AI in banking: Transforming the way we work with AI

5 Nov 2024

DBS’ strategic focus on becoming an AI-fuelled bank is powered by our robust data and AI foundation and our new agile way of working. This has helped deploy AI at scale and speed, while setting new benchmarks for the industry.

As we move into the next lap with data and AI, we remain committed to bringing our employees along on this exciting journey.

Contents

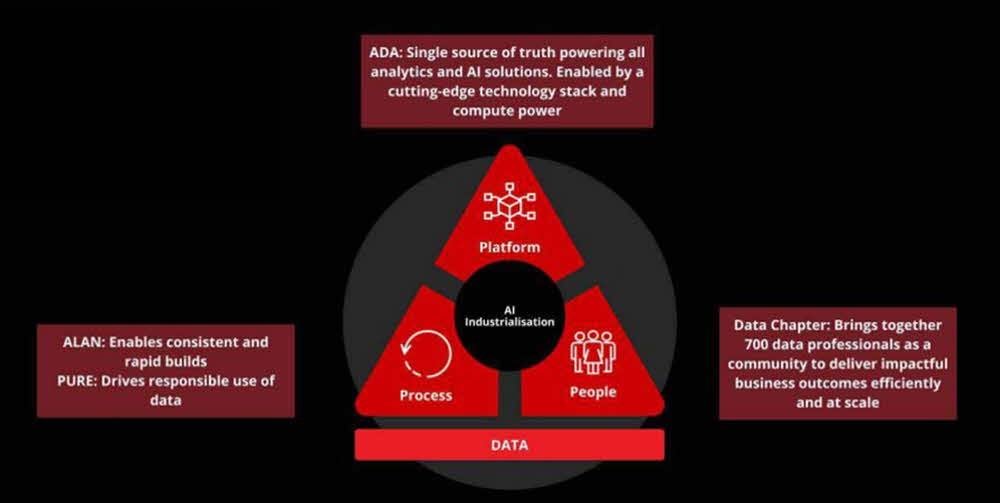

Establishing a robust data and AI foundation

In 2018, we recognised that AI industrialisation would be a defining competitive advantage and kicked off an aggressive transformation.

The outcomes:

- Over 350 AI use cases

- Over 800 AI models delivered

- Reduced time-to-value from AI/ML from 18 months to 2 to 3 months

- SGD 370 million economic value from AI in 2023, SGD 1 billion economic value projected in 2025

AI in finance and banking: Accelerating with agility at scale

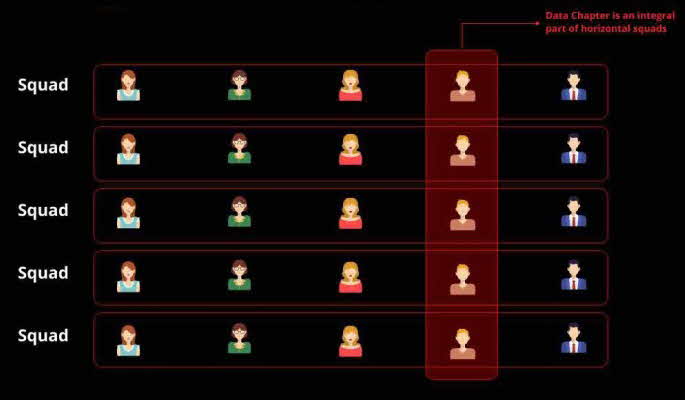

Our agility at scale approach is called Managing through Journeys (MtJs). A new way of working where horizontal squads regularly apply AI/ML to make better business decisions.

Data Chapter members are embedded in each squad to drive data-driven experimentation and use of AI/ML models.

1. In the past, employees were organised vertically by functions.

2. Now, employees work in horizontal squads to deliver a differentiated end-to-end customer experience. Data Chapter members are embedded within squads to accelerate AI and Gen AI deployment.

The outcomes:

- Over 60 MtJs in the bank

- 44% income growth in SME business

- 46% income growth in Treasures business

- 118% increase in consumer finance loan volumes in Indonesia, China and India

Executing our strategy: Gen AI applications in banking and beyond

Our robust data and AI foundation, coupled with our MtJs approach, has enabled us to rapidly identify and deploy Gen AI use cases. This has unlocked new opportunities to better empower our employees and serve our customers.

- Over 240 Gen AI ideas generated internally in 2023

- Over 20 Gen AI use cases under implementation

- An estimated 90% of employees have access to Gen AI tools at work

- 20% reduction in Customer Service Officers’ call handling time with Gen AI-enabled CSO Assistant

Learn more about our AI journey thus far, and our approach to leveraging AI in this study by Harvard Business School.

Banks using AI: Enabling a future ready workforce

The success of our data and AI journey is a result of our consistent efforts to empower DBS employees with the skills and tools they need to succeed in this rapidly evolving field. This includes platforms and learning resources that can help them enhance their efficiency and creativity – so that they may focus on higher-value work.

Educate

We educate employees through various e-learning modules, expert-led webinars, and even role-specific training for business analysts, product owners, and others. For example, everyone in the bank has access to our Gen AI training curriculum.

Excite

Through exciting events, roadshows, interactive workshops and other engagement activities, we hope to inspire employees and pique their interests around this field.

Empower

We further encourage and empower employees by providing them the right resources and tools to explore new technology, with the guidance needed. The bank offers over 700 courses tailored to data professionals, with over 5,000 employees receiving bespoke training in 2024.

Learn more about how DBS continues to innovate with AI and more emerging technologies at the Singapore Fintech Festival 2024 at the Singapore Expo (Hall 2, booth 2B23) from 6 to 8 Nov 2024.