invested USD 100 million in IT, including talent and top-notch infrastructure such as a trading system which allows straight-through processing.

This paved the way for uniform system and accounting standards as the TM franchise expanded across Asia. That in turn enabled the TM team to develop its proprietary models, so it could go head-to-head with foreign players to price better and more sophisticated products.

An even bigger game-changer came in 2009. As trading margins shrank after the Global Financial Crisis, DBS scaled up its cross-selling activities to boost fee income.

Mr Andrew Ng at an event in 2019. Photo: DBS

“We needed to automate our infrastructure to scale up its distribution to relationship managers across consumer, corporate and private banking, as well as to external customers,” said Mr Ng.

When DBS embarked on its digital transformation in 2014, TM’s digitalisation journey hit the fast lane as well.

A key milestone was Digimarkets, DBS’ in-house system. It was launched in 2017 to price and book trades at lightning speeds and vast volumes.

“It used to take, say, 10 minutes to do a deal. But with Digimarkets, we could have hundreds of people using this digital distribution platform simultaneously to complete deals in a minute,” said Mr Ng. “That really saves a lot of resources and manpower. It ensures that pricing on FX, interest rates and derivatives are faster, allowing us to scale volume.”

Not surprisingly, volumes surged. DBS’ FX volume spiked from SGD 400 billion in 2017 to SGD 1.19 trillion in 2022 while equity derivative volumes expanded by around six times.

With an influx of new talent trained in quantitative analysis, the TM unit was able to create algorithms to manage transactions and square positions more efficiently.

The results were impressive: despite shrinking margins on FX trades, DBS was able to make a USD 24 fee on USD 1 million of transactions in 2022, compared to just USD 13 in 2018 without algorithms.

What’s more, automation improved work-life balance. DBS staff used to have to work until 10pm or even later to complete manual processes, recalled Mr Ng. “With digitalised workflows, they could leave the office at 6pm.”

Bringing seamless service to the next level

TM merged with DBS’ equity capital markets unit, brokerage firm DBS Vickers, and the DBS Digital Exchange (DDEX) to form the Global Financial Markets (GFM) group in early 2024.

Putting all these functions under one TM umbrella allows the bank to serve clients’ needs even better by providing customised solutions and market liquidity, said Mr Ng.

“From our clients’ perspective, this integration offers a much better experience and a full suite of solutions.”

Looking back at TM’s track record, Mr Ng points to the unit’s robust income growth, which rose to SGD 725 million in 2023.

He added, “We have had turnover rates of about 12% in the past decade or more, much lower than market levels. Our headcount has stayed at about 700, but our productivity and Return on Average Equity have increased.”

One point of pride for Mr Wong is seeing how far the entire bank has come in pulling together to build TM into a regional franchise.

“DBS has always worked as one team to create a name that will be remembered and respected – not just in Asia, but in the world,” he said.

As part of DBS’ Global Financial Markets (GFM) group today, TM has built on its dominance in the Singapore dollar market across multiple asset classes to become a regional leader in market making, product structuring, distribution, and fixed income origination. Our expertise and digital capabilities have won us various global and regional awards – we were named World’s Most Innovative Bank for FX by Global Finance in 2023 and Asia’s Investment Bank of the Year by The Banker in 2024.