Scam or Not - A Checklist of 7 Important Questions to Ask

Scams come in all shapes and sizes, and they’re not always easy to identify – especially since they are designed to prey on unsuspecting individuals through cleverly disguised schemes. They often come in the form of convincing stories, create fake advertisements, SMSes, websites and/ or emails that look legitimate, and exploit psychological triggers to manipulate emotions and bait victims into making rash decisions. As such, staying one step ahead of scammers has become more crucial than ever.

Equip yourself with the knowledge needed to safely navigate cyberspace in this day and age. In this guide, we have compiled a few useful checklists to help you identify and safeguard yourself against common scams in Singapore.

Common scams in Singapore: A general checklist

Did you receive an email, WhatsApp/ SMS or any other form of communication and suspect it may be a scam? Check it against this list to determine how likely it is to be legitimate.

Disclaimer: These scam checklists are meant as a guide only. The best way to determine whether a communication is part of a scam is to verify it directly with the supposed source. For example, if you have received a message that is seemingly from the bank, call up the bank to verify the authenticity of the message.

1. Is the sender requesting for personal and/ or sensitive information?

DBS and legitimate authorities will never request for sensitive personal information, such as your banking credentials or Singpass details.

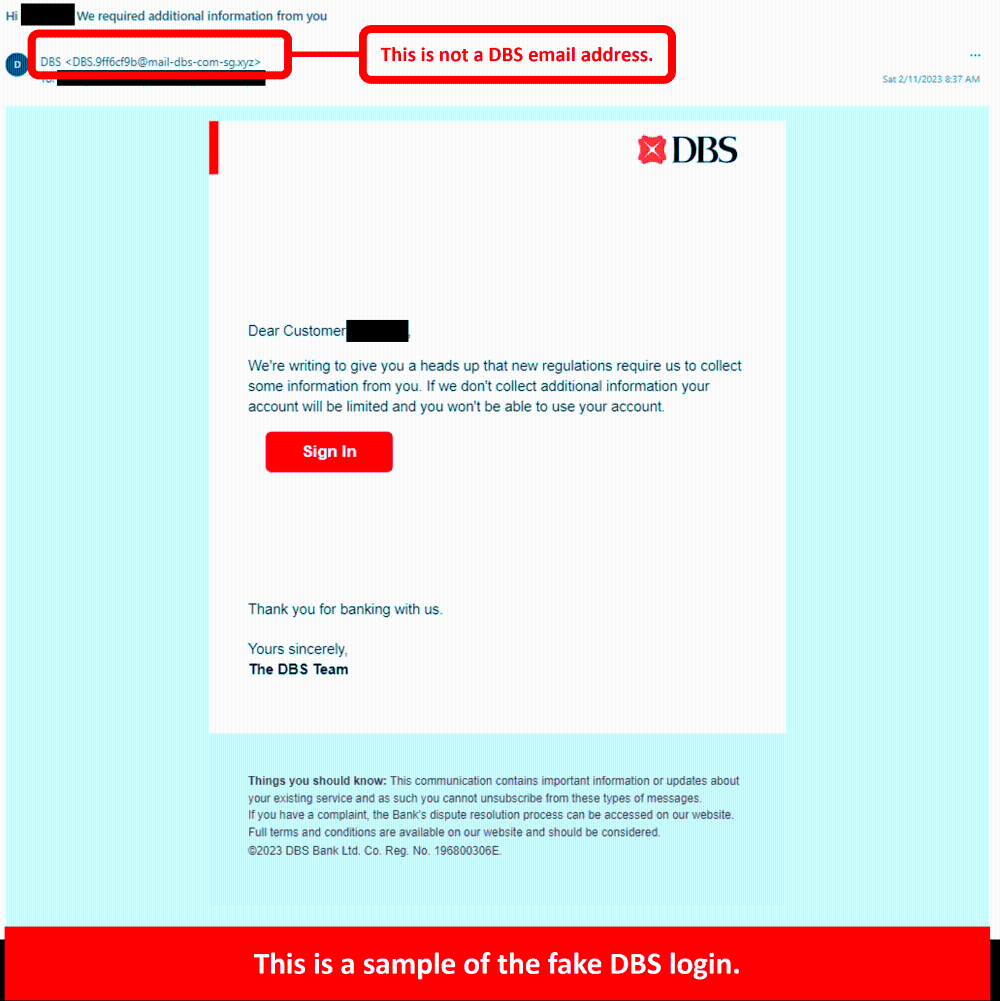

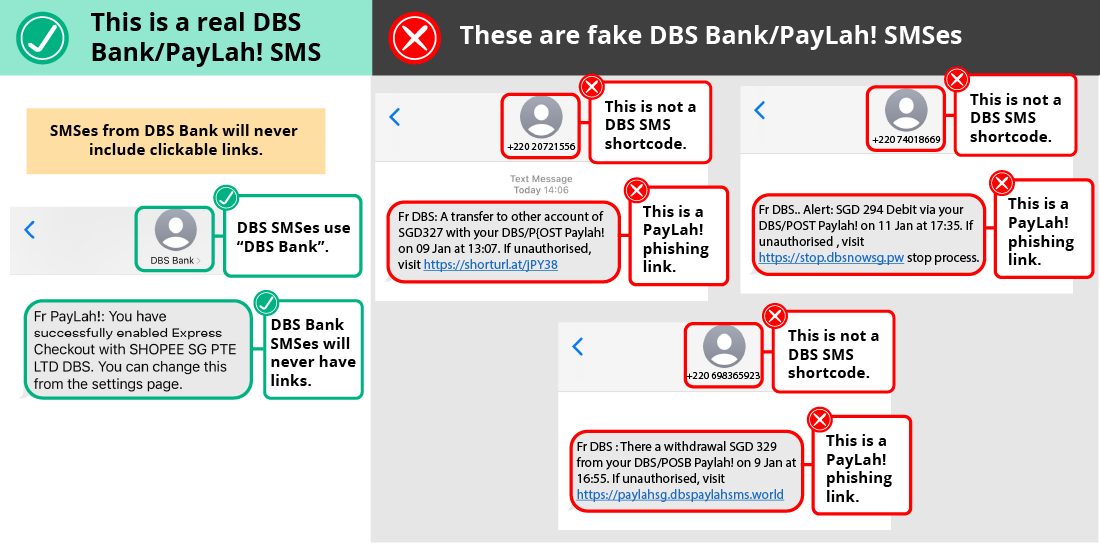

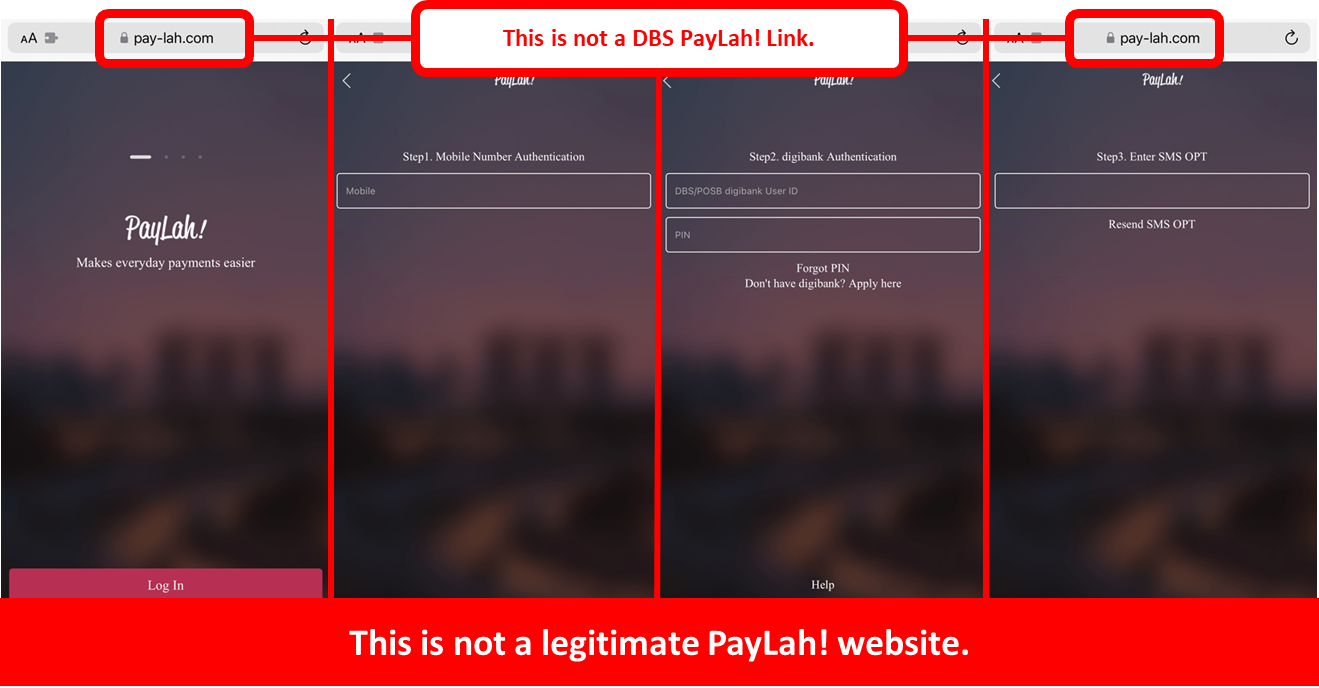

2. Does the message contain links, QR codes, and/ or attachments?

If yes, these may contain malware or phishing attempts. If you click or scan them, do not enter any of your personal details and do not download any apps from third-party sources (i.e., anywhere other than the official Google Play store or Apple app store). DBS does not send any links or QR codes via SMS.

3. Were you expecting this message?

Unsolicited communications that arrive unexpectedly are a red flag. For example, if a “courier company” contacts you when you are not expecting any deliveries, or if a “government” official contacts you out of the blue. Another common scam is through fake password reset emails that trick victims into typing in their current log-in credentials.

4. Does the message seem very urgent?

Scammers often use pressure tactics, creating a sense of urgency and pressure for you to act quickly without thinking.

5. Are there any spelling errors?

Look out for spelling, grammar and any other language errors in the emails, messages and/ or websites. These are common in scams. Check the domain names, URLs, and sender’s details. Also, watch out for inconsistencies in logos, branding, or formatting that deviate from the official brand. Look closely! Scammers these days do a great job in copying official sites.

6. Is the message very generic?

If the message is important and legitimate, the sender will probably have your information. In contrast, scammers tend to use generic or impersonal greetings that may not even address you by name.

7. Do you have a bad feeling about it?

Trust your instincts. If something feels off or too good to be true, trust your instincts and investigate further.

Red flags for more specific types of scams

Scammers are always looking for new ways to target their victims. While some scams are obvious, others are more sneaky and targeted. These scams can be harder to spot, but they often have specific tell-tale signs that can help you identify them.

Here are some red flags that are specific to e-commerce or online shopping scams, job scams and romance or love scams in Singapore.

Online shopping scams

As the convenience of online shopping continues to redefine our retail experience, so does the lurking threat of scams. In addition to the general questions above, these are some red flags specific to shopping scams.

1. Is this offer too good to be true?

Scammers often use fake ads on social media platforms. They list a popular product and an unbeatable price to lure bargain hunters into reaching out to them. From there, they send fake payment details (usually through QR codes and links) to phish for your payment credentials.

2. Is this a verified seller and/or shopping platform?

Before committing to a purchase, it’s best to check online reviews and search for reviews or feedback about the product, service, or organisation online.

3. Is payment through a safe and established channel?

Scammers may pressure victims to pay using specific methods, insisting on payment through non-traditional or untraceable methods (e.g., wire transfers or prepaid cards). They may also ask you to transfer money overseas, which is unusual for a local seller.

Job scams

Looking for a job can be tough, and scammers know it. They trick people who really need a job by promising easy money and quick success. Here are some additional questions that can help you to tell the difference between a real job and a fake one.

1. Is the job description vague?

Fake job listings often lack of specific job details, responsibilities, or requirements.

2. Is it too good to be true?

Promises of high salaries with minimal work or experience requirements is a big red flag.

3. Is this a job you applied for?

Be suspicious of unsolicited job offers. You should not be receiving job offers without applying or expressing interest in the position.

4. Is the recruiter professional?

Watch out for poorly written or unprofessional emails, job listings, or communication. These are likely to be illegitimate.

5. Can you find the company’s contact information?

Job scammers usually do not have a physical office address, company website, or legitimate contact information.

6. What is the hiring process?

Be wary of immediate offers without a proper interview or background check.

7. Do you need to pay upfront “fees” to get hired?

No legitimate employer will ask you to pay to secure your job. Sometimes, scammers disguise this as payment for training, background checks, or other job-related expenses.

8. Are the employers using free email services?

Most companies pay for a company domain, whereas scammers just use free services.

Romance / love scams

Online connections may seem exciting, but they sometimes hide tricky scams. Love scammers prey on lonely people looking for love by pretending to care. From saying "I love you" too fast to asking for money, these are some common signs of a love scam.

1. Are they asking you for money?

Beware of requests for money or financial assistance! Scammers often come up with elaborate stories of emergencies or urgent needs to scam victims into giving them money.

2. Are things moving too fast, too soon?

Look out for declarations of love or deep emotional connection occurring very early in the relationship.

3. How much do you know about this person?

If you can’t find detailed and verifiable information about the person's background, life, and experiences, they may be a scammer. Also, look out for contradictions or inconsistencies in the person's background, life events, or personal details.

4. Are you hiding your relationship from close friends and family?

Love scammers work to isolate you from friends and family, discouraging you from seeking advice. This way, you are less likely to realise you may be getting scammed.

5. Does the love interest look like a movie star?

Photos that appear overly glamorous or professional are most likely taken from stock photo websites.

6. Do they avoid meeting up in person and making video calls?

Refusal or avoidance of video calls, providing excuses like technical issues or personal reasons, is a sign that they are not who they seem. Scammers will also try all means to avoid meeting in person.

For more information on the latest scams in Singapore, visit #BSHARP by DBS or ScamAlert Singapore by National Crime Prevention Council (NCPC).

Next

You May Also Like

Recommended for you